Summary

I present a brief analysis about the optimal time to withdraw coins from a faucet that charges a fee. I will describe this in terms of Gridcoin, because I am a supporter, but the ideas apply to any coin and faucet.

Introduction

Faucets is one of the best way for beginners to acquire an initial amount of coins for free. Gridcoin (GRC) operates a faucet-bot on Gridcoin discord, from which all users can get about 0.8 GRC per day. This is a great initiative, so many thanks to Delta for developing the bot, because it brings users to the channel and promotes further engagement with the community.

All the transactions within the server are free of charge, but if a user wants to withdraw their balance to their personal wallet, there is a 1 GRC fee. Since Gridcoin offers a 1.5% annual interest on balances, one might wonder when it is worth paying the 1GRC withdrawal fee to move the balance to your wallet and reap the rewards.

Answer

For all practical purposes the answer is never. The best strategy is to keep all your coins in the faucet, until you do not want to use the faucet anymore and then withdraw once at the end. This strategy will serve you fine and you can at this point stop reading without missing out on anything essential. In the next section, I will present a few graphs and some potential exceptions to the rule (that can in practice be ignored).

Graphs

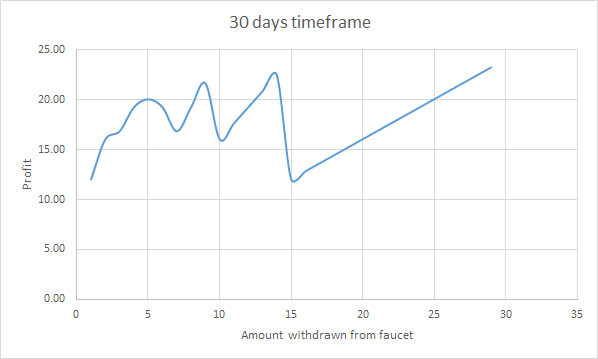

The first step of the analysis is to decide on the timescale that you want to use when maximising profits from the faucet. The optimal strategy will depend on the timescale chosen. Below, I present three graphs for three different users that wish to maximise their earnings over a period of 1 month, 1 year and 500 days respectively. The graphs show the expected profit versus the withdrawal amount from the faucet. Using the first graph as an example, if your strategy is to make a withdrawal every time your balance is 5 GRC so that you can earn interest on those withdrawals, then at the end of the month you will have 20 GRC. On the other hand, only withdrawing at the end would give you 23.2 GRC, so it is a superior strategy.

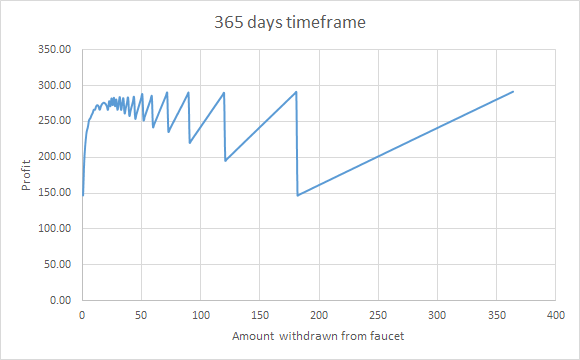

The situation is the same in the second graph, even though the time-frame is much longer (1 year). Once again, you are better off only withdrawing at the end, a strategy that will earn you 291.2 GRC compared to the second best profit of 290.69 GRC which can be achieved when withdrawing amounts of 181 GRC every time.

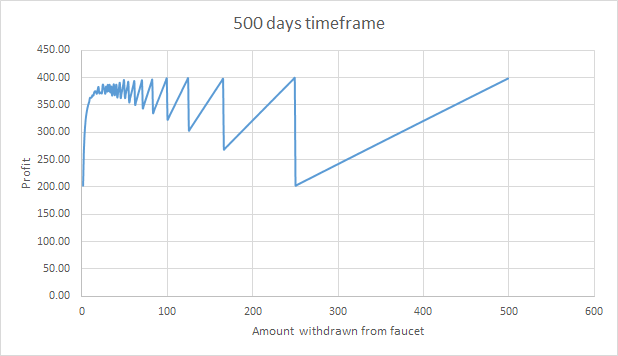

The third graph is quite interesting because it provides an example where the strategy fails (albeit by not much): Withdrawing at the end will give you 399.20 GRC compared to a profit of 400.44 GRC that can be achieved by withdrawing in the middle.

This final graph also proves the point made at the beginning: the time-frame matters! We see for example that if you are willing to spend 500 days maximising your profits, you should withdraw your balance after 250 days. On the other hand, if you are "only" committed for 365 days, you should just wait and withdraw once at the end. This is because, in the second case there is not enough time for your coins to generate interest that will compensate for the withdrawal fee.

Conclusion

When it comes to faucets, the amounts involved are really so tiny that is not worth worrying about what to do with them. My interest in performing these calculations was just out of curiosity and for the fun of it. That being said, my GRC will be staying in my faucet wallet for now!

(The first image of the article is courtesy of pixabay.com)

I just wanted to clarify that the bot is a fully functioning wallet that happens to have a faucet.

I am delighted to be hosting this for the community and recently I've been redirecting my trading gains to the faucet which I enjoy doing. Happy crunching!

You can donate to the faucet via the following address:

SFJdw5kVzWyKapsJWgKX3UeLxrHF6To347