4 financial goals that, if we set them now for 2026, can completely change our lives

MONEY MANAGEMENT

We start by properly managing what we already have, meaning the capital we possess and the money that comes into our pocket every month. This is the alpha and omega, because if we do not know where our money goes, we cannot do anything meaningful with it. That is why we start with a simple but effective budget.

I know the word budget gives many people a headache, so here is a very simple rule that can really help, the 50/30/20 rule:

- 50% for essential expenses such as rent, food, bills

- 30% for entertainment and personal needs

- 20% for savings and investments

And if 20% feels like too much? We start with 5 to 10% and build it gradually. The point is not to start perfectly, but to start.

A very good practice is to pay all our expenses by card, so at the end of the month we have a clear picture of where our money went. This helps us see more objectively what was truly necessary and what was not.

DEBT REPAYMENT

Our second priority is to get rid of debt. How can we invest or save when interest is eating our money every single month?

Trust me, especially consumer loans and credit cards with interest rates of 15% to 20% are financial bleeding.

Here we have two strategies:

- Either we start with the debts that have the highest interest rate, which is the smartest approach

- Or we start with the smallest balance to build psychological momentum, which is the more human approach

Both work. We choose what suits us best. What matters is to get rid of debt once and for all.

Does the same apply to mortgages? Mortgages are a different case. They usually have more reasonable interest rates and do not necessarily need to be paid off early, unless that helps us sleep better at night.

What is important to remember is that every euro we save in interest is pure profit for us. And it is one of the safest returns we can ever get.

INCOME GROWTH

No matter how much we cut expenses, there is always a ceiling. When it comes to income growth, there is not.

So let 2026 be the year we aim for more. And how do we do that? More easily than we think.

We ask for a raise at work. We document our value and show our results. If a raise does not happen, we change jobs. Job hopping is no longer taboo, it is a strategy. Many people see increases of 20% to 30% with a single move.

Another option is to start something on the side. Freelancing, Airbnb, affiliate marketing, delivery apps, TikTok, YouTube, coaching, creating digital products. The options are endless.

The difference between someone who stays stuck and someone who moves forward is action. We do not wait for everything to be perfect before we start.

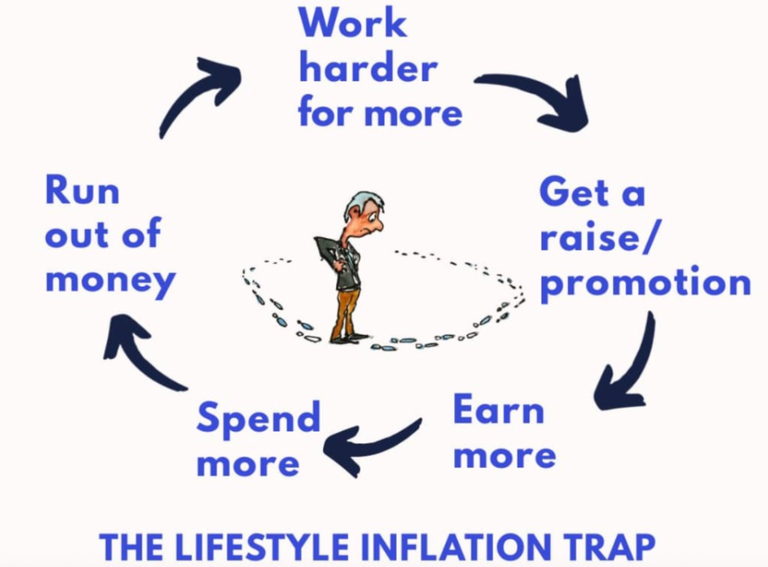

But big caution here. As our income increases, it is crucial not to increase our expenses as well. This is known as lifestyle inflation, and it is very sneaky. We got a raise? Great. We invest the difference. We do not turn it into unnecessary spending.

BUILDING WEALTH

After all that, our ultimate goal should be to protect and grow our money. Here we are talking about a combo of safety, growth, and peace of mind. Believe me, these three always go together.

First, we build an emergency fund. Our goal is to have 3 to 6 months of essential expenses set aside. Because when something goes wrong, we do not want to panic.

And once we have done the first step properly, we know exactly how much we need every month.

This post has been shared on Reddit by @blkchn through the HivePosh initiative.