Those with small holdings should HODL BTC.

Don't ever SELL your BITCOIN!

Let's talk about these topics in today's post:

- 2024 has come and gone.

- What to expect in 2025

- History and Patterns

- Market Timing?

2024 has come and gone now.

The January SPOT ETF brought positive news for investors. Wall Street favors it because they still earn fees between 0.05% and 0.60% for their products. While Grayscale has some of the highest fees in the group, this will change in the coming years as pricing becomes more competitive for all investors.

The April halving affected mining companies, yet the hashrate continues to climb. This means people will earn less but will invest new capital to upgrade their miners.

Bitcoin broke into the 6-digit for the first time on Dec 5.

What to expect in 2025

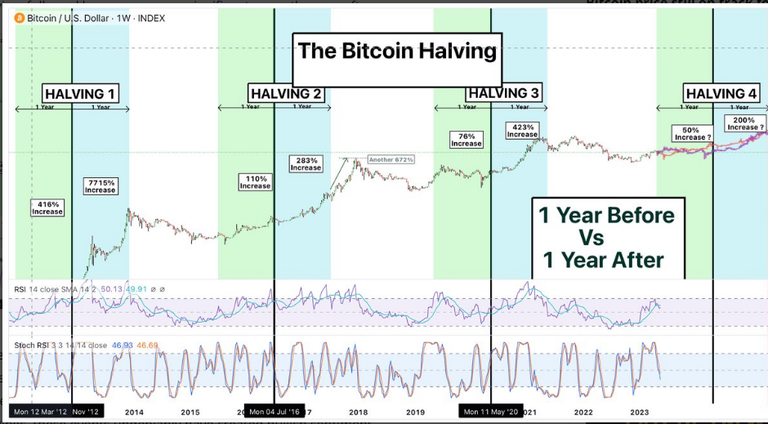

A widely accepted prediction is that Bitcoin typically reaches a new all-time high (ATH) within 1 year to 18 months after a halving event. Following this "peak ATH" of the cycle, Bitcoin usually enters a bear market.

This means that between March 2025 and December 2025, most people anticipate Bitcoin reaching its peak. This expectation has led some to consider selling their BTC and shifting to alternative cryptocurrencies (ALTS) or fiat currency. They believe that if Bitcoin follows historical patterns, a 70-90% drop could follow.

History and Patterns

While history is often studied, the future remains uncertain. It may not repeat exactly, but it can follow similar patterns. This is where the SPOT ETF, nation-states, sovereign wealth funds, and countries buying BTC can potentially change the cycle forever. In past cycles, retail investors didn't have access to billions of dollars in their IRA or brokerage accounts with products like IBIT, FBTC, etc. MicroStrategy (MSTR) only began buying and holding BTC in 2020. These developments are new.

Michael Saylor has stated he will always be buying at all-time highs, meaning you should buy consistently, regardless of the price. If this sentiment is common among BTC believers, you won't want to sell your Bitcoin only to be priced out in the future.

Market Timing?

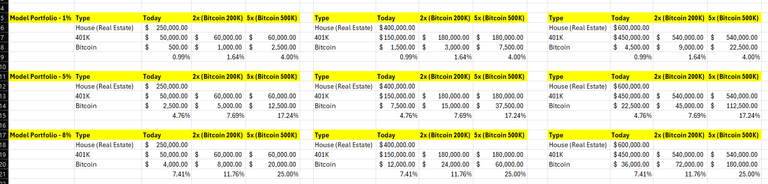

I wanted to create a model portfolio that reflects the typical Bitcoin ownership of someone in America. I used three tiers of ownership: 1%, 5%, and 8% of their net worth, specifically in their 401K(excluding home value).

Then, I considered three different net worth scenarios: $50K, $150K, and $450K, creating a matrix of 9 different scenarios. Finally, I demonstrated what would happen if Bitcoin were to double (2x) or quintuple (5x) from current prices. The result shows that Bitcoin would account for between 1% and 25% of your total net worth (excluding your home).

*Note: I used a 20% growth in 401K asset value.

**Note: The time is not needed.

For anyone with less than 10% in BITCOIN/ETHER compared to other assets they own, it is just better to HODL. The Bitcoin is still a "small" percentage of your total net worth:

- 1% Tier: 1.64% / 4%

- 5% Tier: 7.89% / 17.24%

- 8% Tier: 11.76% / 25.00%

Unless you're a "whale" or someone who is "ALL-IN" on Bitcoin with no assets outside of digital holdings, it's wiser to HODL until 2040 or 2050. Just as selling NVIDIA shares in 2016, 2018, or 2020 would have made it very expensive to buy back in, the same principle applies to Bitcoin in 2025. Trying to time an 80% correction could result in missing the next price surge.

Be honest, tell me when you plan to sell and what was your re-entry point rules.

Have a profitable day!

Posted Using INLEO