The @hbdstabilizer started operating in February 2021. In its four years of operation, it has gone through different amounts of funds, from very small up to big sums, and then a pullback in the last year.

The bot is operated by @smooth. Lets take a look at the data.

For those who are not familiar with the project, the job of the @hbdstabilizer is to keep the HBD peg around the dollar, by trading HIVE and HBD on the internal market. It is a bot that provides liquidity for HBD around the dollar. It does this with funds that are received from the Decentralized Hive Fund DHF.

At the top the stabilizer was asking for 240k HBD per day. In the last years it has scaled back and now it is operating at 12k HBD per day. The HBD price is still holding well, meaning the funds seems to do the job for now.

Lower funds for the stabilize should provide opportunity for other participants to make their own proposals and create more bots that do similar job, so it is more decentralized. There seems to be other bots operating on the internal market now, also providing liquidity for HBD.

We have two scenarios/modes of the stabilizer operation.

- Buying HBD

- Selling HBD

HBD is paired on the internal market with HIVE so the trading is in the two native Hive currencies.

1.Buying HBD

When HBD is below the peg then the stabilizer is buying HBD to bring the HBD value to $1. Because, it receives HBD from the DHF, first it converts the HBD to HIVE, and then uses HIVE on the internal market to buy HBD. Buying HBD means selling HIVE.

Selling HBD

If the price of HBD is above the dollar then the stabilizer is selling HBD to bring it back to $1. The stabilizer receives HBD from the, sells it on the internal market for HIVE and sends back the HIVE to the DHF, where it is instantly converted to HBD so it can be used from the DHF.

From the description above we can conclude that the @hbdstabulizer is receiving funds in HBD only, but it is returning funds in HBD and HIVE. To be able to compare the received vs returned funds we will need to convert the HIVE sent to the DHF in HBD.

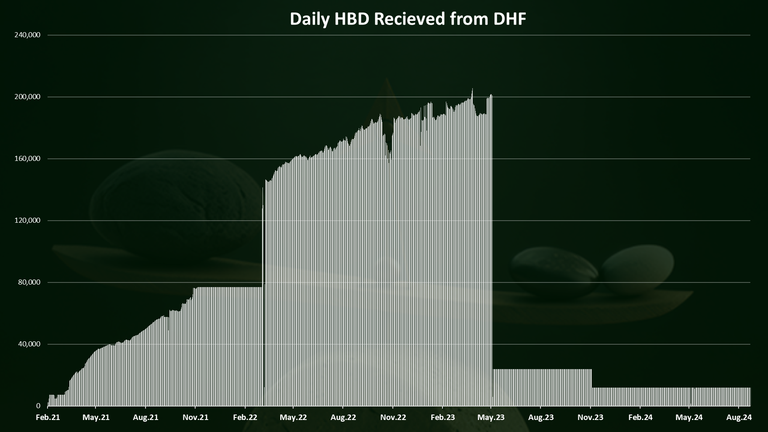

HBD Received from the DHF

As already mentioned the DHF is paying funds only in HBD. Here is the chart for the HBD transferred to the stabilizer.

At first the amount of funds for the stabilizer grew. At the peak in April 2023 the stabilizer had a 200k HBD daily budget.

This growth was following the growth of the HBD funds in the DHF, as the stabilizer was asking 240k funds, but the daily budget was lower than that.

Then a cut in May 2023 to 24k HBD per day, and again a reduction in funds to 12k per day in November 2023, where we are now, almost one year later.

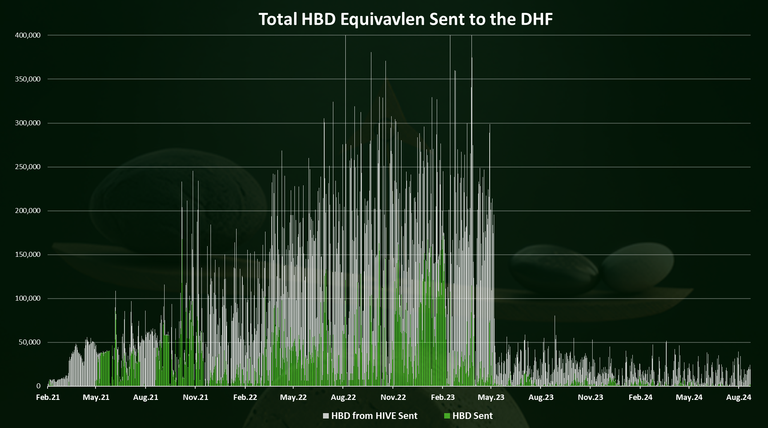

HBD Sent to the DHF

As mentioned above the stabilizer is sending funds to the DHF in the form of HIVE and HBD. The HIVE is converted to HBD. Here is the chart.

Note that funds sent to the @hive.fund are in the form of HIVE and HBD. I have converted the HIVE rewards to HBD, for easy representation and comparison.

We can see that the majority of the funds that the stabilizer sends back to the DHF has been in the form of HIVE and then those are instantly converted back to HBD in the DHF. This is understandable as the stabilizer is mostly buying HBD and it needs HIVE to do that. When it doesn’t need the funds it sends them back in the form of HBD.

We can see that for most of the time it had extra funds, and it was sending them back. Just on a few occasions it was using them all. We can also notice the scaling back in the operation of the stabilizer. In the last year it has reduced the funds its operating with quite a lot.

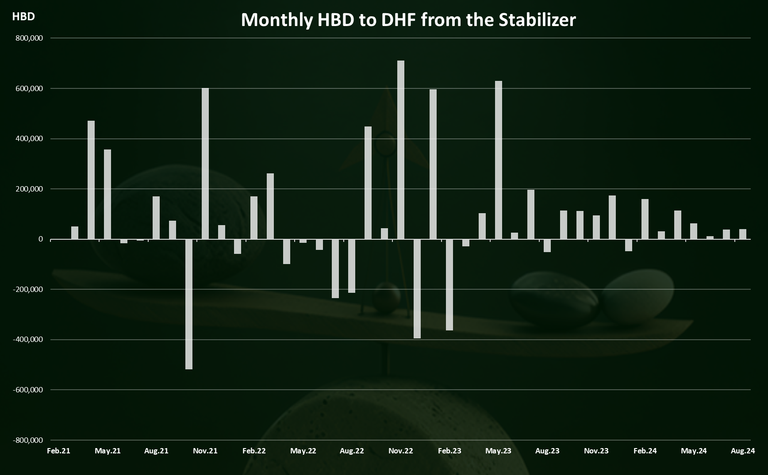

HBD Received VS Sent

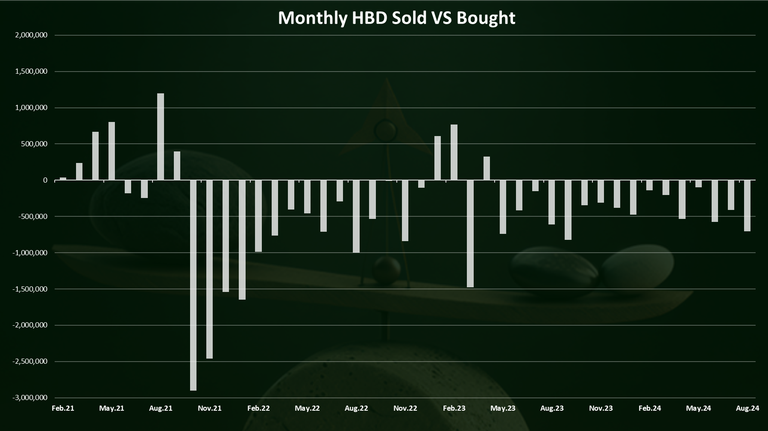

If we plot the amount of HBD received VS sent to the @hive.fund from the @hbdstabilizers on a monthly basis we get this.

A positive bar means that the stabilizer has sent more funds to the DHF then received, a net profit, while a negative bar means that the stabilizer has received more funds then sent back, or a net loss.

What’s interesting from the chart above is that when HBD loses its peg on the market, even on the downside, usually then it is when the stabilizer makes profit.

We can see that the bars are now smaller most likely because of lower amount of funds that the stabilizer receives. Also most of the months the stabilizer is slightly positive meaning adding more funds to the DHF. This is the case for almost all of 2024 and the second half of 2023.

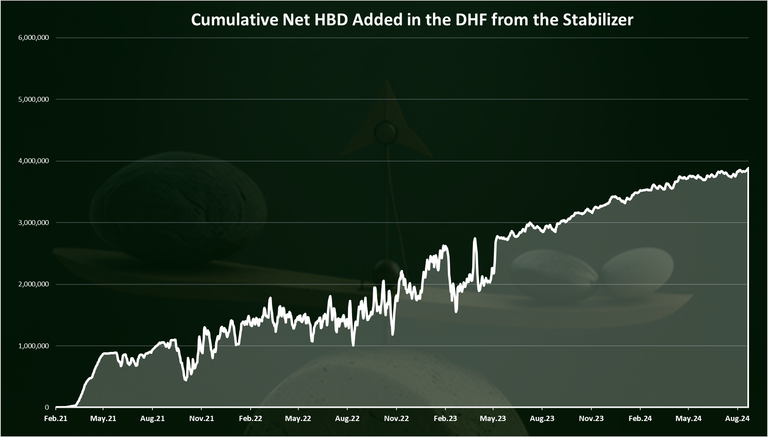

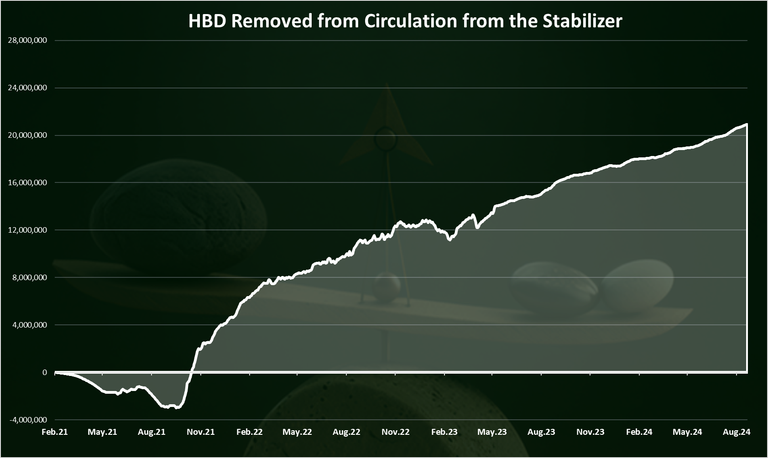

When we add the above the cumulative HBD added in the DHF from the @hbdstabilizer looks like this.

Almost 4M HBD profit for the DHF from the @hbdstabilizer.

We can see that there was some ups and downs in 2023, but the overall trend has been up. With the lower funds that the stabilizer has now, the movements are lower, but still going up.

The hbdstabilizer profitability is a combination of the trading HBD that it is making on the internal market, and the conversions from HBD to HIVE. Also, the stabilizer is a beneficiary to the comments rewards of the @hbd.funder that are being upvoted daily from large stakeholders and this provides more than 200k HIVE equivalent per month.

As mentioned above the @hbdstabilizer is constantly making HBD to HIVE conversions in order to have HIVE and buy HBD if needed. The thing is these conversions take 3.5 days and have a market risk in them, and sometimes they can be market positive, while other times negative. Because the stabilizer has been making a relatively big amounts in conversions, those can add up.

HBD Sold VS Bought

Let’s take a look at the market activities and how much selling and buying the stabilizers has been doing.

Positive bar means the stabilizer is selling HBD, negative bar means it is buying HBD.

As we can see from the chart the stabilizer has been mostly buying HBD in the past. In the first few months it has been selling more HBD because at the time the HIVE to HBD conversions were not enabled on the blockchain and HBD was constantly trading above $1. When the HIVE to HBD conversion was enabled, HBD returned to its peg and since then the stabilizer has been mostly in buying mode for HBD supporting the price on the downside.

In the last period this trend has continued as well with the stabilizer mostly buying HBD. Although the numbers are now lower and the volatility as well.

In the last three months the stabilizer bought around 500k each month on the internal market.

The cumulative data for the amount of HBD bought from the stabilizer looks like this.

We can see that at the start in the period February – July 2021, the stabilizer was selling more HBD. Then at the end of 2021 it started buying more HBD, because the HBD supply expanded meanwhile and there were excess amounts in a hands of speculators.

In the last period the amount of HBD buys has been lower and the line has flatten out, although still with a trend for growth.

In total the stabilizer has removed 21M HBD from circulation in its period of operation, out of which around 6M HBD in 2021, 8M in 2022, 5M in 2023. For 2024 the current number is around 3.5M HBD, and will probably end around 5M, around the same level as 2023.

HBD Price

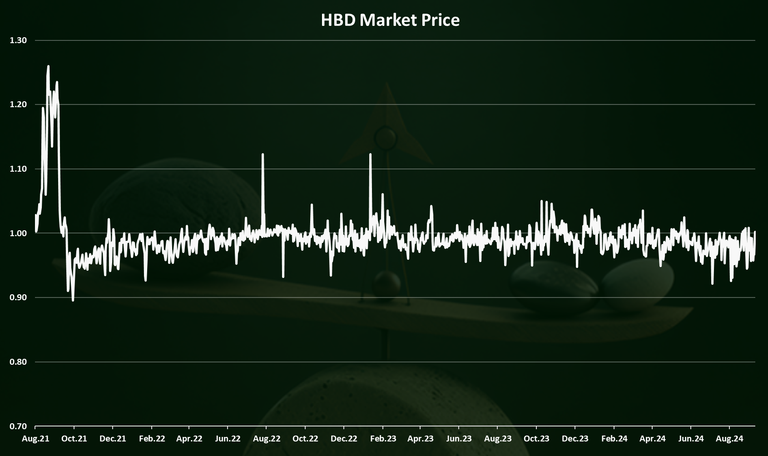

At the end the chart for the HBD price in the period.

We can see that back in 2021 the price of HBD was above the peg of one dollar. This is because the HIVE to HBD conversions were not active in the period, the bull market was on, and the speculators pushed the price of HBD above one dollar.

Since September 2021 HBD has been far more stable although not ideal. On a few occasions the price increased to more than $1.1 but only for a short period, and on a few occasions, it has dropped to around 0.95. Still much better than in the last period.

Note that these are external market prices, sometimes they are based on very low trading volume and can be inaccurate, while the on chain price has been at the peg at all time, and users can convert HBD to HIVE for one dollar at any time.

Summary

The main takeaway from the above is that the @hbdstabilizer has been helping the HBD peg on the downside and has removed a total of 21M HBD from circulation in the last three years. There has been a downtrend since 2021 in the overall need for support, with 2024 maybe around the same level as 2023. It is worth noting that on the other side of the equation for supporting the HBD price, the activities on the internal market, conversions, buying HBD on the internal market, is putting more HIVE in circulation, increasing the overall inflation for HIVE. The pro is more stable and liquid HBD.

The conversions that the stabilizer is now doing previously were mostly made by users themselves.

As far as the DHF goes, the stabilizer has added a total of 4M HBD to its budget. Some of it is from authors rewards as beneficiary.

Since September 2021, the price of HBD has been relatively stable, with very short-lived spikes to 1.2 and drops to around 0.95.

The internal market has increased liquidity and HBD now has the most liquidity there, thanks to the stabilizer.

In the last year the stabilizer has decreased its funding from 240k to 24k and then to 12k per day.

All the best

@dalz

I really like this chart

If this is not "stable coin" I don't know what is. I think this is probably the best algorithymic stable coin I have seen. Just compare this chart to the world best stable coin (the US Dollar), the dollar index, and you will see that DXY is more volatile than HBD.

I plotted DXY for the same interval and this is a weekly chart

Yea it has been performing well. Hope it continues to do so, so we can build an economy around it

We all remember Luna.

I had to answer this to a number of people who poo-poos HBD as algo stable coin and refuse to buy it. I recently had to go though with it in conversation with multiple large investors, and this is the chart I show.

DXY with HBD.

Boom!

Great job!!!

The longer it sticks around the better. Its now in good shape for four years. Thats something! It has survived the 2022 crash! We just need to be carefull and to balance the inflation vs growth to keep it going

I really like the in depth of the article too, helps me understand how the DHF works :)

Thanks for the data. Though I'm not familiar with it, the information was very informative to the users who are into analyzing the movement of HBD and Hive. After reading, I concluded how @hbdstabilizer is a great help to the platform.😊

Thank you so much for giving this data and making us to be quite familiar with it actually

It is actually very interesting to see when the stabilizer kicked in and we have had very few spikes since then and it is doing it's job very well. Like you said the downside is there is less HBD in circulation, but that will change when the price of Hive rises and there is a demand again.

good job! let me know how it works

Great job