BlackRock's iShares Bitcoin Trust ETF (IBIT) just experienced its largest single-day outflow since its launch, with a whopping $332.6 million withdrawn on January 3rd.

This marks the third consecutive day of outflows for the fund, setting a new record and raising eyebrows across the investment community.

Bitcoin ETF

Bitcoin ETF

What's Behind the Outflows?

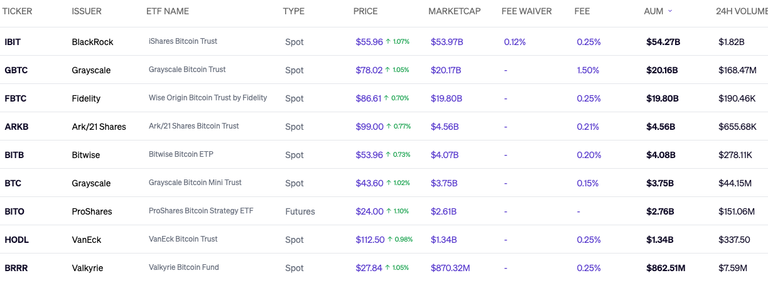

It's tempting to see this as a bearish signal, but let's put things in perspective. IBIT remains the largest Bitcoin ETF, with net assets of around $53.5 billion and total inflows of $36.9 billion since its launch.

The recent outflows, while significant, represent only a small fraction of the fund's total assets.

Several factors might be at play here:

- Year-end portfolio rebalancing: Institutional investors often adjust their portfolios at the start of a new year.

- Profit-taking: After Bitcoin's stellar performance in 2024, some investors might be cashing in their gains.

- Market adjustment: The crypto market has been on a tear, and a pause for breath is natural and healthy.

The Bigger Picture

While IBIT saw outflows, other Bitcoin ETFs actually recorded inflows on the same day.

Bitwise's BITB and Fidelity's FBTC saw inflows of $48.3 million and $36.2 million, respectively.

This suggests that the outflows might be more about fund-specific dynamics than a broader market trend.

It's also worth noting that Bitcoin's price has held relatively steady despite these outflows. As of January 6th, Bitcoin was trading around $99,300, down from its all-time high of $108,315 in December but still showing steady strength.

Looking Ahead

Despite this short-term blip, many analysts remain bullish on Bitcoin and crypto ETFs for 2025.

Bernstein predicts Bitcoin ETF inflows could exceed $70 billion this year, potentially pushing Bitcoin's price to $200,000 by year-end.

The crypto market is maturing, with increased institutional participation leading to greater stability and more sophisticated price discovery mechanisms.

The regulatory environment is also expected to become more favorable, particularly with the new administration in place.

What This Means for Investors

While the IBIT outflows are noteworthy, they don't necessarily signal a bearish turn for the market. Instead, they remind us of the importance of diversification and the need to keep a long-term perspective in the volatile world of crypto.

Congratulations @harryinawolf! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 50 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: