Hi investors,

Today on the menu:

- Circle brings USDC stablecoin to the VISA Network

- US Democrats push for StableCoin Regulation

- The Rise and Fall of Crypto Narratives

- Ethereum 2.0 Update

- Bitcoin Market Update

... and some closing thoughts

DISCLAIMER: This content is not financial advice and only represents my personal opinions.

Always do your own research.

Circle USDC will soon become part of the VISA Network.

By far, the most impressive news this week, on December 3 Circle announced that it has joined VISA's FinTech Fast Track program and will start piloting B2B USDC <> VISA payments in early 2021.

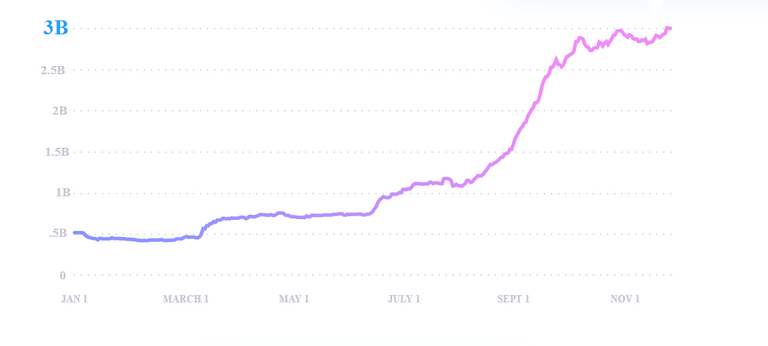

USDC is a fully-reserved digital dollar stablecoin supported across a number of public blockchains (Ethereum, Algorand and Solana) and the second largest stablecoin (in blue/purple) by market-cap after Tether (in green).

The long term vision behind this partnership is to connect crypto to traditional payment rails and develop crypto's utility beyond a set of speculative assets and technologies.

In the short term though, the partnership aims at making it possible for businesses to receive and spend USDC balances using a corporate VISA card.

If Circle successfully "graduate" from the program next year, VISA will allow Circle corporate customers to acquire VISA credit cards which will make it possible to receive payouts in USDC and pay any merchant part of the VISA network using USDC.

As Forbes writer Michael del Castillo puts it:

"[Eventually businesses] will be able to send international USDC payments to any business supported by Visa, and after those funds are converted to the national currency, spend them anywhere that accepts Visa".

Here's an example from Circle's press release:

"For example, a global ecommerce marketplace (say eBay or Amazon) will be able to identify USDC compatible wallets in their region that have approved Visa card programs connected to them. The marketplace will be able to provide their sellers with the option to receive payouts in USDC to one of these Visa partner wallets".

According to Circle, USDC payment has a number of advantages over "traditional" fiat money:

"The new payout feature will significantly accelerate funds flows, with near-instant settlement and availability, while at the same time reducing transaction fees for businesses, marketplaces, creators, sellers and suppliers."

Here's CIRCLE CEO Jeremy Allaire and VISA's Head of Crypto Cuy Sheffield on the VISA/USDC partnership:

This is a great victory for Circle and a major step towards connecting traditional finance to crypto finance. This is also a great news for Ethereum which hosts most of the total supply of USDC as of now.

As Jeremy Allaire points out the partnership is also likely to accelerate stablecoin adoption:

Circle and Visa will work together to educate and enable Visa’s global network of hundreds of fintech partners in its Fintech Fast Track Program and select marketplace partners looking to take advantage of the power of digital dollar stablecoins for global-scale payouts. Delivered through a joint sales and marketing program, Visa partners will gain access to Circle’s suite of products and APIs for using digital currency and public blockchains in payments, commerce and financial applications.

Weird anti-crypto STABLE law is rushed before US Congress.

Say what you want about President Trump, at least crypto flourished during his administration. His appointment of Brian Brooks as head of the OCC produced very bullish decisions like letting chartered US banks custody crypto.

We've recently seen a push-back against this landmark decision with the introduction by Democrat legislators of the lamely named Stablecoin Tethering and Bank Licensing Enforcement (STABLE) Act which aims to ban any stablecoin that is not issued by a federal bank (including USCD, Tether, Gemini Dollars or even Dai stablecoins issued on MakerDAO)

As (the same) Jeremy Allaire noted in a fiery tweet strom, the bill would represent a huge step backwards for the crypto industry in the US:

This sentiment is echoed pretty much everywhere in the crypto industry, head of crypto advocacy group Coin Center Peter Van Valkenburgh called it a disaster:

Centralized stablecoins aside, the bill is a disaster with regard to decentralized applications like Maker Dao, as well as a disaster for the larger innovation-enabling platforms, like Ethereum, on which those applications run.

Here's Castle Island VC partner Matt Walsch's take:

This bill is indeed quite literally a mess and a sorry misguided attempt at nipping in the bud a nascent industry for absurd political reasons.

Here's what the bill's sponsor Congresswoman Rashida Tlaib had to say about the bill:

[The STABLE act] would protect consumers from the risks posed by emerging digital payment instruments, such as Facebook’s Libra and other Stablecoins currently offered in the market, by regulating their issuance and related commercial activities.

The STABLE Act would remedy some of those challenge [by] getting ahead of the curve on preventing cryptocurrency providers from repeating the crimes against low- and moderate-income residents of color that traditional big banks have is —and has been— critically important

So, according to Tlaib, the best way to protect minorities against the evil of banks is to force crypto start-ups to... become banks themselves?

Go figure.

The worst part is that large stablecoin issuers like Facebook would have no issues at all complying with the law and becoming banks while smaller companies and start-ups would get wiped out by compliance cost.

This is exactly what happened with the GDPR in Europe. A law that was yet gain trying to "protect" the consumer eventually led to costly compliance requirements that stifled competition and aggregated power into the ands of already powerful companies like Facebook and Google that had no issue complying while continuing mining private data for private gains.

When will governments start trusting the free market and stop trying to regulate for the sake of regulating?

The Rise and Fall of Crypto Narratives.

Dan Held wrote a fun article that describes the rise and fall of crypto narratives.

While I don't agree with Dan's Bitcoin maximalism, this is a good read that can help those new to the space get a little perspective on the history of hype in crypto and, hopefuly, spare them some costly investment mistakes.

A good complement to the article is this conversation between Dan Held and Erik Vorhees on Bitcoin v. Altcoin hosted on the What Bitcoin Did Podcast.

Ethereum 2.0:

Messari just issued a timely report about Ethereum 2.0 titled: "ETH 2.0: The Next Evolution of the Cryptoeconomy" which I haven't finished reading yet.

As you might have heard, Phase 0 of the Ethrereum 2.0 blockchain (aka The Beacon Chain) launched successfully this week.

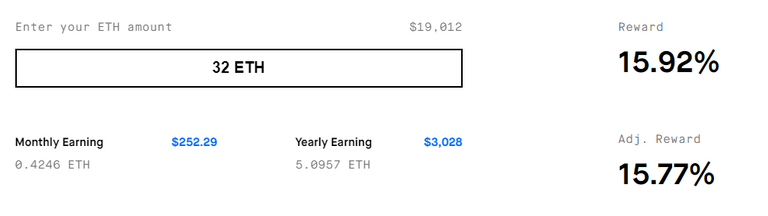

It's now possible to send 32 ETH to an Ethereum 1.0 smart contract to be converted into ETH 2.0 and start staking. Keep in min that the conversion is irreversible and that staking at this early stage can be risky.

According to this website the current staking reward on the Beacon Chain is around 15.9% for staking 32 ETH.

If solo staking isn't your thing, hosted staking services already exist and will let you stake for a fee.For more information on staking, you ca consult this guide.

Bitcoin Market Update.

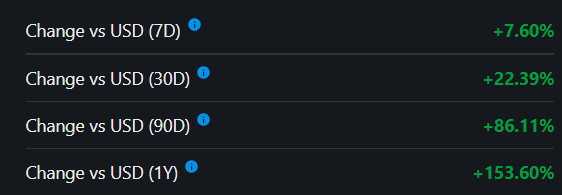

Bitcoin is trading at $19,087 at the time of writing, we're up +7.60% since last week and +153.60% YdD.

The market had a bit of a pull-back around all-time high but my outlook for 2021 is still bullish as I wrote in my last market update.

This week the CEO of BlackRock Larry Fink said bitcoin has “caught the attention” of many people and that the cryptocurrency market was still relatively small compared to others.

This is quite a turnaround from his 2017 take of Bitcoin as an index for money laundering and goes to show that institutional money is now taking the asset seriously.

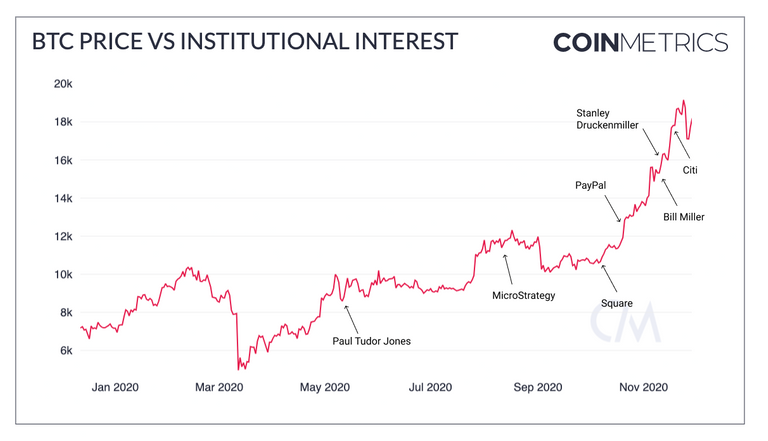

On this subject, CoinMetrics' latest State of the Network issue looks at institutional interest in Bitcoin from an on-chain analytics perspective.

Speaking of fundamentals, Messari (which has revamped its website to make it look like a Bloomberg terminal) has added a very convenient "Fundamental" section that let's you compare the fees paid to each network.

You'll be pleased to hear that the Bitcoin network is still processing a very healthy amount of fee, second only to Ethereum and miles ahead of NEM (?!) and all of the other "zombie chains".

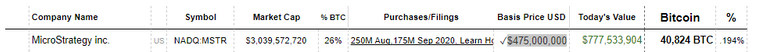

Finally, CEO of MicroStrategy Michael Saylor announced yesterday that his firm has added another $50M USD to its $BTC position.

MicroStrategy is now sitting on a Bitcoin treasury chest valued around $777M USD at the time of writing for a cost basis of $475M USD according to this website.

The news was rather well received by the community.

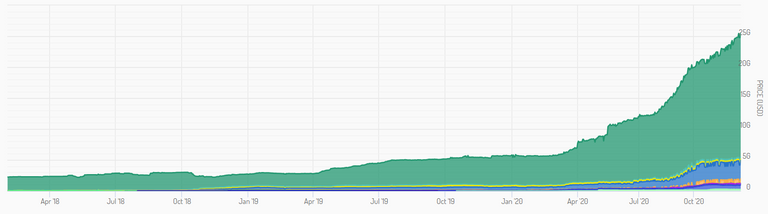

As well as the stock market, which has rewarded the company's stock with a x2.5 gain since it first announced having put Bitcoin on its balance sheet.

Closing Thoughts.

Stop trying to time the market, instead start dollar-cost averaging into projects you have strong convictions about.

This is the way.

See you next weekend for more market insights.

Until then,

🦊

Some big news there.

The Visa-Circle deal is rather large. This means that Visa is basically accepting the stablecoin for future transactions.

We are seeing more decisions that will further insulate the USD against other currencies.

Posted Using LeoFinance Beta

True but let's not forget that USDC is basically the same good ol' USD but on blockchain rails,

If anything it's really bullish for the entire Ethereum ecosystem though (since most of the USDC supply lives on Ethereum)

I feel if and whenever BTC hits 20k, it won't be long until it further hits 50k.

I hope you're right haha

Congratulations @f0x-society! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz:

@tipu curate

Upvoted 👌 (Mana: 11/22) Liquid rewards.