Hi investors,

In today's article:

- Bitcoin market update

- The case for holding ETH

- Debunking the "Blockchain not Bitcoin" fallacy

- China doesn't "control" Bitcoin

DISCLAIMER: This content is not financial advice and only represents my own personal views

Bitcoin Market Update.

BTC is trading at $18,503 USD at the time of writing as we're nearing historical ATH price established in 2017.

Source:Messari

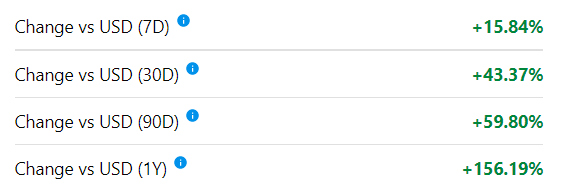

It's been an incredibly successful year for BTC which has outperformed most assets and, I believe, will keep outperforming in the coming year.

Source: https://casebitcoin.com/

From a technical level, you can see a very nice cup and handle pattern forming. I expect price to blast right through 20k sometime around EoY /early Q1 2021 and price discovery to continue up from there.

As such, I don't think previous ATH will be a technical level of significant resistance like it was in 2017.

Mind you, I am not saying that we won't see a correction before we break $20k, I just don't believe that previous all-time high will become a protracted level of consolidation like $10k was during 2020.

The main reason why I expect Bitcoin to break previous all time eventually is because I think it's unlikely we're going to see large holders take serious profit just yet.

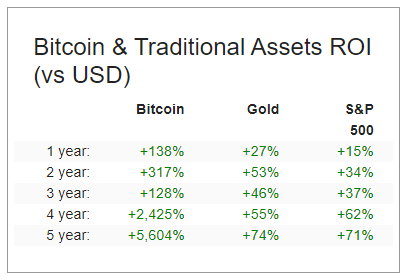

As of November 2020, the aggregate BTC cost basis (a metric known as Realized Market Cap) is much lower in this cycle than it was back at the peak of the 2017 Bitcoin bubble.

Let me break this down.

Total Market Cap / Realized Market Cap = 345 billion / 129 billion = 2.6

This tells us that your average BTC holder has "only" doubled the value of their Bitcoin position at current price. For comparison, the same metric was at around 5 (325/65) back in December 2017.

For anyone who's spend some amount of time interacting with the Bitcoin community, it's obvious that nobody is ready to take serious profit just yet and be left behind when the "real" bull market begins.

To put it differently, the market is waiting for dumb money to return and drive the price higher like we saw in 2017.

Looking back at the data, the rapid acceleration of realized cap in late 2017 suggests that the gap in position size between bitcoin "whales" and dumb new money was extreme.

Drawn in by sensationalist headlines and get-rich-quick dreams, most of these late-comers only acquired Bitcoin as a bridge currency to gamble on ICO tokens. Trading against them were large Bitcoin holders (whales) hardened by a nearly 4 years of bear market.

New money never stood a chance.

As the market peaked in mid December 2017 and demand started to dry out, Bitcoin whales continued to aggressively take profit.

The price of BTC started to go down quickly and with it all the other altcoins and ICO scam coins.

Lacking convictions to hold their expensive bags, the new money quickly abandoned ship.

A two-year bear market followed.

Fast forward to today and Bitcoin is a completely different beast.

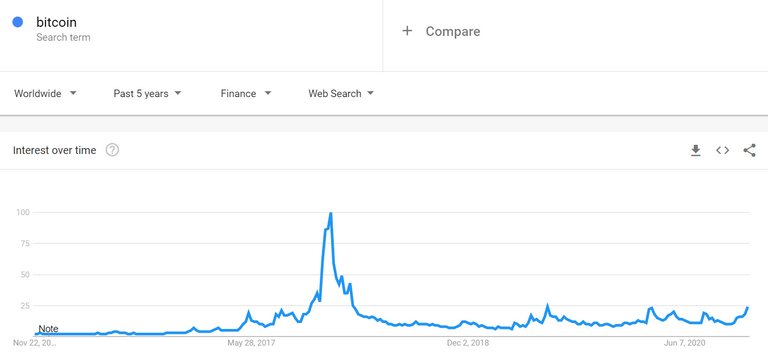

Google trend data seems to show that retail is still largely on the sideline. This time the rally seem driven by smart institutional money in search for yield.

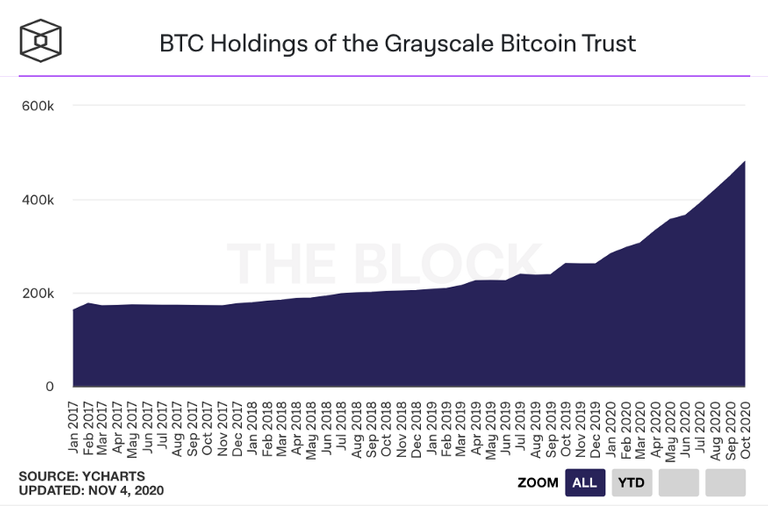

Unlike in 2017 though the market is ready to accommodate larger position sizes thanks to institution-friendly investment vehicles like Grayscale's GBTC, derivatives markets like the CME and clarification around crypto-custody by US chartered banks.

Source: The Block

Another powerful catalyst is the uncertainty around the US election and, corollary to that, fear that the next administration keeps debasing the USD via QE and fiscal stimulus in an attempt to meet high inflation targets set by the FED.

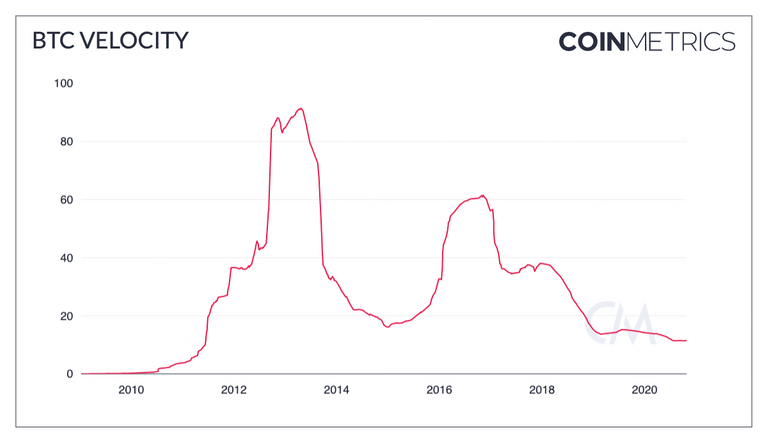

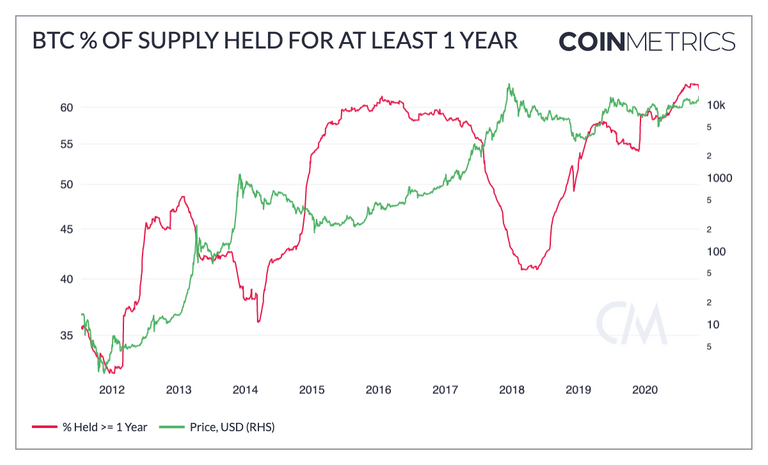

Finally, the total amount of Bitcoin available on the market is dropping fast. Halving aside, Bitcoin velocity is at its lowest in 8 years while over 60% of the total BTC supply had been held for at least 1 year.

For the first time of its young history, Bitcoin is trading in a depressed economy and thriving like a fish in water.

I don't dabble price prediction but I suspect that we'll continue to see BTC overperform other assets in 2021 as retail wakes up to this new bull market and start piling in.

I also think we'll see even more famed Wall Street investors come out of the wood-work and hype BTC as a good asset for portfolio diversification, thus removing a lot of career risk for traditional institutions to introduce BTC to their clients.

A word of caution though. If you're just discovering Bitcoin now and wondering if you should sell your house for BTC... just don't.

Source: BitcoinWisdom

Five straight weeks of vertical green candles is not a good entry into any investment.

The best approach to gain exposure to this very volatile asset is by far to slowly dollar-cost average into a position. The right mindset is to treat your BTC like a saving account that appreciate over time.

Patience wins the game here.

The Case for Holding Ether.

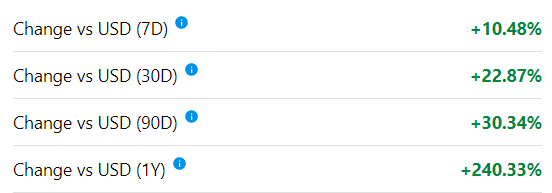

Ether (ETH) also had a helluva year, trading at $514 USD at the time of writing, the asset is up 300% since our market alert back in April 2020.

ETH has notably overperformed BTC YtD and I believe that it will continue to gain traction in 2021. Demand will come both from developers and users of decentralized crypto finance apps and Ethereum community members using ETH as an alternative store of value to Bitcoin.

Source: Messari

Beside, the launch of Phase 0 of Ethereum 2.0 has, in my view, made ETH a much better asset to hold.

Not only holding ETH 1.0 gives you some exposure to the growth in DeFi, it's also a synthetic call option to acquire ETH 2.0 at ETH 1.0 spot price.

Since ETH 2.0 will be a cash-flow generating asset, I wouldn't be surprised to see the market start to reprice ETH 1.0 up to discount future cash flows from ETH 2.0.

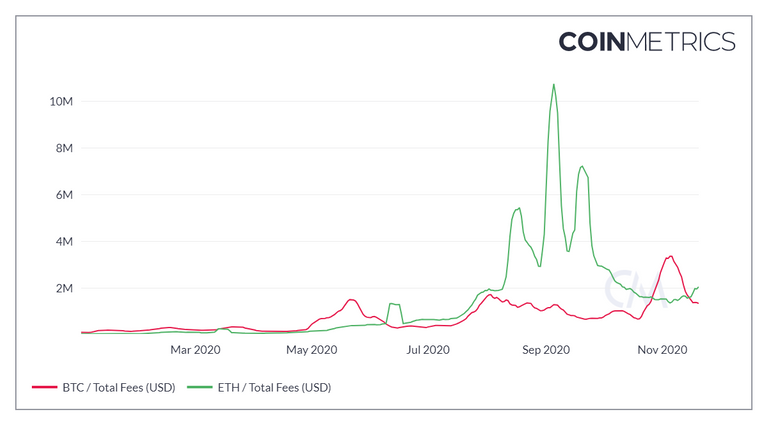

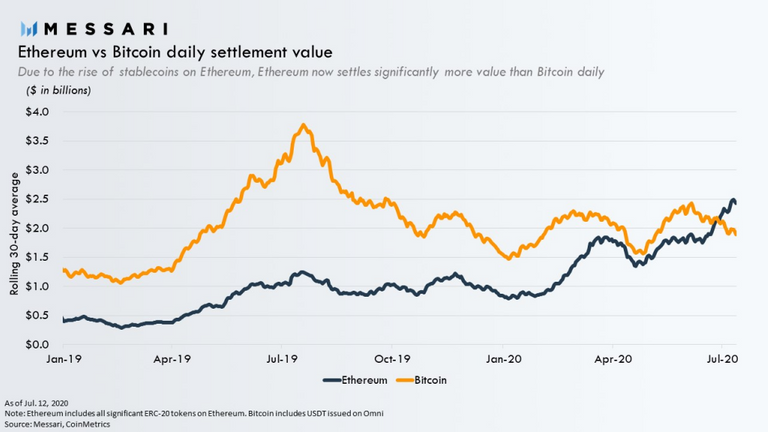

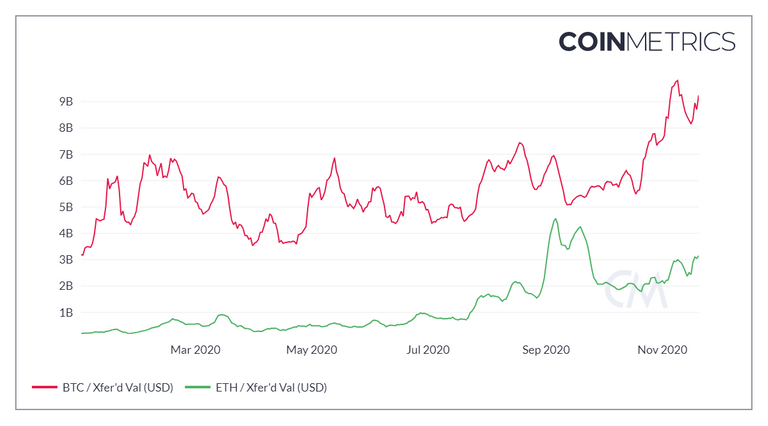

Make no mistake, Ethereum has massive momentum going into 2021. Its community rivals Bitcoin's in size, the network rewards miners handsomely which is good for its security and a July 2020 report from Messari revealed that more value is settled on Ethereum than on Bitcoin.

This brings me to my next point.

The "Blockchain not Bitcoin" Fallacy

In this section, I'll try to put to rest the misguided concept of "blockchain not Bitcoin" which still captures a lot of mental bandwidth in places like LinkedIn (yikes!) and with people that don't have a firm grasp on the technology behind "blockchain".

The "blockchain not Bitcoin" school of thought spawned during the darkest hours of the 2015 Bitcoin bear market.

Back then, Bitcoin was in a terrible shape and still marred by associations with the Silk-Road and money-laundering.

Since nobody at the time would touch Bitcoin with a 10-foot pole, blockchain took off as a concept instead.

The idea can be unironically boiled down to this: Bitcoin is bad but blockchain is good.

It was the beginning of "everything on a blockchain", from mangoes to salads to medical records, enterprise blockchain became this miracle solution for all the biggest pain points in any industry ...and a techno-panacea that would fix all the world's problems.

Fast-forward 5 years and enterprise blockchain has gone nowhere while public blockchains like Bitcoin and Ethereum are settling billions of dollars in value every day.

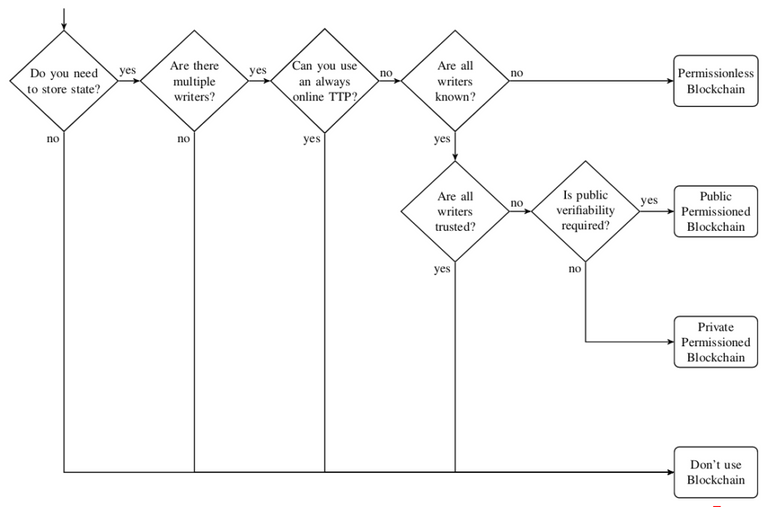

The reason why private blockchain turned out to be such a flop is because blockchain as a concept was poorly understood by companies that tried to implement it.

Fundamentally, a blockchain is a way to write and store data in a very redundant and costly fashion.

Blockchain costly write-process is what makes it an ideal underlying data structure for an immutable and decentralized ledger like Bitcoin but a terrible option for almost everything else else.

Simply put, if your database is not going to live in an adversarial environment, blockchain is not a good data structure for your app.

Forcing a blockchain into a set-up that doesn't require one only adds cost and unnecessary complexity where you can get by with a simple bare-metal data base or cloud storage solution.

Here's a thought experiment for you. It involves using blockchain for supply chain.

Say you want to put bananas "on the blockchain". You and the other companies in your supply chain set up a shared blockchain database so that each banana bunch produced gets a QR code which certifies its origin and tracks its location along the supply chain. This data is written in your shared enterprise blockchain.

Now what happens if an apple gets accidentally labelled with a QR code intended for a banana?

Well the blockchain can't tell the difference between an apple and a banana since it's just a database. But now your apple is forever marked as being a banana in your blockchain.

Congratulations, you've introduced garbage data in your immutable blockchain.

No worries, you say, that would never happen! I trust my suppliers to enter correct data in our shared blockchain database!

If you assume trust from your suppliers though, why would you ever need a blockchain database to start with?

This is known as the oracle problem. Since your blockchain has no way of interacting with the real world, you have to trust that the data that is written into your blockchain is correct otherwise you end up with garbage data.

As a result, blockchain works well to track native digital assets securely (like Bitcoin balances) but very poorly when you need to trust third parties to bridge your blockchain with the real world (which is the case in most business activities).

Now, if one really wanted to use a blockchain database for an enterprise application, they might as well use the rails that are already provided by public blockchains like Bitcoin or Ethereum.

You don't build a road for your car to drive on whenever you need to go to the supermarket, you just take the driveway.

Okay but, doesn't China control Bitcoin?

China Controls Bitcoin is a Myth

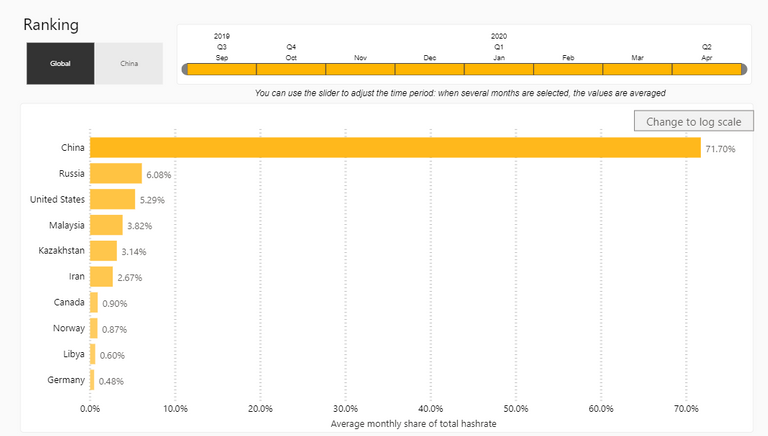

It is an undisputed fact that most hashing power comes from miners located in China.

Source: https://cbeci.org/mining_map

However, it is not true that whom who produces the most hashing power controls Bitcoin.

Equating hashing power to control is a rookie mistake.

Let's break this down.

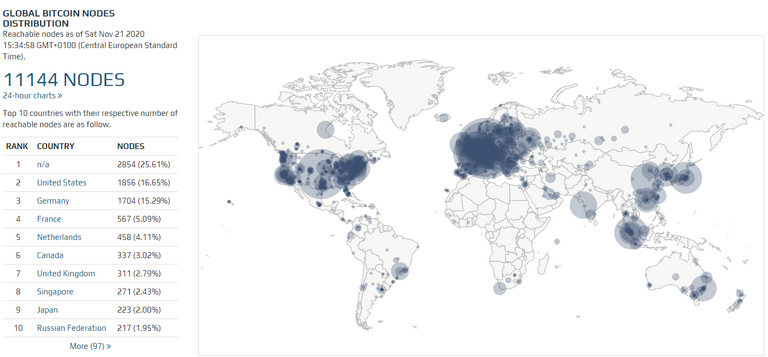

Bitcoin or rather the rules for pushing a transaction through the Bitcoin network (no double spending, 21 million cap, etc) are enforced by another set of participants called Bitcoin nodes.

Unlike mining which can only be done on an industrial scale nowadays, running a node to validate transactions and enforce network rules can be done for less than $300 USD.

Since the cost of validation is cheap, the network of Bitcoin node operators is extremely well decentralized.

Source: https://bitnodes.io/

Miners only provide security to the network and bundle transactions into blocks which they then hash in order to write them into the blockchain.

The only control that miners have is to be able to censor transactions by refusing to include them into a block. Chinese miners could, say, refuse to include transactions coming from Taiwan.

This particular threat of censorship is real though and, as Bitcoin continues to grow and becomes established as an international settlement network, countries will be incentivized to develop their mining capacity to make sure that their transactions continue to go through uncensored.

The good news is that Bitcoin mining is not permissioned. Anyone who can front the capital may become a miner and try to hash blocks.

To sum up, China doesn't control Bitcoin however I believe that we'll see mounting geo-political urgency around developing mining capacity in the West in the next 10 years with the goal of rebalancing the distribution of mining power around the globe.

See you next weekend for more market insights.

Until then,

🦊

Congratulations @f0x-society! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP