With gold dropping below 1300, I am expecting our downside targets are 1280-1260. It could go lower of course but this is my prediction for the time being. Lets take a quick look at the commitment of traders report for gold.

Looking at this chart, which will be updated on the weekend to let us see the reduction in shorts from the smart money, I would imagine its going to begin to look bullish. I believe this will give additional encourage meant of the 1280-1260 level. It is possible gold goes down below 1200, since liquidity is starting to contract and if it does so fast enough, will make the price of all assets decrease, and most likely send money to treasury's since they are a safe haven and has proven during a recession, this is where money goes. That prediction is a bit trickier to make and does not yet have enough evidence to make yet. The treasury market is also looking terrible, and it could be predicting higher inflation which would benefit gold!

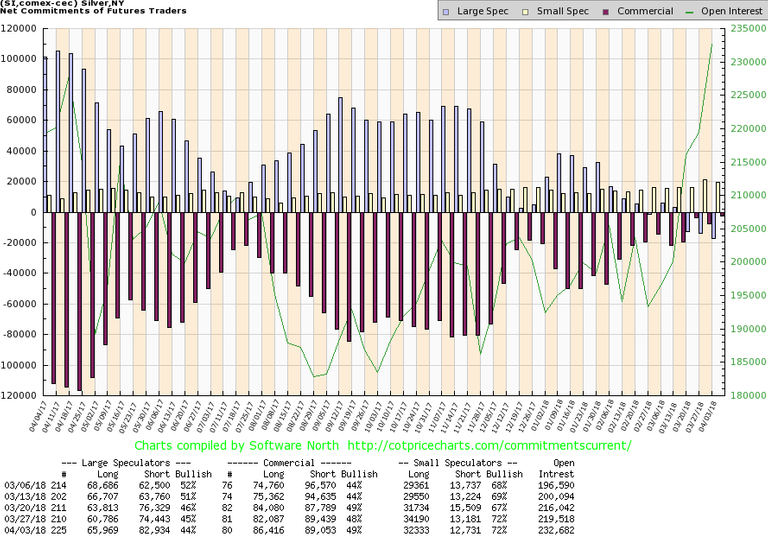

Quick look at silver

Silvers commitment of traders report looks a lot more a lot more bullish and Its going to get even more bullish looking when its reported. I think silver has a very limited down side even if gold falls. Silver may possibly hold its ground or perform similar percentage move as gold unless like I said everything starts to fall in price which would be short term as more money printing would come to play like 2008