Huge pumps coming in hot.

My irresponsibly long position in Holozing is now worth double what it was a few days ago.

These bags are getting heavy. Will I sell? Nah. Degen for life.

Market cap now sits at six figures.

A bittersweet victory!

While my staked Zing remains untouched and on the way to moon (hopefully) I can't help but feel the sting of the dreaded "impermanent loss"... which is basically just a fancy degenerate way of saying my LP position automatically sold Zing tokens to the recent buyer in exchange for Hive. This buyer appears to be @jeffjagoe who looks to have bought around 4.4M Zing using two gigantic orders for 5000 and 10000 Hive respectively.

This is very impressive and a testament to the shear amount of liquidity that an AMM pool can provide. It's a bit serendipitous that there are almost exactly 100M Zing in circulation at the moment, so this single order represents 4.4% of every token that's been minted for the last year... all at once! For context if someone tried to buy 4.4% of all Bitcoin in circulation the price would pump to something ridiculous like $1M per BTC. It would also take them weeks if not months of bidding to accomplish that goal. That percentage of tokens simply can't be bought from the orderbook model and only works using AMM magic.

Well... shit!

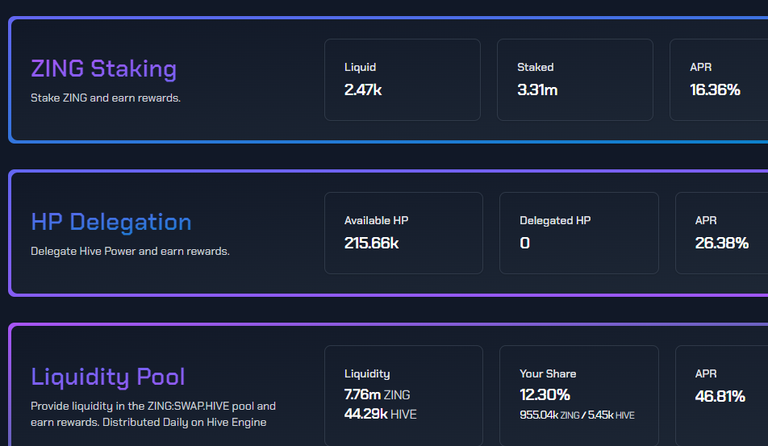

So imagine my surprise when the face and reputation backing the project hints on Xitter that the LP is once again being "overpaid" and they might have to reduce the allocation in a couple months. I'm not gonna lie, discussions like this are a little worrisome. The allocation to this LP has already been reduced once and I complained about it then as well but it wasn't so bad back then because I hadn't just lost a bunch of money on impermanent losses.

My LP position has lost hundreds of thousands Zing due to this pump. I'm basically "down bad" in terms of IL and then I get told that my super risky position that I just lost a bunch of money on is being overpaid? So basically what this all comes down to seems like extreme differences in perspective which I needed to try to wrap my head around.

So on the flip side...

We have @acidyo and the dev team. These are the guys building the game. They have expenses and they need to raise as much money as possible; not only to pay their current bills but also to expand outward and scale up if possible. From this vantage point we can see that they don't want to be wasting any money, and 47% yield on the LP after an x2 pump could appear to be wasted money. I vehemently disagree but I could see how someone in this position could come to that conclusion.

Price Fixing is never a valid option in any economy

Attempting to manipulate the APR of an LP is impossible because this number is unilaterally decided by the free market. If the spot price of the token goes up, yield goes up. If that higher yield incentives more liquidity to crowd the trade, the yield goes down. If emissions are reduced on the LP... yeah the yield will go down temporarily until makers decide the risk/reward is no longer in their favor and they pull their money out of the risky position. When that happens the yield goes back up. This is a free-market system that corrects itself and should only be measured by the amount of Zing tokens for sale in the LP, which is still substantial.

Unit of Account

Measuring the value of any of these metrics in terms of USD will end up equating to an extreme framing bias that leads us away from the truth of the situation. For example it is being stated that there is "$1200 pending Zing rewards to the LP for 60 days". Ah yes well that $1200 isn't dollars at all... and two days ago that dollar amount of half of what it is today. These are not dollars these are Zing, and the percentage of tokens being allocated to liquidity on a relative scale is very little compared to how much liquidity those emissions are providing.

Again, I don't understand how anyone could be upset that the LP doesn't have enough liquidity when someone literally just bought almost 5% of all tokens in circulation in a couple minutes. That is a ton of liquidity, and higher APR on the LP could incentivize more buying and more liquidity and create the kinds of flywheels that we see happening with garbage memecoins.

The Risk of the LP is exponentially higher than all other sources of farm.

Something would be horribly wrong if the LP did not have a way higher APR than every other way to earn the token. Why? Because the liquidity makers are taking all the risk. If the price moves in either direction, up or down, impermanent losses kick in and we lose money. The ONLY thing that offsets this risk is the yield provided to the LP.

Every other situation results in a loss.

The yield is the only reason to enter an LP vs just holding those two assets on the side outside of the LP. This is a mathematical fact. So again I really don't want to be told I'm being overpaid after I just lost a bunch of money. The optics on that take are not ideal, even if understandable from an alternate perspective.

The new higher APR directly reflects the increased risk and volatility of the asset.

Take another look at my position

I'm down hundreds of thousands of Zing here. At the same time I'm up almost 2000 Hive, but due to IL slippage this will always be a loss. More importantly: the entire LP is a crippling systemic risk to both assets. If Zing collapses to zero I lose EVERYTHING. Not just the Zing but the 5450 Hive as well. Poof, gone. All of it. Bye Bye. The only financial incentive to take any of these risks is the APR. And even that is not enough: I'm personally doing it because I want to provide value to the project and liquidity is one of the best ways to do that. Even at 47% this APR is still a massive risk. I do not recommend it unless you know exactly what you are doing.

As a side note the topic of AMM farms, yield, volatility, and k=x*y impermanent losses are surprisingly complex. In fact back during the 2021 FOMO I basically proved that every website attempting to explain IL didn't actually understand it. Like their math was correct but then they tried to act like it was somehow siphoning arbitrage from other sources... which is just flat out provably incorrect. I guess what I'm getting at here is that these are advanced economics and they are very easy to mess up and make wrong assumptions.

The LP doesn't fund the project

Doesn't it though?

The Flywheel

Without liquidity no one can buy or sell the token.

The entire cycle gets destroyed.

- High liquidity allows users to buy in size.

- Pumping price increases all APR.

- Higher APR gets more delegations.

- More delegations fund project.

- Funding for the project creates value and allows it to scale.

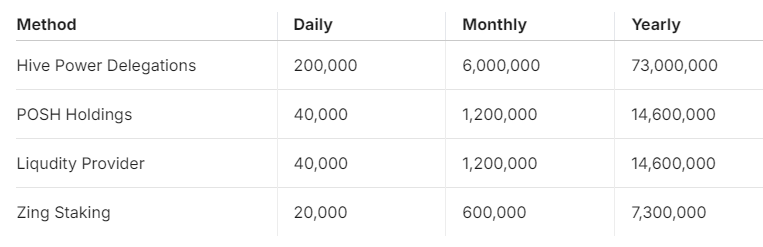

Four main ways to farm.

Actually there is just one main way to farm: which is the delegations. The vast majority of Zing tokens are being allocated to the delegations. Everything else pales in comparison. In fact these numbers aren't even accurate as I've already stated the LP has already been nerfed quite a bit (half?). This is a big reason why nerfing it again seems really inappropriate. Changes to emissions before the game is even launched should have a very good reason.

Risk free yield.

Notice that every other way to earn the token is completely risk free. We stake our liquid Zing because there is nothing else to do with them and doing so earns free yield with a 4-week timelock. We delegate to the project and we can sell that yield instantly for more APR than curation on Hive is offering. POSH holding emissions are the same deal.

The only option that comes with any risk whatsoever is the LP, and it comes with so much risk that it's quite apparent that it's not even possible to farm Zing there. As the game becomes playable and continues development the price of Zing will go up and LP positions will bleed exponentially more Zing than they could ever farm. Again, that is why the yield there should be exponentially higher than anything else. Market making is risky business.

The yield on HP delegations currently sits at a staggering 26%... which is more than double what someone can farm with Hive curation at the moment. It's quite obvious that either the price of Zing has to come down or they need to get more delegations to crowd the trade and bring the APR down. Or they could reduce the yield on delegations because it's "overpaid" but I don't think that's a reasonable expectation at this point.

That was a big trade... gigantic even.

The market cap of Zing was less than $50k while I was defending the bottom. Why was it that low? Because the Hive delegators have a financial incentive to sell all their Zing immediately for a higher yield than curation. That is why I was buying: I could see that the tokenomics of the system were pushing the price of the token down to comical levels. There were days I bought more tokens than there was total inflation for that time period... by myself.

So the reason why a couple thousand dollars makes a huge splash has nothing to do with the LP not working properly and everything to do with the total market cap being one of the smallest microcaps I have ever had the pleasure of buying. The fact that someone could dump a couple thousand dollars into an MC of $50k and only have to go x2 is shockingly good considering less than 10% of the emissions rate is being allocated to the LP. But maybe I'm just repeating myself over and over at this point.

What is at stake here?

A token like Zing can go x10 and still be a microcap. It can go x10 again and x10 again on top of that and still be a drop in the bucket compared to everything else out there. These are the kinds of numbers we are dealing with and I think it could be short sighted to try tinkering with economics when everything seems to be working just fine.

There is a reason why memecoins have been doing so well this cycle... and that reason is this exact economic discussion we are talking about right here. Do memecoins give a shit about funding a dev team to create a product with utility? No. All of the money goes into either creating liquidity or creating a hardcap on the token, both of which tend to make the price moon due to the fair-launch mechanics of Solana presales. The dev team does not get paid because their is no dev team. Something to think about.

Conclusion

The Zing team is under a lot of pressure to deliver this product to market. Projects like this are ALWAYS behind schedule and underfunded, so I get it. Money is tight and a lot of the funding is directly correlated to Hive's sad depressed price. It only makes sense that they'd be looking to reduce waste and cut the fat where ever possible. I can guarantee that this LP, which is doing great, is not the place to carve out a pound of flesh. These allocations are more than paying for themselves. Meaning if yield is taken away from the LP everyone loses money.

This is an extremely complex discussion and I'm thinking about setting up a Xitter Spaces to discuss it further with @acidyo and anyone else who would be willing to participate. Perhaps we could extend the conversation to other aspects of the game as well. We still have another two months to sort this all out so there's really no rush or reason to get worked up about any of this just yet. Let me know in the comments if you'd have any interest speaking or attending such a discussion.

I appreciate your thoughts put into this and I may be repeating what I said in some of the tweets but, here's how I see it.

Some of the things you mention were never a risk for zing, i.e. it going to 0 and people losing "everything", this was never an option in my book. I know people are used to this on other chains farming random tokens but unless something catastrophic happened out of our control zing could've never gone to "0".

LP's also receive .25% fee on every swap so it's not just all about the zing rewards. Many provide liquidity without any rewards and they do okay. (I'd be interested in knowing how much you've earned from the swap fees after having provided liquidity for as long as you have)

Hive-engine in general was never meant to be the only LP in existence as it is a bit different compared to others, we were hoping we'd have pegged zing on other chains and allow for easy arbitrating and rewarding those providing liquidity there as well, that would've gotten us a lot more liquidity potentially which could've kept the price more stable during big trades.

On the other side of the coin we also have changes to delegations and staking which were upped to make up for the difference in APR which mainly happened due to the lack of liquidity on the LP. While this may not have been the best move it helped keep delegators happy when prices were low but it seems quite obvious that this is the preferred method which may have caused liquidity on the LP to stay this low on second thought. We have almost 90% of all zing staked currently so we'll be assessing further changes to the reward distribution not just for the LP but also for the other methods, for some it may seem like a nerf but it may fit in well with our upcoming achievements to be more of a "moving distribution around".

Anyway, while the LP is important and a big reason we have spent a lot of issuance towards it, we just wanna make sure it starts to scale over time because if that amount made the price go up that much a similar amount may drop it down as well which isn't nice to witness if a bad actor has something against money or the project.

It's also a bit unfortunate how deserted the books seem on hive-engine to fix the spread compared to the LP, maybe the bots got outdated or got tired of having to figure out what's wrong with the l2 over time.

I think most of my stuff is staked. My position in the pool is only like .6%, so I don't have as much skin the game as you. I think there are a lot of people working on this that are a lot smarter than me. I'm just kind of riding the wave and waiting for the game. Still trying to decide if I want to buy more vials!

I definitely spent too much but it's fun to be a degen so here we are!

$420 on vials... lol weeeeeeeeee

Haha, I probably won't even hit close to that!

You never go full degen, friend.

I never heard of Zing. And what is AMM? Anyway, let me know when you think the token is at it's peak for this cycle and I'll ape in and be your exit liquidity. Then I'll sell at the bottom of the market in 2026.

Oh it's like this Pokemon-style game being built on Hive by Acidyo and friends.

Game will be playable soonish you'll be hearing a lot lot more about it I'm sure.

!PIZZA