The first step to beating an addiction is admitting you have a problem. And I would like to say, I have a problem. DeFi on Polygon is too much fun. I've always had a little bit of a problem with degen farming but it was always kept in check due to gas fees on Ethereum being just a little too high. Now that DeFi on Polygon has officially hit it's stride, all bets are off.

My addiction started manifesting itself with Binance Smart Chain (BSC). Fees were low and profits were high. BSC speed ran last year's DeFi summer over the course of just a few months; absolutely exploding and going from a little over $1b Total Value Locked (TVL) in March to nearly $30b TVL in May. But just as all good things in crypto, it had to come to an end.

A series of exploits and flash loan attacks put a damper on BSC's flame and just like many others, I lost trust in the chain itself. TVL plummeted to a third of it's peak. But while BSC was destroying itself, DeFi platforms on Polygon were buidling. Dev activity on Polygon exploded, with big name players like Aave, SushiSwap and Curve making the jump over to the fledgling chain.

These moves did not go unnoticed. From May to June TVL on Polygon went from less than $500m to over $5b in the span of just a month and a half. With BSC lagging, I needed a new outlet for my degen farming addiction. That's when I noticed Polygon. Many of my favorite DeFi platforms had already made their intentions of moving their products over, so it was time to give it a shot.

Degen Farming

While I'm very excited for my favorite blue chip platforms to make the move over to Polygon, I wouldn't exactly call these degen farms. Harvest, Badger, Kyber and many others have proven themselves to be safe places to store my long-term assets and earn a respectable yield. Degen farms offer something juicier. Something with a bit more risk involved.

In traditional finance (TradFi) getting 8% APY on your assets is insane. On blue chip DeFi platforms 50-100% APY is more than acceptable. With Degen farms, if you're not pulling 1,000%+ APY, you're doing it wrong.

Obviously the above meme is in jest. It's irresponsible to only yolo your funds. I do however set aside a portion of my portfolio specifically for degen farming. Historically that number varies from 10%-35% depending on the market season we're in. However, thanks to Polygon's extraordinarily low fees and insanely high yield farms, that number has crept up to 50% for the first time ever.

It didn't help that I had moved about 25% of my portfolio into stable coins awaiting a few projects I was looking forward to. I figured, while I'm waiting for these to launch I might as well put them to work. All it took was one dip into a few Polygon degen farms and it was off to the races. In one day I went up 30% on FISH, on what was honestly a luckily timed buy and the result of 10,000%+ APY.

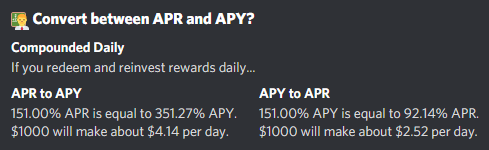

Now I can't stop, I check every degen farm that comes out on Polygon and jump in at least for a taste. That's the beauty of Polygon. The infrastructure and dev support of Ethereum with none of the nasty gas fees to hurt profits. On Ethereum if you were to invest $1,000 into the Harvest UniswapV3 vault for ETH-USDT, at a respectable 151% APY you would be earning $2.52/day. At average gas prices it would take almost 15 days to recoup the gas fees before you're profitable.

On Polygon if you were to invest $1,000 into a pool with 151% APY, it would take less than one day for the profit to start coming in. The only costs you would need to overcome would potentially be swap or deposit fees. This is the beauty of Polygon. If you're feeling squirrely and a pump is incoming you can jump into a degen farm or shitcoin project for the day and go into a stablecoin position before going to bed. All without losing a cent of profit.

Final Thoughts

Obviously some of the above is hyperbole or sarcasm but the core sentiment is true. Polygon has proven itself to be a fantastic platform for actively managed DeFi assets. Thanks to extremely low gas prices, Polygon makes it incredibly easy to zap into any project and zap out with minimal losses. Just because it's cheap to move funds, basic security tips should not be disregarded. I do recommend always checking your approvals on DeBank or Polygonscan and revoking anything you're no longer using.

But with that being said if you haven't taken a look at DeFi on Polygon I highly recommend you do. Just like with anything in crypto there's a large number of scam projects and ponzi schemes but if you can wade through the muck there's quite a few opportunities for some real money to be made. Some good starting places are Polycat, Quickswap and Aave. All three were early on the scene in Polygon and have proven they're in it for the long haul. Obviously though do your own research on all of them.

I hope you enjoyed reading. I think I've shown I certainly need some help. I'm obviously not a financial advisor and recommend doing your own research on everything I've mentioned. If you enjoyed don't forget to follow and like the post! Happy earnings!

Daily faucets with instant payouts and solid referral programs - GetZen, PipeFlare

The most trusted hardware wallet, Ledger. Get a $25 voucher and crypto beginners guide through this link.

Posted Using LeoFinance Beta

Congratulations @absolute.unit! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 300 upvotes.

Your next target is to reach 400 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz: