Image by 3D Animation Production Company from Pixabay

Significance of USD for the World’s Economy as its the World Reserve Currency

Well… well… Some fundamentals that shook the global economy from last year still persists, and one of those is US Fed’s interest rates hikes.

The initial stages of the hike really caused a lot of pain to global economies, especially emerging country economies.

The US Dollars or Greenback, was strengthening against all other global currencies..

The issue with this aspect was that US Dollars is still a World Reserve Currency.

International trade is still dominated by the exchange of USD.

Loans by international agencies are given in the form of USD.

- All countries have to maintain enough foreign exchange reserves of USD so their local currency value stays relevant, else there is the risk of devaluation of their local currency.

Worth of other country currencies dependent on their USD Forex Reserves

Image by StockSnap from Pixabay

The value of every country’s currency is very much determined by the amount of USD foreign exchange reserves they hold.

A surplus revenue of USD, that is generally the result of export earnings, results in appreciation of a country’s currency.

Similarly, depreciation of a country’s currency is mainly the result of more import expenditure of USD than USD export earnings.

However, the lifeline of every country’s currency is maintaining enough balance of USD, else they face the threat of devaluation.

US FED Interest rate hikes creates a risky scenario where some currencies can collapse

Now coming back to the topic of US FED interest rate hikes being a big pain point to many low income countries of the world.

The monetary tightening measure of the Fed essentially decreases USD money supply from the system. This is because the cost of borrowing USD is higher.

As interest rates were hiked, USD appreciated in value to all other global currencies of the world.

It became costlier for other countries to procure USD. However, they need USD to import many essential commodities like crude oil, food grains etc.

The low income countries like Pakistan, Somalia, Congo and other low income countries in Africa face difficulties because they have very low amounts of foreign exchange reserves that are further depleting.

Countries like Sri Lanka that have financed their economy availing external debt have already collapsed due to not having USD foreign exchange Reserves, thus having no ability to pay back the loans they have taken in USD.

Woes of low income countries are compounded further in the background of Global Economic Slowdown

There are additional scenarios creating difficulties for low income and poor countries, one is global economic slowdown.

There is weak economic activity in these countries leading to low growth for their economy with low GDP rates, jobs, earnings, exports etc. So already currencies of such countries are weak but rising appreciation of USD, only weakens these currencies further.

Image by Gerd Altmann from Pixabay

There will be no way these countries can have enough economic growth in the background of global economic slowdown to earn needed revenues in their local currency via productive economic and business activities in their country or in USD currency through export earnings.

Last year the value of all Global currencies depreciated due to various factors

Last year we were all painfully aware of inflationary effects because the cost of crude oil was rising high due to supply chain shortages brought about because of the war in Ukraine. So, cost of essential commodities like vegetables, foods, grains went up.

So, one can say the value of a country’s local country depreciated in a compounded fashion last year due to -

- Appreciation of USD due to monetary tightening measures of the US FED with interest rate hikes

- Inflation woes due to geo-political tensions mainly Russian war against Ukraine

- Global Economic slowdown which meant less economic opportunities to earn and accumulate USD reserves through exports as global economy has less demand.

Hopes that the Fed would pivot now as inflation has come down

Now of course the news as I am aware is that the US FED has not hiked rates further from 50bb to 75bb.

Greenbacks’s dominance has fallen as reflected by the DXY index, so atleast currencies of advanced and solvent economies have stopped depreciating against the dollar.

Tradingview

USD strength has declined since September from 114$ to 102$ now. DXY measures Dollar's strength against a basket of 6 World currencies.

Crude oil prices have fallen, probably because production of the oil has increased.

Tradingview

Crude Oil prices have declined since March of last year from $115 to $81 now.

Natural Gas prices have also fallen.

So, there are some cheers and hope that perhaps the US FED will stop its monetary tightening measure, or perhaps soften it and the global economy will be saved from a recession and poor countries will be saved from falling into a debt spiral crisis.

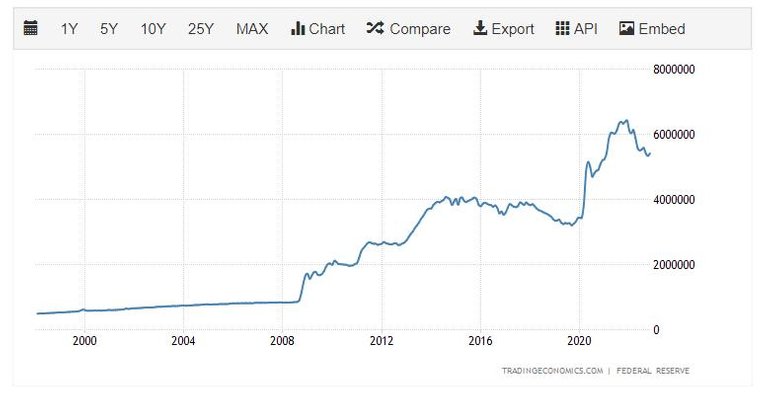

USD Supply curbs likely to continue as excess supply needs to completely drain away

Source As can be seen, US Fed's interest rate hikes is reducing money supply, but still there is a lot of USD supply in the economy which needs to be still reduced. Since, 2008, Fed has injected a lot of USD supply and now they are trying to reduce it.

However, this looks unlikely, because the US FED has made it clear that it will do what is needed to tame inflation. Yes, it’s true there is supply side induced inflation that this rate hike policy cannot control, but the reality is that the US economy is facing the effects of demand side inflation which the FED is keen to curb.

One has to remember that since 2008, the US FED has been increasing the supply of USD. This meant, it was cheap to borrow USD for companies, individuals and businesses, enterprises. The problem was that this borrowed USD did not lead to enough growth and earnings which happens when investment takes place by the above mentioned entities which creates multiplier effects and a boom period for the economy.

Yes, more economic activity, employment, purchasing power etc, etc.

So, what happened was that the excess USD supply went to rich entities, companies and individuals and they invested it in the stock market which propped up asset market valuations.

There are still such entities around having too much money on their hands, causing inflation.

High interest rate situation is a challenging time for small individuals and companies

On the other side of the coin, we have a different scenario. There is the common man, who has taken home loans when the interest rates were cheap but is now stressed due to sudden rise in interest rates, and the risk of default bores bad for them. There are small companies who are stressed as well not able to pay back loans and can shut down.

Even big companies are laying off employees, and at a time when there is still inflationary pressures, most people don’t have salary increases.

Therefore, it’s very true that the US Fed's policy of rising interest rates is causing turmoil to low income, underdeveloped countries while it’s causing pain to US Citizens and companies as well.

Yet, that’s the route the US Fed seems more likely to take and a global recessionary stage looks quite set. This is the practical truth now whether we like it or not.

Why not gravitate towards an asset that is not controlled by the Government but by us!!

Yes, so saving is a sound idea in such circumstances, maintain USD cash liquidity and invest only when suitable conditions come forth!!

However, I conclude on behalf of those Citizens of low income countries who will be affected due to this US FED rate hike policy. Such people may feel after a while that why should they suffer for the policy actions of Central banks of other advanced countries?.

Why should they suffer for the incompetence of their country Government’s Central bank authorities, who have not been able to run the economy of their country effectively to atleast be saved from the crisis of currency devaluation?.

Their anger is justified and one of the ways they can move away from the power of these country Goverments is by holding a sovereign currency that cannot be manipulated by the Government.

Sure, there’s gold, but still their eyes will go towards currencies like BTC and XMR, Bitcoin and Monero… these digital assets give people ownership over their wealth and it’s a currency asset whose issuance is not under the control of such authorities.

So, let’s hope, common people like us get ownership over our wealth which we earned, instead of having it eroded being in Government controlled currencies.

Now will this really happen, will people feel that crypto will save them from the shackles of Governments, we don’t want to trust?. We would know about all this in the coming years, as a phenomenon will play out.

But I still believe what I sang in words about Bitcoin a few years ago!!

More power to us to have sovereign ownership and control over our wealth. It is our Right!!

This is very nice article but it is still under rated.

Hey thanks for the appreaciations!! and support as well

Congratulations @mintymile! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 22000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Support the HiveBuzz project. Vote for our proposal!

Yay! 🤗

Your content has been boosted with Ecency Points

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more, by @bhattg.