I’m sure you must have heard of Market Capitalization ( Market Cap), if you didn’t understand what it meant, well you are in the right place. Market Cap is the total value of all the coins. That is, the price per token multiplied by the total available token.

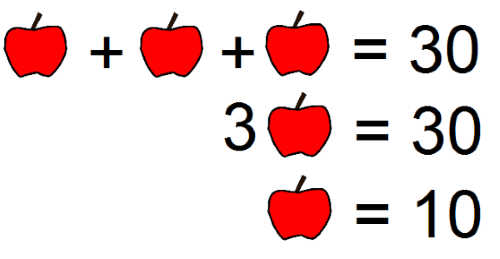

For instance, there is a bag of 100 apples, one apple cost $10, that means the total market cap of that bag of apple is 100 apples X $10 = $1000. That’s how it’s used to calculate market capitalization.

Market cap is essential for how stable a coin would be. A crypto with a larger market cap is likely to be more stable than a crypto with a lower market cap.

Have you also heard of Circulating Supply market cap or fully diluted supply market cap? Don’t worry I will explain that to you using the same Apple reference. Remember we have a bag of 100 apples , but let’s say we have extra 20 hanging on the tree, un plucked . Those 100 apples in the bag is known as the circulating supply because they are the ones available while the total 100 apples plus the 20 hanging on the tree is known as the Fully diluted Supply market cap.

An Advantage of Checking Market Cap before investment

It’s necessary to check market cap and price history, this is because it gives you the information of how stable a coin is. Investors consider cryptos with higher market capitalization as a low risk investment, because they have shown proof of withstanding high volatility. Meaning that they can withstand a lot of people cashing out with the price crashing down drastically.

Not a bad explanation... but I would also say that MC can help you determine whether a token (or a stock) is fairly valued. This gets VERY tricky with pure cryptocurrencies, but it can be a very apparent metric to compare with the level of liquidity pools against their respective exchange/governance tokens. So if a DeFi platform has $100 million of liquidity, and the market cap of the token is $50 million, I would say it's undervalued.

Thanks a lot for this explanation