I published similar study for Steem in my post Steem Inflation Profile Explains Its Price Performance around 8 months back. There have been many explanations about why steem inflation (25%) is more than planned (<9.5%). But for whatever reasons inflation remained high and so prices kept collapsing.

Although Hive is in existence, in itself, for much shorter time but trends can still be computed from the available data.

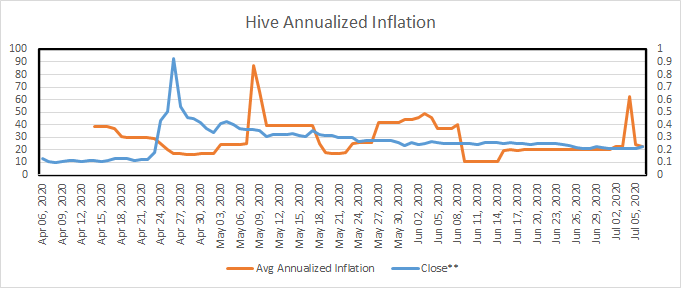

The figure above shows the annualized median inflation for Hive. Median period is 10 days to reduce volatility. And more or less the inflation is same or even bit higher than Steem. And now there should not be any constraints imposed by HBD, as HBD supply is only ~5mn and below 6.6mn (10 percent of 66mn mcap of Hive), as was claimed for steem.

All in all I am skeptical of Hive price performance over long term as long as the inflation remains higher than 9%, which is current target inflation for the blockchain.

Comments and feedback is welcome and much appreciated.

This post is update of my previous post on this issue - Hive Annualized Inflation.

The Hive prices have collapsed 50% since publication of first analysis on 16th May 2020 as was predicted. It is direct result of this large inflation. Many whales are grabbing inflation rewards and dumping onto the market. One can do the analysis of many whales on hivestats- their APR is in the range of above 15%.