Yes, 2025 has already delivered an impressive market rally, with the S&P 500 hitting all time highs and trading above 6,900 points. But the question everyone is asking is simple: Will the rally continue into 2026?

THE 2025 RALLY AND FORECASTS FOR 2026

The S&P 500 closed 2023 up 24%, 2024 up 23%, and so far in 2025 it has gained more than 18%. Three consecutive years of double digit returns. By any standard, impressive.

And yet, forecasts for 2026 remain optimistic.

According to CNBC’s annual survey of 14 top analysts:

- The average target for 2026 places the S&P 500 at 7,629 points

- The median forecast is 7,650

- Bullish scenarios reach as high as 8,100 points

In short, Wall Street expects another year of double digit gains in 2026. Some analysts see a continuation of the upward cycle, while others take a more cautious stance.

John Stoltzfus of Oppenheimer expects 8,100, Binky Chadha of Deutsche Bank sees 8,000, while Morgan Stanley forecasts 7,800, citing continued investment in artificial intelligence and capital flows toward the technology sector.

UBS SEES THE UPSIDE CONTINUING

UBS reinforces the bullish scenario. In a recent report, the bank argues that the 2025 rally was not driven by excessive optimism or inflated valuations. It was driven by earnings.

And earnings are expected to keep growing.

- UBS forecasts a 10% increase in S&P 500 earnings per share in 2026

- It places the index at 7,700 points by year end

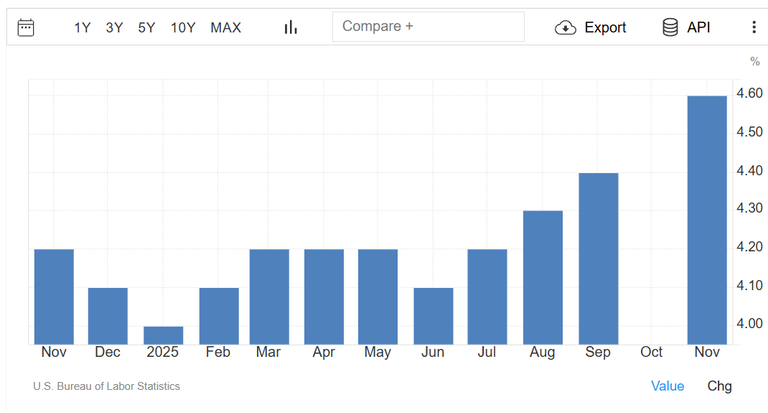

- It expects additional interest rate cuts from the Fed following the third consecutive cut in December 2025

UBS also highlights three key factors:

(a) the appointment of a new Fed Chair, with potential candidates Kevin Hassett or Christopher Waller, which could support a more dovish stance

(b) a critical Supreme Court decision regarding the authority to impose tariffs under Trump, expected to provide clarity and reduce uncertainty

(c) artificial intelligence, which beyond the hype is beginning to translate into higher productivity and earnings, with stronger effects expected in 2026 and 2027

THE MORE CAUTIOUS VOICES

Not everyone is optimistic. Bank of America takes a more cautious view, forecasting the index at 7,100 points. Savita Subramanian, the bank’s chief strategist, focuses on fatigue in the labor market, especially in mid skill professions.

She argues that valuation compression is possible and does not rule out a bear case at 5,500 points. In a bull case, however, she sees the index reaching 8,500. In other words, the range of scenarios is extremely wide.

What everyone agrees on is that 2026 could be a year of increased volatility. A more demanding environment that will separate investors with a clear strategy from those simply chasing the hype.

Congratulations @steemychicken1! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: