BEWARE those holding USDC, often thought of as a "safer" stablecoin "bet" than USDT, but still bearing potentially significant risks nonetheless. The story is that Circle is losing gobs of money in addition to reaching for yield in questionable ways, and to questionable lenders who have already blown up (ie. Genesis, BlockFi, Celsius, Galaxy, Alameda, and 3AC)!

If they can't keep the money raise train rolling, well, you know how this one's also likely to play out...

Via @CryptoInsider23 on twitter...

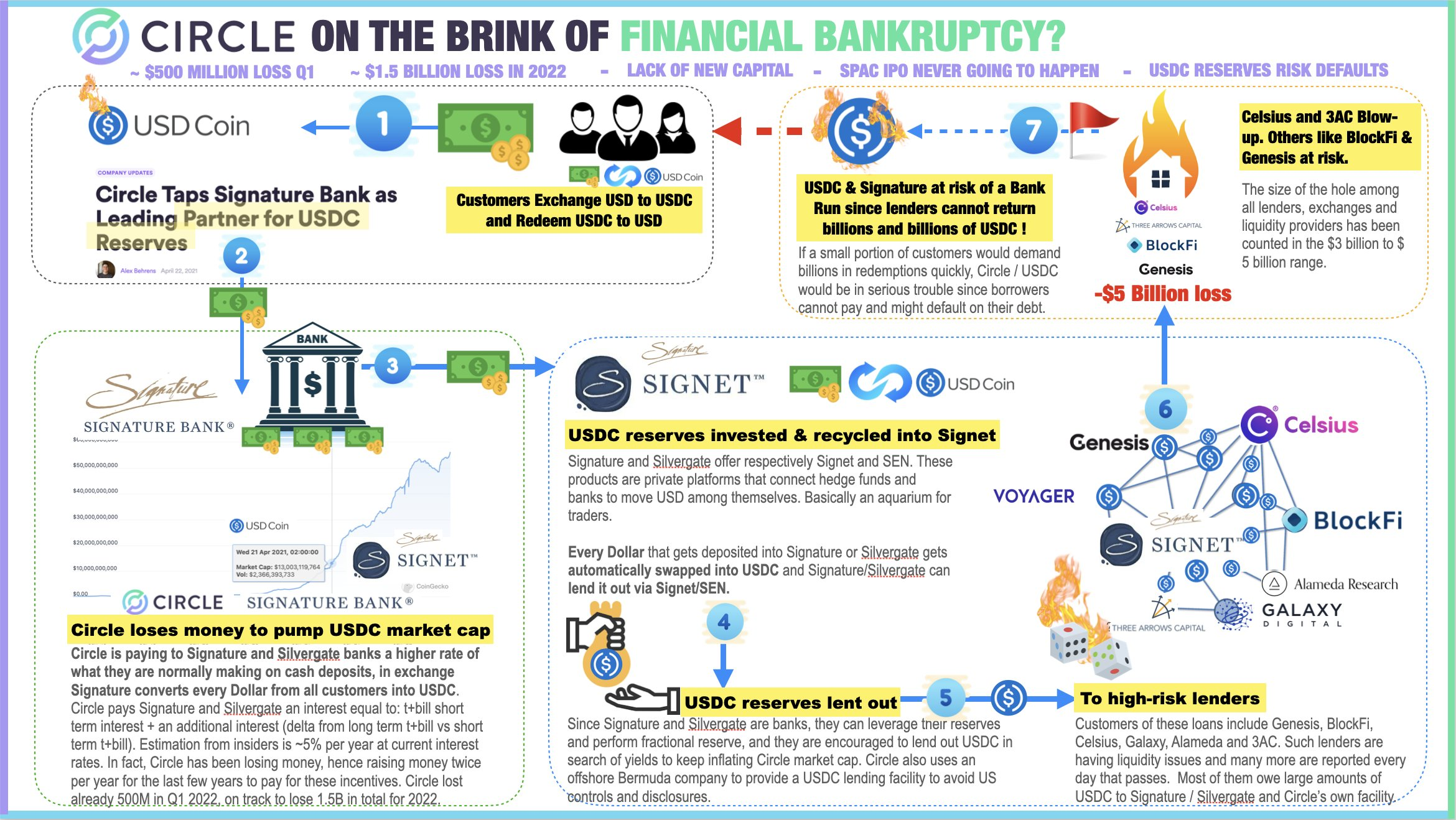

Circle's USDC scheme is on the brink of collapse. If you read their SPAC IPO filings its clear they have been losing money constantly but theres something dirtier happening underneath. They're at major risk on defaulting on USDC reserves. A deep dive on USDC.

How it starts: Circle loses money to pump USDC market cap. Circle pays the higher rate of what Signature and Silvergate are normally making on cash deposit. For this arrangement Signature converts every Dollar from all customers into USDC.

Circle is paying an interest equal to: t+bill short term interest + an additional interest (delta from long term t+bill vs short term t+bill).

My sources say this is ~5% per year at current interest rates. This is why Circle is always losing money! They were raising money twice per year for the last few years to pay for these incentives. Circle lost already 500M in Q1 2022 on track to lose 1.5B in total for 2022!!!

The next part: USDC reserves are invested and recycled into Signet & SEN. Every dollar that gets deposited into Signature or Silvergate gets auto swapped into USDC and they can lend it out. Since they are banks, they can leverage their reserves and go fractional reserve.

Circle also uses an offshore Bermuda company to provide a USDC lending facility to avoid US controls and disclosures.

The shady part: USDC is now lent to high-risk lenders. Customers of these loans include Genesis, BlockFi, Celsius, Galaxy, Alameda and 3AC. It's a list of nearly every borrower that is blowing up LMFAO!!

The size of the hole among all lenders, exchanges and liquidity providers has been counted in the $3 to $5 billion range. You can see USDC and Signature are at risk of a Bank Run since lenders cannot return billions and billions of USDC!!

Im a crypto insider so I can and need to tell you what's going on behind the curtain and it really is so very bad. This is the dirty secret being kept quiet by crypto hedge funds and the big guys. Be careful for when this blows up. PEACE. ☮️