Hello Readers,

I hope all of you are spending an awesome day with your loved ones and also enjoying the ongoing pump season in crypto. Well, if you are not aware yet, a piece of big news is currently shaking up the world of tech and cryptocurrency as MicroStrategy, which is often called a “Bitcoin proxy,” just recently officially debuted on the Nasdaq-100. This is a major milestone for the company, and without a doubt, it also signals how Bitcoin and cryptocurrency are becoming a bigger part of the global financial world. So in this post, let us take a dive and try to break it down so it is easy to understand why this is such a big deal for crypto. So, if you are interested, let’s dig into it without any further ado.

A New Addition to Nasdaq-100

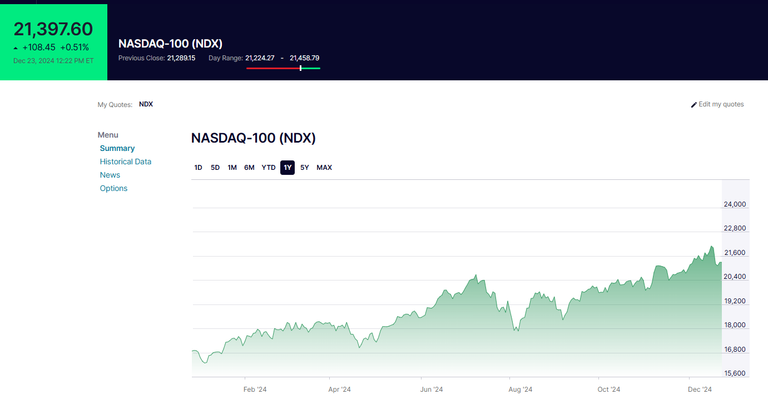

For those who don't know, the Nasdaq-100 is an index in the US stock market that contains the top 100 largest non-financial companies that are listed on the Nasdaq stock exchange. So just think of it as a list of top-tier companies like Google, Tesla, Apple and Microsoft etc. Now, MicroStrategy has just recently joined this exclusive club, along with Palantir and Axon Enterprise. Together, they replaced three companies - Illumina, Super Micro and Moderna. Trading with this updated index started just today, on December 23.

MicroStrategy’s current position in the Nasdaq-100 is really significant not only for the company and its investors but also for the whole crypto community. This company entered into the top 100 list as the 52nd largest company, making up about 0.42% of the total value of the index. This groundbreaking move also means that exchange-traded funds aka ETFs that track the Nasdaq-100 (one popular example would be the Invesco QQQ fund with $320 billion in assets) will now start including MicroStrategy’s shares automatically in its portfolio. Now this is very important because it could automatically bring in more investors in Microstrategy (whether they like it or not) since the fund will now hold MicroStrategy’s stock.

What This Means for Cryptocurrency

The recent addition of MicroStrategy to the Nasdaq-100 is about to create a new era by introducing cryptocurrency exposure to the index. Because we know MicroStrategy owns a massive amount of Bitcoin and has tied much of its business to the cryptocurrency’s performance already. Analysts predict that this inclusion could potentially lead to a massive $2.1 billion in buying activity from ETFs and also other funds that track the Nasdaq-100. That is a lot of money flowing into a company that is closely linked to Bitcoin!

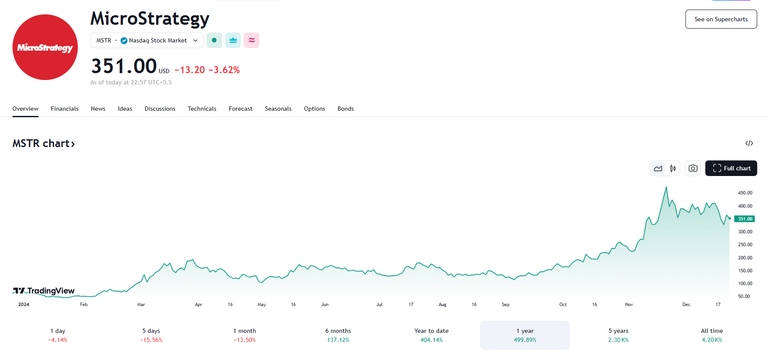

MicroStrategy’s stock has already been on a tear this year, climbing a whopping 476% profit. On November 20th, it hit a record price of $473 per share, which was around the same time Bitcoin reached an all-time high of $92,000. This clearly shows just how closely MicroStrategy’s fortunes are tied to Bitcoin’s growth.

A $561 Million Bitcoin Purchase

MicroStrategy’s love for Bitcoin does not just stop at its stock performance. The company recently made it to the headlines again by buying an additional 5,262 Bitcoins for $561 million. This brings its total Bitcoin holdings to an incredible 444,262 BTC and one step closer to touching the 1 million mark. The purchase was funded through an “at-the-market” program aka ATM, where the company sells shares to raise cash. And on top of it, MicroStrategy still has another $7.08 billion left in treasury to spend through its ATM program.

A Bold Bet on Bitcoin

MicroStrategy was not always focused on cryptocurrency. Originally, it was an enterprise software company. But in 2020, under the leadership of its founder Michael Saylor, the company took a revolutionary decision to make Bitcoin a central part of its strategy. Saylor has fully embraced Bitcoin, even betting the company’s future on it. This year alone, Bitcoin’s value has risen by about 120%, thanks to more people and businesses adopting it. In addition to that, the hype around President-elect Trump’s plans to create a U.S. Bitcoin strategic reserve has added even more excitement to it, making people even more interested and positive towards Bitcoin.

MicroStrategy’s debut on the Nasdaq-100 is a giant step for cryptocurrency’s acceptance in mainstream finance. But we have to admit that it brings both opportunities and risks with this event. On one hand, it makes it easier for investors to gain exposure to Bitcoin through traditional financial markets. On the other hand, Bitcoin’s famously volatile price could make MicroStrategy’s stock and now even the whole Nasdaq-100 more unpredictable than before. But still, this moment is immense and marks a turning point. As more companies like MicroStrategy start to embrace Bitcoin, the line between traditional finance and cryptocurrency will continue to fade away. So, whether you are a crypto enthusiast or just curious about how it all works, one thing is clear, the world of finance is changing fast, and Bitcoin is playing a big part in it.

Informaion source

I hope you liked reading my post about Microstrategy and its recent achievement of making it to the Nasdaq-100. Let me know your thoughts regarding this news in the comment section below and I will be seeing you all in my next post.

Posted Using InLeo Alpha