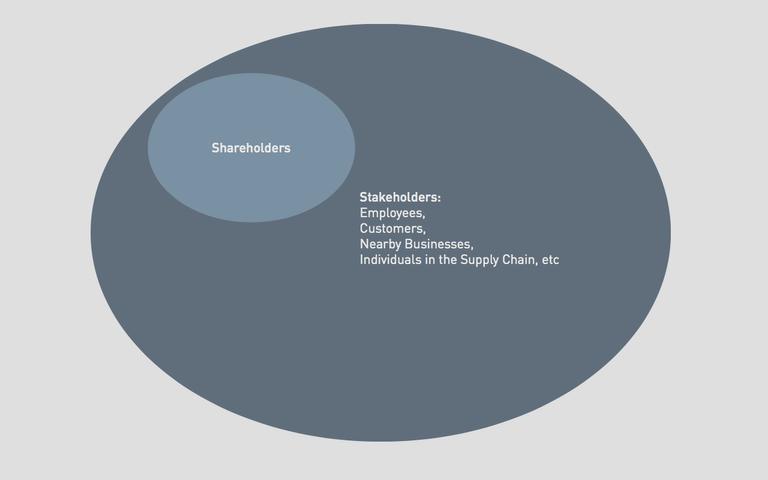

Governance is important because ones capacity to influence relates to their wealth. We are now in the era of a shareholder-economy, in which shareholders govern the economy. Shareholders get voting rights, one vote per share, to decide on the course of business. However, this system is flawed. Two major issues have developed. First, polarised wealth inequality. Second, catastrophic environmental externalities. Now, alternative systems look attractive.

My personal view on the cause of increasing wealth inequality is simple. It's because the more capital you have, the easier it is to make more money. Also, my view towards why shareholder-economies cause catastrophic environmental externalities is also as basic. It's because these economies are short-shorted. They focus on the interests of an exclusive subsection of the economy, whose focus is to profit.

Regardless of personal views, over recent years, issues around wealth inequality and climate change have compounded. Now, the argument for a stakeholder-economy has become popular and is gaining traction. A stakeholder-economy refocuses the economy's sense of purpose. Rather than maximising profit, it focuses on maximising value. It does so by factoring the interests of all the stakeholders. Be it an employee, customer, the local community, or a farmer next door.

Chairman and CEO of Blackrock, Larry Fink, recently advocated for a stakeholder-economy. In his annual letter to CEOs, the boss of the world's largest asset manager made his view clear. He wrote, "Since the financial crisis, those with capital have reaped enormous benefits. At the same time, many individuals across the world are facing a combination of low rates, low wage growth, and inadequate retirement systems…To prosper over time, every company must not only deliver financial performance, but also show how it makes a positive contribution to society...Companies must benefit all of their stakeholders, including shareholders, employees, customers, and the communities in which they operate…Without a sense of purpose, no company, either public or private, can achieve its full potential. It will ultimately lose the license to operate from key stakeholders. It will succumb to short-term pressures to distribute earnings, and, in the process, sacrifice investments in employee development, innovation, and capital expenditures that are necessary for long-term growth."

The Shadow Chancellor of the Exchequer, John McDonnell, has also promoted a stakeholder-economy. The rationale is found in Labour's recent report titled, Alternative Models of Ownership. Labour's vision is based on a decentralised, bottom-up power dynamic, with government support and oversight. The report considers how business structures can promote long-termism, and a fair economy. These business structures include Cooperatives, Municipal and locally-led ownership, and National ownership.

I believe that both men's motives govern their suggestions. Larry Fink's argument that company's need a sense of purpose, keeps the balance of power the way it is. Shareholder's continue to govern the economy. However, Labour's suggestions change the balance of power. Both the government, as well as the stakeholder, stand to gain.

I see merit in Labour's vision. But, I'm also cognisant of a common argument touted against Nationalisation 2.0. Which is that it's prohibitively expensive. However, I have a solution to this price problem, where the value is net positive from the start.

The solution has its roots in the story of Ricardo Semler. Ricardo is the former Chairman and CEO of Semco, a Brazilian Industrial Firm. Under his leadership, Semco grew from $4 million in revenue to over $160 million in about 20 years. He did this by completely transforming the company's governance. He implemented a stakeholder-governance system to a capitalist, corporate venture. It's outlined in detail in his book, 'Maverick!: The Success Story Behind The World's Most Unusual Workplace'.

Many critics and plaudits mistake Ricardo's governance model. They claim it has 'no rules', and is like an 'anarchy'. When in fact, it is best described as a governance model based on syndicalism.

Syndicalism is a proposed type of economic system, considered a replacement for capitalism. It's a system of economic organisation in which the ecosystem is owned and managed by the workers.

Ricardo's syndicalist governance model features a bottom-up power dynamic, healthy competition, innovation, and profit sharing. Yet, all the while, he remained the majority shareholder of the business.

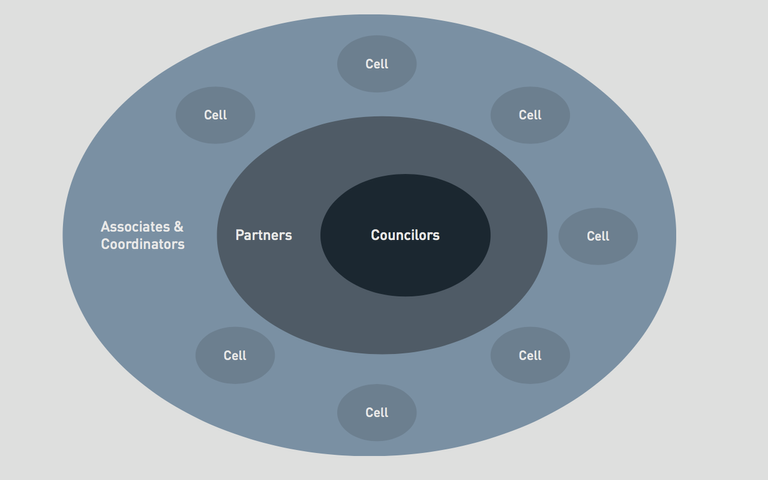

To put in place this new governance model, he re-structured his business into 'concentric circles'. The inner-most circle contained only a small group of Counsellors. Their role was to stimulate decisions. The second circle featured Partners. Their role was to run the company. Finally, the last circle featured Associates and Co-ordinators. Associates formed into small teams ('cells') and were each led by a Co-ordinator. They managed end-to-end aspects of the business. It was designed like this to increase the accountability of each cell. Because of the high accountability, cells were given significant autonomy. To the point that they decided on their own wages.

Other features included the following. Elected leaders and managers evaluated and elected by their inferiors. Profit-sharing based on a pre-defined formula. No bureaucracy. Day to day decisions were 'ruled by wisdom that varies from factory to factory, and worker to worker'. Finally, a satellite programme for innovation and leanness. The satellite program encouraged employees to set up as entrepreneurial sub-contractors.

This decentralised, stakeholder governance system has always been possible for companies. But, the company operates in an environment that favours the shareholder. So, for it to work, the shareholders need to give up power. In Semco's case, as the majority shareholder, only Ricardo needed to do it.

Now, as a society, we can do better. It is possible to have a decentralised, stakeholder-economy. The invention of blockchains and smart currency makes this possible.

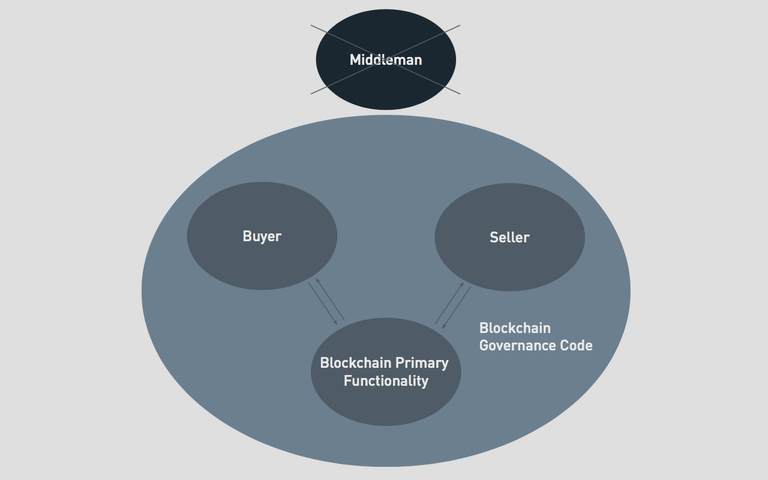

Blockchains present a new paradigm in governance. Blockchains replace intermediaries and gatekeepers with code, thus redressing power asymmetries. But, it does not circumvent the fact that the code itself must be governed.

Due to the lack of governance processes in blockchains today, problems are arising. The developers at Bitcoin and Ethereum are balancing the conflicts of interest well. But, without a formal process, in the long term, they will likely suffer.

In fact, we are already seeing environmental and governance issues arise in Bitcoin. This is due to the miner's reluctance to switch from Proof-of-Work (PoW) to Proof-of-Stake (PoS). Despite both energy and efficiency gains, miners have invested money into PoW hardware. Thus, they want to continue to use it, though this does not benefit the users.

In looking at how different models of governance affect the economic system, one thing becomes clear. The economic system we want to pursue, determines how we should govern the code.

If we wanted to have a shareholder-economy, we could, like Dash, implement a system based on one vote per share. But, with this, it is likely that similar problems of today are to arise.

Another alternative is to pursue a 'One-Party-State' model. The problem here is that leaders of these economies usually end up taking most of the wealth. Again, we have already witnessed this, with developers stealing from various cryptocurrency coffers.

Another alternative is to pursue a total democracy. This is based on a one vote-per-person system. These systems are often dismissed because they can be slow and inefficient. For example, referendums encourage many people to vote on issues they know little about. While, those with significant knowledge, cannot exert influence. However, in adopting syndicalist principles we sidestep these shortcomings.

I would like to create a new governance framework. The framework's purpose is to change the power dynamic governing the economy. It's aim is to support all stakeholders. Currently, I am developing a protocol. The protocol follows these principles:

Decentralised, stakeholder, bottom-up power dynamic

Fully democratic top-down, rank-and-file organisation based on user reputation and voting

Self-organising, self-regulating, flexible and adaptable

Encouraging of competition and innovation with rewards based on value, not capital

Able to raise finance internally and externally

Impossible to buy-out

Accountability

The plan is to create the first ever stakeholder smart currency. Then I'd like to release the governance protocol for widespread adoption. Some of the functionality currently under consideration includes:

A network organised by various tiers of federations and councils

A reputation and voting mechanism

A self-governing treasury and financial reserve

Worker-buyout-mechanism

Progressive procurement strategy based on sidechains

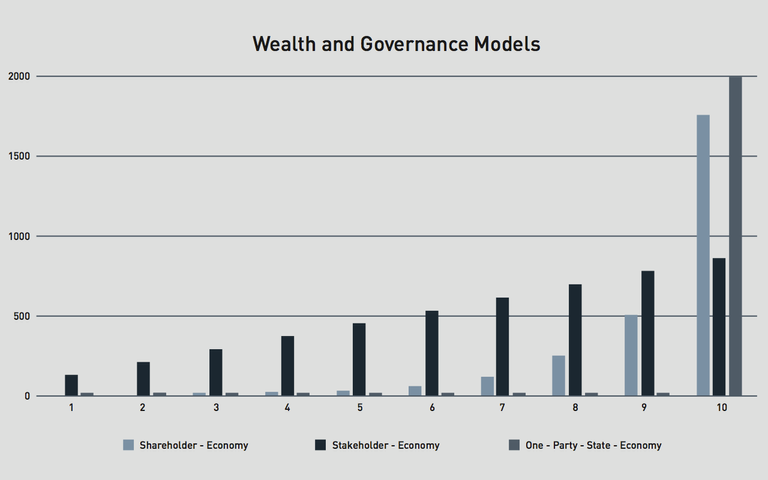

I conclude by returning to my first point. Governance is important because ones capacity to influence relates to their wealth. The graph below shows an estimated distribution of wealth under different governance models. I hope you agree with me which one is best for society.

In the spirit of syndicalism, this article is an open invitation to individuals get involved. To those interested in developing a sustainable, stakeholder-focused economic system. Feel free to message me. Also, if you'd like to support this research, please send bitcoin to [1CBzVNMYdnZH3yVVc2JF1YuMx3UUtMFzrx], litecoin to [LUdPMgvat2We6EG9oryvpuf4jaha9DXVCx], or ethereum to [0x66F6bA71144826F5E225a323A0880838c36BD595].

References:

https://libcom.org/library/principles-of-syndicalism-tom-brown

'Maverick!: The Success Story Behind The World's Most Unusual Workplace' by Ricardo Semler

https://corpgov.law.harvard.edu/2018/01/18/blackrock-supports-stakeholder-governance/

https://labour.org.uk/wp-content/uploads/2017/10/Alternative-Models-of-Ownership.pdf