Due to the price plunge in gold back in 2013, the mining industry had to do something in order to bring down the cost per ounce mined. No business can operate in an environment where the cost of producing a product is higher than what an end-user is willing to pay for it. Not to mention, when you have a " cartel" with a hand in price manipulation via paper gold contracts and other shenanigans taking place for monetary policy support, along with all the variables related to market price mechanisms, it can be a tough business to navigate. The bottom line in any business is that it must keep the current boat afloat and turn a profit in order to provide future capital investment.

High-grading in the gold mining industry has taken place on a larger scale for the past few years, and it is a key reason why some companies' cost of production per ounce have come down. A plummeting price for oil is also a contributing factor, but that's a rabbit hole I will not venture down today. Nor will I be examining what the current cost of production per ounce is. Here is the bigger picture by keeping it simple.

Back in 2013, all-in sustaining costs ( AISC) and all-in cost metrics were developed by the World Gold Council (WGC), along with its member companies, so that gold mining companies can use those metrics to report their costs as part of their overall reporting disclosure for the mining industry…

"It is expected that these new metrics, the 'all-in sustaining cost' and the 'all-in cost' will be helpful to investors, governments, local communities and other stakeholders in understanding the economics of gold mining. The 'all-in sustaining costs' is an extension of existing 'cash cost' metrics and incorporate costs related to sustaining production. The 'all-in costs' includes additional costs which reflect the varying costs of producing gold over the life-cycle of a mine. It is up to individual companies to determine how they report to the market and to decide whether their stakeholders will find these new metrics of value in understanding their businesses; it is expected that, since many companies report on a calendar year basis, they may choose to use these metrics from 1 January 2014."

AISC still leaves out substantial line items, such as working capital, income taxes, acquisition costs, development capital, and financing costs. More importantly, it leaves lots of leeway for miners calculating their numbers. _ Barrick Gold (ABX) acknowledged this in its 3Q13 _financial report:

"These measures are not representative of all of our cash expenditures as they do not include income tax payments, interest costs or dividend payments."_

High-grading has been successful in offsetting some expenses, but that plan comes with a price.

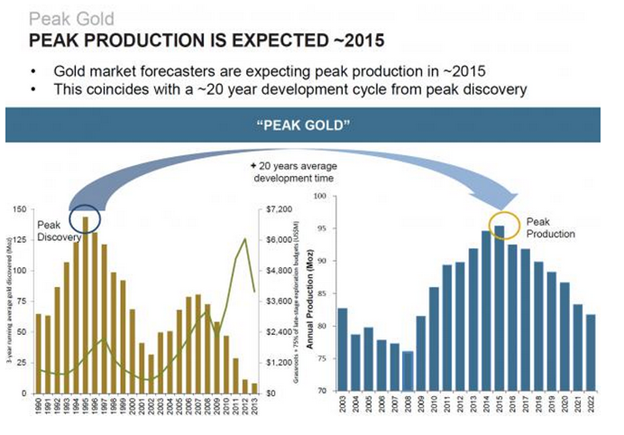

Why gold mine production is increasing—despite falling prices … " High grading and Capex cuts: Some gold companies—including Barrick Gold (ABX), Goldcorp Inc. (GG), and Newmont Mining (NEM)—are going for high-grading at some of the mines. High-grading is when the high-grade portion of the mine is mined first. This increases the grade of the ore that's mined. Also, it lowers the cost per unit. However, this trend is bad for long-term supply. It depletes the reserves very quickly . Gold companies —including ABX, AngloGold Ashanti (or AU) and Agnico Eagle (or AEM)— have also slashed capital and exploration spending. As a result, there aren't many new projects coming online . This will put pressure on gold's long-term supply . Many industry experts—including World Gold Council (or WGC)—believe that 2014 will be the peak year for gold production. Long-term supply: Although gold production is increasing, it won't be long before the supply plateaus. Lower grades will put upward pressure on costs." – Annie Gilroy at Market Realist, November 2014

Where does "peak gold" fit into this picture? Production was in decline even before the 2013 price shock. If you take future supply out of the ground, don't forget to fill the void as the price of your product begins to rise.

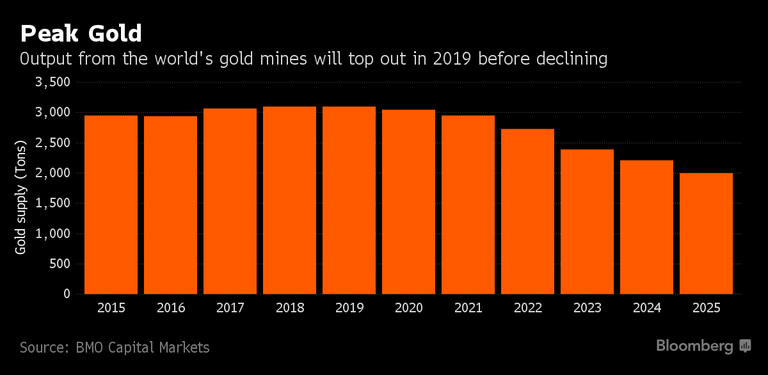

Peak Gold Seen This Year as Mining's "Weaklings" Bite the Dust_ – Bloomberg_, May 2015

For many miners, no avoiding Peak Gold; production expected to drop 18% over 9yrs –_ Financial Post_, October 2015

High Grading Strategy Not Good For Long-Term Mining Assets… "What we haven't really seen is a huge amount of producers really cutting operations very dramatically in terms of reducing their core costs." – William Tankard__w/Thomson Reuters GFMS –_ Kitco News_, October 2015

Half of Gold Output May Not Be "Viable" as Price Sags: Randgold Resources CEO Mark Bristow … "New supplies of gold could begin to dry up in the near future. High Grading has already mined the easily accessible ore on claims, leaving only gold that will prove much more difficult and expensive to dig out of the ground. Gold miners buffeted by the drop in prices are shortening the life of mines by focusing only on the best quality ore, a practice known as high grading, which will restrict future output and support higher prices , according to Bristow. He said in a presentation to bankers in Toronto that the industry life span is down to about five years because companies have been aggressively high grading at the expense of future production." – Bloomberg, November 2015

Geologist & CEO_ Wade Hodges of Nevada Exploration: Peak Gold is here, falling production & reduced discoveries – SGTReport, January 2016

Newmont CEO: Gold supply to drop 7% by 2021 … "Analyst Jonathan Guy, from London-based Numis, went even further. He told FT.com that if gold prices remain close to $1,200 or lower, big projects such as Barrick and NovaGold's touted Donlin mine in Alaska, will be halted as they 'do not make sense' at such low prices." – Mining.com, June 2016

John Bridges, Analyst at JPMorgan: Gold Rally Breaks Long Term Downtrend Lines; Peak Gold, Production Is Rolling Over –_ Bloomberg Video_, February 2016

Peak Gold Coming as Exploration Dwindles, Randgold CEO Says –_ Bloomberg, September 2016

Gold Miners Are Running Out of Metal: Five Charts Explaining Why… Dwindling Discoveries, Capex Cuts, Falling Reserves, Supply Crunch Coming, The Race for Reserves with Mergers & Acquisitions –_ Bloomberg_, December 2016

Peak Gold – Biggest Gold Story Not Being Reported__ … "The risk of falling gold production and a consequent reduction in supply are slowly percolating into the mainstream and analysts are asking whether 2015 or 2016 marked the year of peak gold production… Byron King has written about this increasingly important supply factor in the gold market and brings together the views and research of Glencore CEO, Ivan Glasenberg, Thomson Reuters GFMS and others…"_

QUOTE

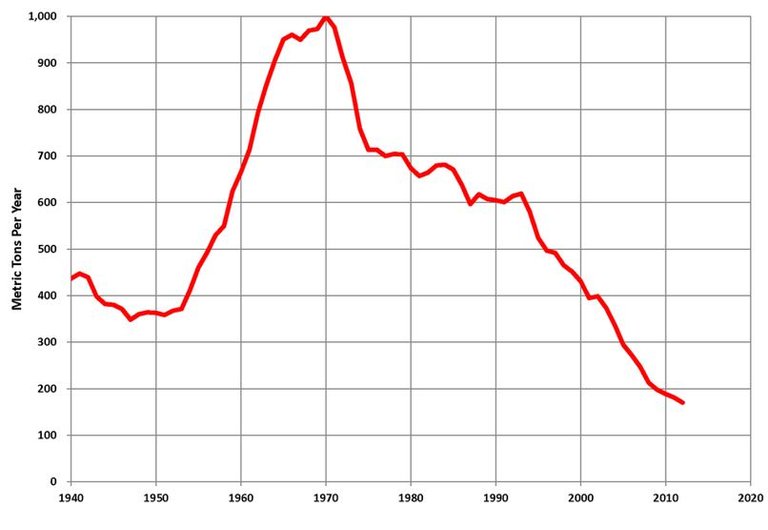

…The collapse in South African gold production is the "classic canary in the coal mine" and likely foreshadows the coming decline in global gold production… – Goldcore, March 2017_

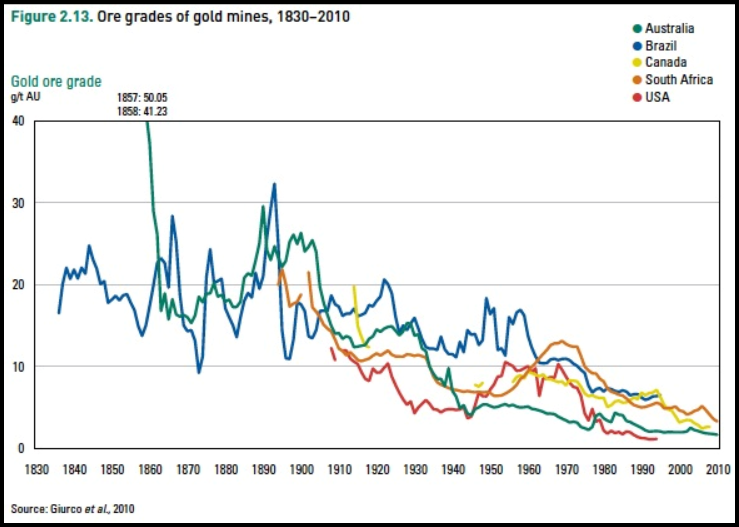

The Great Gold Supply Disconnect: Market Severely Undervalues Price… "Before I show you the Gold Supply Disconnect, let's look at this interesting chart which shows the falling ore grades of five different gold producing countries…_

**...At one time (1900), the average gold ore grade in the world was over 20 grams per ton…. 32 grams equals one troy ounce. Today, the top gold miners are struggling to produce gold at a little more than 1.2 grams per ton. Back when Nixon dropped the U.S. Dollar-Gold peg in 1971, the average gold ore grade from these five countries was approximately 8-10 grams per ton…. nearly EIGHT TIMES higher than today. ** The gold mining industry is now producing the most expensive gold dust in history…. and doing so for mere peanuts." – SRSrocco Report, June 2017

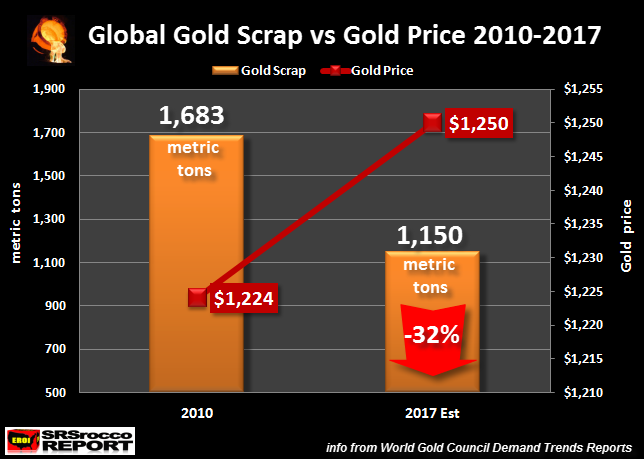

MAJOR GOLD MARKET INDICATOR SHIFT: Trouble For Future Supply… "As I stated, this major gold market indicator trend shift_ suggests that individuals are now holding onto their gold rather than sell it for a higher FIAT MONETARY PRICE . Furthermore , the declining amount of global gold scrap supply will put more pressure on the market going forward . World gold scrap supply of 1,683 mt in 2010, accounted for 61% of global mine supply of 2,744 mt. This year, estimated gold scrap supply of 1,150 mt would only account for 35% of the 3,250 mt of forecasted world mine supply. What a change in seven years." – SRSrocco Report, August 2017

Randall Oliphant , outgoing chair of the World Gold Council: Industry Is Approaching Peak Gold – Bloomberg Video, September 2017

** ** We Don't Know How to Replace the Great Big Gold Deposits From the Past… "Pierre Lassonde, chairman of Franco-Nevada, expects production in the gold mining sector to decline significantly and foresees a price push for the yellow metal." – Finanz und Wirtschaft, October 2017

Factors Likely to Hinder Gold Industry Growth… "Even through a small number of major projects are anticipated to come online by the end of 2017, the project pipeline remains weak. And while major miners have improved cash flow and reduced debt over the last few years, production development expenditure remains at multi-year lows… Previously, incremental production from newer mines led to continued growth in overall gold production. However, newer mines are now at or near full potential, leading to slowing down in growth rates. This has made further production gains increasingly difficult. _ This is the aftermath of sharp cuts in capital expenditure in recent years as well as the lack of significant discoveries … As existing reserves are depleted, the current project pipeline will be inadequate to replace them completely and ultimately leading to a supply crunch . Some gold companies, including Barrick Gold Corp. (ABX – Free Report) , Goldcorp, Inc. (GG – Free Report) and Newmont Mining Corp. (NEM – Free Report) are currently high-grading at certain mines. The high-grade portion of a mine is mined first as this increases the grade of the mined ore and lowers cost per unit. However, it has pitfalls as it depletes reserves very quickly, thus affecting long-term supply ." – Zacks Research, September 2017

"We Are Running Out of Gold" – Goldcorp's Ian Telfer (PART 1/3) – Kitco News, October 2017_

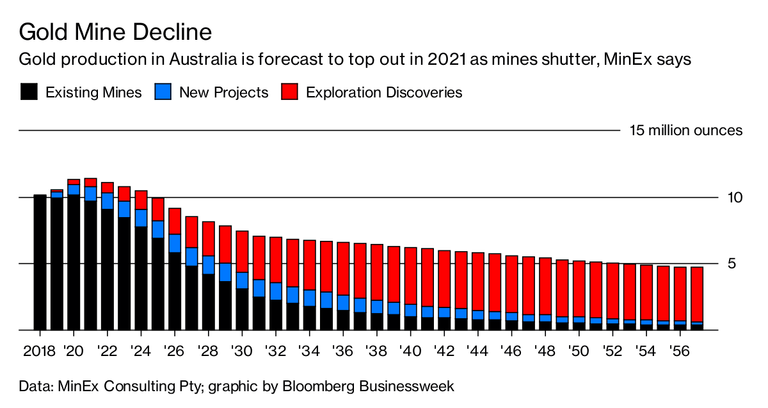

Peak Gold Output Is Looming for World's No. 2 Producer__ … "_ Gold output in Australia will peak in 2021 and more than halve by the mid-2050's as aging mines close , according to Melbourne-based industry adviser MinEx Consulting Pty. The nation needs to act to boost future production from new discoveries, or risk significant supply disruption in the medium-term , MinEx managing director Richard Schodde said in a study published Monday. Gold exploration spending rose 26 percent in the 12 months to July, Australia's government said in a report this month." – Bloomberg BusinessWeek, October 2017

Plan Your Trade, Trade Your Plan_

TraderStef on Twitter