Solana, the high-speed blockchain known for its low transaction costs, is at a crossroads. A new proposal, SIMD-0224 (also referred to as SIMD-0228), has sparked a heated debate within the community.

This proposal aims to overhaul Solana's current inflation model, potentially reshaping the network's economic future.

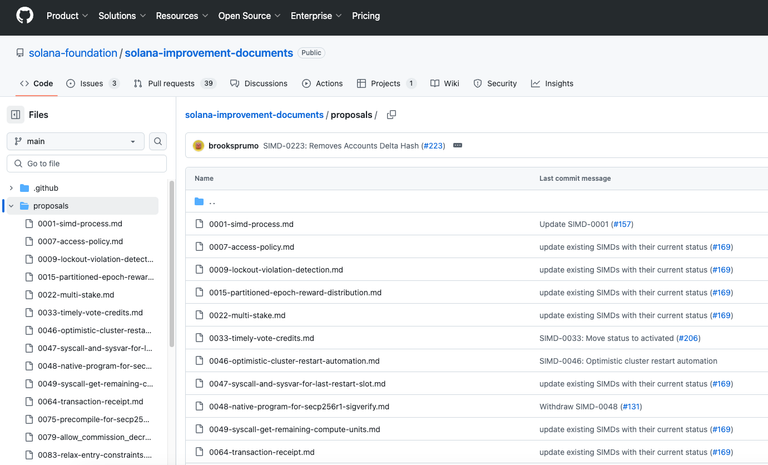

Solana Improvement Documents

Solana Improvement Documents

The Current Situation

Solana's existing inflation mechanism operates on a fixed schedule, with a static rate of SOL issuance as staking rewards. As of January 2025, the inflation rate stands at 4.7%, which some argue is unnecessarily high given the network's current activity and fee structure.

The Proposed Change

SIMD-0224 suggests a shift from the fixed inflation schedule to a dynamic, market-driven model.

- The proposal sets a target staking rate of 50% to enhance network security and decentralization.

- If more than 50% of SOL is staked, the supply will decrease, lowering the yield and discouraging further staking.

- If less than 50% is staked, the supply will increase, raising the yield and incentivizing staking.

- The minimum inflation rate would be 0%, while the maximum would be determined based on Solana's current issuance curve.

Potential Impacts

Reduced Selling Pressure

Proponents argue that this mechanism could systematically reduce selling pressure while maintaining healthy staking participation. By aligning inflation adjustments with actual network activity, the issuance would more accurately reflect Solana's real-time economic and security status.

Lower Staking Yields

One obvious impact is that SOL staking yields may decrease. Historically, these yields have remained above 7%. If issuance decreases, this yield will likely follow suit, although growing MEV rewards might partially offset this impact.

Alignment with Network Activity

The new model aims to make Solana's inflation rate more responsive to market conditions, potentially reducing the current "tax burden" on non-staking SOL holders.

Community Reactions

As with any significant proposal, opinions within the Solana community are divided.

Messari analyst Patryk supports the proposal, viewing it as a positive evolution from "blind issuance" to "smart issuance." He believes it could benefit SOL holders while having a neutral impact on stakers.

On the other hand, Solana forum member Bji opposes the change. He argues that the primary purpose of inflation is to incentivize validator participation and maintain network security. With validators already earning significantly from transaction fees, priority fees, and MEV, Bji contends that reducing inflation rewards might not greatly affect validators but could decrease stakers' rewards.

Concerns and Counterarguments

Critics of the proposal raise several valid points.

The assumption of a positive correlation between staking percentage and economic activity may not always hold true.

The current model already provides a market equilibrium for stakers, and the proposed changes might unnecessarily complicate these dynamics.

Introducing a dynamic inflation model at this stage of Solana's development could be premature and introduce unnecessary complexity and risk.

Fixed, predictable inflation rates are generally considered better for economic stability.

As Solana continues to mature, finding the right balance between network security, staker incentives, and economic stability is crucial. The SIMD-0224 proposal represents a significant shift in Solana's economic model, and its potential implementation could have far-reaching effects on the ecosystem.

Whether this proposal passes or not, it's clear that Solana's community is actively engaged in shaping the network's future. As investors and users, staying informed about these developments is key to understanding Solana's long-term prospects in the ever-evolving crypto landscape.