Rethinking $HBD Bonds and Witness Parameters for $HBD APY

[UPDATE: For those who might find this post "way too complicated" or want a "dumbed down version," I have published a lighthearted Children's Story Version (with the help of PeakD's AI button) 🤣.]

This post provides a hypothetical example of how to structure Layer 1 $HBD Bond offerings.

I am providing this to get members of the community engaged in deeper dialogue about the concept.

As @taskmaster4450 said in a post yesterday about “How To Implement Time Vaults And Hive Bonds”:

The interest rates ... have only one purpose: draw in capital.

My unique contribution to this discussion is the suggestion that we should focus our efforts toward managing the amount of capital we want to draw into the ecosystem rather than trying to manage the interest rates needed to do that.

Implementation of L1 $HBD Bonds will also require an instantiation of Layer 1 NFTs, which I discussed at some length during my talk on “Two Novel Use-Cases for Hive Layer 1 NFTs” at HiveFest.

The Backstory: A Twitter and Twitter Spaces Conversation

A couple days ago, there was a lengthy twitter conversation about $HBD APY (in particular) and $HBD Bonds (in general).

The conversation began in response to a twitter post by @khaleelkazi that was a recording of a twitter spaces discussion (about stablecoins) between @khaleelkazi, @taskmaster4450, @anomadsoul, @theycallmedan, and @edicted.

@threespeak responded to @khaleelkazi’s post with a tweet of his own, saying:

- HBD supply is infinite

- Volume comes from local spending of HBD earnings from value added activities

- @edict3d u can make money on HBD purchases. The 5% does not exist if u do it properly

- pls lower APR to 6% lower risk on community and put 16% APR and risk on speculators

That sparked an extensive twitter conversation that included @threespeak, @khaleelkazi, @edicted, @trostparadox, @themarkymark, and @rubencress (and maybe a few others).

Much of that conversation was then discussed in more detail during Saturday’s 3-hour @cttpodcast, which can be listened to here or here or here (my brief comments start at 53:07 on 3speak.tv or 58:00 on twitter).

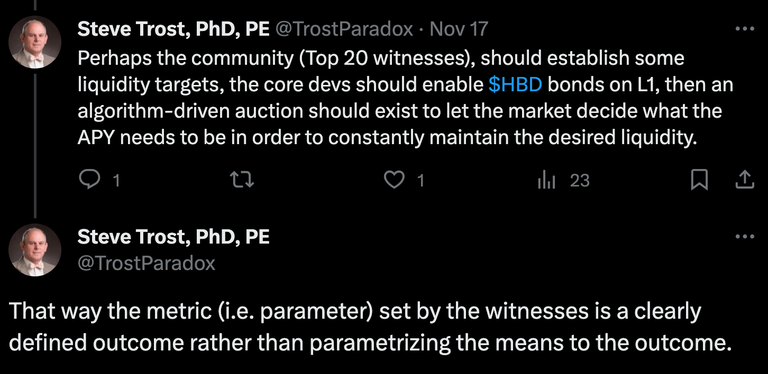

The purpose of this post is to expand on one of the suggestions I voiced during the aforementioned CTT. My suggestion was to parameterize (as a witness parameter) how much $HBD we would like to have locked up (and for how long), rather than parametrizing the $HBD APY itself. That way, the community can focus on the desired end result rather than merely the means to that end. Doing so allows for far more effective management.

(NOTE: In my twitter post (below), I used the term ‘liquidity’, but a better term would be total value locked, or TVL, so I will use TVL for the remainder of this post.)

~~~ embed:1725527576733728996 twitter metadata:VHJvc3RQYXJhZG94fHxodHRwczovL3R3aXR0ZXIuY29tL1Ryb3N0UGFyYWRveC9zdGF0dXMvMTcyNTUyNzU3NjczMzcyODk5Nnw= ~~~

The Suggestion: Parameterize the Amount of Desired Total Locked-In Capital

Here is one way to do this:

- Each witness ‘votes’ on how much TVL they would like to see for the specified time horizon (for our hypothetical example, we’ll assume a specified TVL time horizon of 18 months).

- Each witness ‘votes’ on a maximum APY for the specified $HBD Bond maturity (for our hypothetical example, we’ll assume a specified $HBD Bond maturity of 2 years).

- On the first day of each month, an L1 algorithm checks the Top 20 witness feeds and establishes and publishes that month’s $HBD Bond offering.

- On the seventh day of each month, an L1 algorithm receives bids for that month’s $HBD Bond offering. Each bid would be for a specific amount of $HBD, a specific APY bid, and must include a security deposit (e.g. 5% of the bond amount).

- NOTE: Any style of auction would suffice, but I would suggest a dutch auction. Under a dutch auction, the bids would be rank-ordered from best to worst (i.e. lowest APY to highest), the total bond amounts would be allocated starting with the best bid then moving down the list until all the bond funds have been allocated, with all bidders receiving the same APY as the last successful bidder.

- At the close of the bidding period, an L1 algorithm would:

- Return the security deposits of all unsuccessful bidders.

- Notify all successful bidders, informing them of the amount of their bond, the lock-up period, the APY, the balance due, and the deadline for completing their bond purchase.

- Mint new L1 $HBD Bond NFTs for each successful bidder who completes their purchase before the purchase deadline.

- Send (to the DHF) the security deposits for each ‘successful’ bidder who fails to complete their purchase before the purchase deadline.

Here is a hypothetical example of the way the process might proceed:

- An L1 Hard Fork (HF):

- Codifies two new witness parameters:

- Desired TVL at 18 months

- Max APY for 2-year $HBD Bonds

- Enables the creation of transferable L1 $HBD-Bond NFTs

- Enables L1 algorithms for determining monthly $HBD Bond offerings (based on witness parameters and actual TVL) and conducting a monthly auction for said $HBD Bonds

- Codifies two new witness parameters:

- On Day 1 of Month 1 (after the HF), the witness parameteers (median values of the Top 20 witnesses) are as follows:

- 18-month desired TVL: 100,000 $HBD

- 2-year max APY: 20%

- On Day 7 of Month 1, the L1 algorithm determines the following $HBD Bond offerings:

- 2-year: 100,000 $HBD (because the current 18-month TVL is zero $HBD)

- During the bidding period, the following bids are received (for 2-year $HBD Bonds):

- Bid #1: 100,000 $HBD at 20% (with 5,000 $HBD security deposit)

- Bid #2: 50,000 at $HBD 19% (with 2,500 $HBD security deposit)

- Bid #3: 40,000 at $HBD 18% (with 2,000 $HBD security deposit)

- Bid #4: 50,000 at $HBD 17% (with 2,500 $HBD security deposit)

- Immediately after the bidding period closes, the following security deposits are returned:

- 5,000 $HBD to Bidder #1

- 2,000 $HBD to Bidder #2 (500 $HBD of Bidder #2’s security deposit is retained, because they qualify for a 10,000 $HBD Bond, instead of the 50,000 $HBD Bond they originally bid for)

- The following $HBD Bonds are prepped for purchase (by L1 algorithm) (with interest rate set by dutch-auction rules)

- 50,000 $HBD for Bidder #4 at 19% APY

- 40,000 $HBD for Bidder #3 at 19% APY

- 10,000 $HBD for Bidder #2 at 19% APY

- After payment of the balance due is received from the successful bidders, the following $HBD Bond L1 NFTs are minted and transferred (by L1 algorithm) to the respective bondholders

- 50,000 $HBD for Bidder #4 at 19% APY

- 40,000 $HBD for Bidder #3 at 19% APY

- 10,000 $HBD for Bidder #2 at 19% APY

- If no changes occur to the Top 20 witness parameters

- On Day 1 of Month 2, no bonds are offered (because the 18-month TVL is 100,000 $HBD)

- On Day 1 of Month 3, no bonds are offered (because the 18-month TVL is 100,000 $HBD)

- On Day 1 of Month 4, no bonds are offered (because the 18-month TVL is 100,000 $HBD)

- On Day 1 of Month 5, no bonds are offered (because the 18-month TVL is 100,000 $HBD)

- On Day 1 of Month 6, no bonds are offered (because the 18-month TVL is 100,000 $HBD)

- On Day 1 of Month 7, 100,000 $HBD in new 2-year bonds are offered and auctioned (because the 18-month TVL has dropped to zero $HBD, due to the maturity date of the first set of $HBD Bonds dropping below 18 months in the future)

- Let’s assume the successful APY for the new set of $HBD Bonds is 18%

- On Day 1 of Month 8, no bonds are offered (because the 18-month TVL is 100,000 $HBD)

- On Day 1 of Month 9, no bonds are offered (because the 18-month TVL is 100,000 $HBD)

- On Day 1 of Month 10, no bonds are offered (because the 18-month TVL is 100,000 $HBD)

- On Day 1 of Month 11, no bonds are offered (because the 18-month TVL is 100,000 $HBD)

- On Day 1 of Month 12, no bonds are offered (because the 18-month TVL is 100,000 $HBD)

- On Day 1 of Month 13, 100,000 $HBD in new 2-year bonds are offered and auctioned (because the 18-month TVL has dropped to zero $HBD, due to the maturity date of the second set of $HBD Bonds dropping below 18 months in the future)

- Let’s assume the successful APY for the new set of $HBD Bonds is 17%

- As of the close of Month 13, the following total $HBD Bond amounts have been issued:

- 100,000 $HBD at 19%, maturing in 11 months

- 100,000 $HBD at 18%, maturing in 17 months

- 100,000 $HBD at 17%, maturing in 23 months

Conclusion

The above hypothetical assumes we start with a single time-vault maturity duration (e.g. 2-years). In @taskmaster4450’s post yesterday, he suggested starting with four (1-month, 3-months, 6-months, 1-year). From a technical standpoint, if the time vaults are instantiated as L1 NFTs where the maturity date is merely included as immutable reference data within the NFT, then we essentially have an infinite number of time vault durations we can implement. The challenge with that, for the system I’ve outlined above, becomes managing the monthly $HBD Bond offerings and their respective auctions.

With that said, we could do a hybrid between @taskmaster4450’s suggestion and mine, wherein we parameterize the short-term maturity APYs (and allow anyone to purchase any of those $HBD Bonds at any time, in any amount) and, separately, parameterize the TVL for a single-maturity long-term $HBD Bond. The advantage of this hybrid system would be that we would have, on a monthly basis, a market-based determination of the long-term APY, which would then provide the witnesses valuable information they could use when setting short-term APYs.

Seems good to me, the NFTs might be unnecessary doh. We’re mostly interested in the ability to calculate and verify. Custom JSON should do the trick, add ordinals like image data into the chains blockspace if you really want to have a picture of the bond on chain.

How would you schedule the payouts and in which coin?

We’ve been specifically discussing $HBD Bonds, but once the infrastructure is in place, it could easily be applied to $HIVE as well.

Payouts could be automated, or they could be done purely as claims that the bondholder must initiate. Claims would be easiest to code, so that might be the best way to go.

Interesting, interesting.

Being able to transfer ownership of the bond is critical, with the ownership at maturity being able to claim all the $HBD tied to the bond. I don’t think this could be done purely via custom JSON.

However it’s ultimately implemented, the net result will be some sort of NFT.

The reason I wont be buying more HBD is because of the costs of buying/selling from fiat to bitcoin and from bitcon to HBD or Hive. The exchange fees and spreads are outside the scope of the protocol. So maybe the protocol is doing all it can do to get people to hold HBD. At the end, you need several months of interest before you're back at where you started.

Way too complicated!!

Ah so I'm not the only one?

I like me some complicated game-theory but gah imagine trying to pitch something like this to newbies along with everything else. Or maybe that doesn't matter because we can simplify the frontend and hide most of the mechanics in the background.

It's nice to see that the discussion is continuing and everyone is taking this very seriously.

I feel like I'll need to look at this tomorrow with fresh eyes.

It's a lot to digest.

Already the thing with the 4 different pair of keys is putting people off. Let alone such a complicated scheme. People always forget, for mass adoption interfaces need to be accordingly stupid. I prefer a dumbed down version which is truly user friendly (but brings Hive to 2$) vs. a high-end version for nerds only.

I support adding stuff like this both for investors and to draw more investors to Hive, but yeah, working on the dumbing down part to draw the general public seems like it should take the priority.

100% of the complexity would be back-end only.

A simple UI would allow anyone with $HBD in their wallet to bid on and/or purchase $HBD Bonds. Similarly, a secondary market for trading those bonds would not require any expertise beyond a general understanding of bond markets.

Investors familiar with bond markets would have no issues, with the primary or secondary markets.

The purpose here is not to get existing Hivers to invest in $HBD. The intention is to add an investment use case that is very familiar to a wide range of investors, and to do it in a way that allows the witnesses to focus on managing a metric (TVL) that is more straight forward and much more likely to ensure long-term stability, compared to managing APY.

Hive's multiple private keys is probably one of its greatest strengths.

Even so, onboarding is certainly a big challenge, and will remain so for the foreseeable future.

This added use case ($HBD Bonds) is not geared toward average users, though. This would be meant to appeal to accredited investors and investors who are used to paying advisors and consultants to handle the day-to-day details associated with their investment portfolios.

One thing is potential target of such system, the other is potential influence on other users. If it won't be possible to explain easily, it's going to be seen as old fashioned shady financial shenanigans. It's about perception here. Explaining Hive tokenomics to an avarage person right now is borderline possible.

Let's weight costs and benefits here.

Although, I need to add, personally I find proposed solution appealing.

Agreed! I was about to make the same comment. Regular people would go to a bank in a heartbeat instead.

But, of course! We would not be doing this for 'regular people'.

My guess is that less than a handful of existing Hivers have ever invested directly in a bond instrument like the ones @taskmaster4450 and I and others have been discussing recently.

This is not for the 'average person'. This is for accredited investors (i.e. investors who are accustomed to investing hundreds of thousands of dollars at a time).

I want to say that I agree with a time lock mechanism for a higher APR (basically, like the CDs that banks offer), and bonds that give access to the locked liquidity before maturity, but the way you parametrized the TVL, while I like the idea, is not easy to grasp. And if it's built for a couple of people, is it worth building it?

This would not be built for a couple of people. It would be built to attract many millions of dollars in investment capital, perhaps hundreds of millions.

Hmmm

Definitely

I prefer to buy a little bit of HBD with liquid Hive on the internal market… stake it in savings to earn xx % APY then delegate the rest into exciting projects like Holozing and others to earn 1000 % APY … if HBD moves to locked up bonds I will just move it to Zing or Leo.

You would still have that option. The caveat would be instead of earning 20% for depositing into the 3.5d savings account, you might be earning 6% or 10%. To get the higher APY, you would need to lock up your $HBD for a much longer time period.

Hmmm… 6 % or 10% ??? At the moment you can earn 12% from Curation (9 +3 % ) …. Or even delegation to Ecency …. If HBD APY drops below 12 % I’ll probably move my HBD back to Hive Power.

There's no way to know what the savings APY will be, but it will most likely be less than what it is now.

$HIVE Power represents a 13-week lock-up, so it should be more desirable than a 3.5-day lock-up.

That’s one of the arguments @starkerz has been making, that the current 3.5-day APY is way too high. He’s been suggesting 12%.

Although I agree the number should and likely will be lower than what it currently is, I don’t think we should reduce the number until we can offer longer term bonds at or near the current rate.

My main concerns are that it is not yet clear when the bond system will be ready. it could be 6 months, it could be 18 months, it could be longer. With that being the case, it is important to:

a) begin to help the rest of the community understand that 20% APR for a 3.5 day lock is is asking too much, and is not requiring enough skin in the game for such high APR returns

b) begin the process of the community considering more realistic APR rates based on realistic lock-in times, for when the technology is available

c) Hope that the community understands that it will have to face the shock either way, be it now. by lowering rates, or later by increasing lock in time and lowering rates

d) Hope that the community understands that it is unreasonable to expect such high APR while putting the risk on other community members

e) Hope that the community understands that it is realistic to move the risk of such high APR to speculators, and lower the risk and the counter party risk to the community by moving it to layer II collateralised bond loans

f) Hope that the community understands that there is a difference between HBD that is created as APR inflation that is not pre backed and HBD that is created first by purchasing Hive off the open market and then converted to HBD, and that the latter is far safer for the community

Also, i do not think suggesting a reverse auction to set the interest rates is too complicated. This is standard practice and is used all over the world for decades, centuries even.

in conclusion, since it is not yet clear when the bond system will be implemented, it is better to take the side of caution and at least not come to expect the APR to be 20% for a lock in of 3.5 days.

In my opinion, we are safer lowering the APR now based on the fact that we do not yet know when bonds will be available, when everyone will have to take the shock of increasing their lock and likely lowering their APR anyway.

This being the case, i see it a good idea to being lowering the APR now, incase it runs us into problems between now and the time that the bond system is implemented.

Yes, you’ve mostly convinced me.

If there were already multiple millions of $HBD in savings at the 20% rate, then I’d caution against lowering it until you give those investors a suitable alternative.

However, given the uncertainty about timing for actual bonds, it might be better to lower the rate now, so as not to risk disaffecting a large swath of investors sometime in the future.

It’s a shock one way or another

Hi @trostparadox . I am happy to be a part of this community and hope to make many friends here. Now I start my new life after prison. I will be grateful for your support.