This post is a response to the question “After seeing the negative effects of bailing out large companies in the past, why do you think bail outs still happen?” by @apfeff.

Similar to subsidies, the federal government is scared that these companies are too big going to fail. When companies ask for a bail out, they are usually a massive corporation employing tens of thousands (if not hundreds of thousands) of people. The federal government may also worry that the fall of a certain company may lead to a domino effect of an entire industry then a recession of the entire economy. I believe that setting a precedent of bailouts gives big businesses a sense of security when it comes to tough times. Why bother planning for the next economic downturn when you know the government will be there to bail you out?

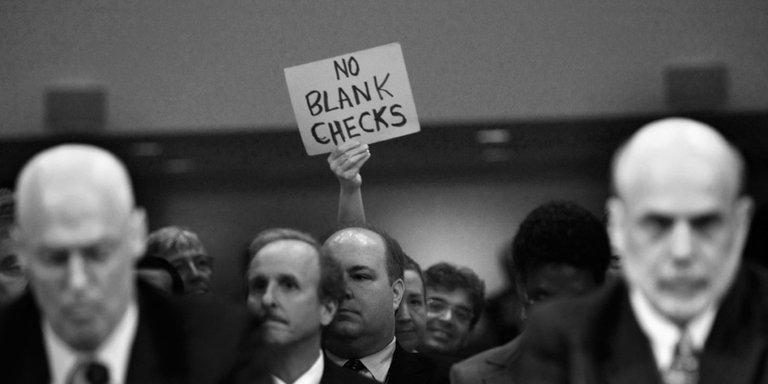

Big companies absolutely have all the leverage in these situations. The economy has collapsed, the people are angry, the government is frustrated. The quick solution is to bail out the companies that have gone into the red. These massive corporations know for a fact that if they fall, it is very likely for a domino effect to happen across their respective industries. So, the federal government wouldn’t just be bailing out the 30,000 jobs in Company A, they may also save the hundreds of thousands of jobs in the rest of the industry.

Do I believe that bailouts are the best solution to economic downturns like the late 2000s housing bubble crash or the COVID-19 pandemic? Absolutely not. I do not believe that tax payer money should be spent bailing out irresponsible businesses who did not plan for the future. An idea would be to require large corporations to set aside a percentage of their revenues to a rainy day fund in the event of a catastrophic emergency such as a recession or a pandemic.