The past week was calm for the precious metals markets due to the celebration of Christmas in the Catholic world. All metals, except silver, showed slight declines, while silver edged up slightly.

A positive for the markets was the signing by US President Donald Trump of the bill on aid to the economy and the budget for 2021, which raises inflation expectations. However, costs will be limited in absolute terms for the time being, which keeps the dollar from depreciating sharply.

By Christmas, agreements were also reached on the terms of EU-UK trade relations after Brexit, which eliminated the risks of Brexit without a trade agreement and could potentially reduce demand for Gold in Europe as a defensive asset.

The current week is a holiday - in many states, weekends continue in connection with the celebration of Christmas and New Year. No important statistics or performances are expected, and the markets will remain calm. The US Congress approved an $ 892 billion stimulus program to support the economy. The total budget spending is about $ 2.3 trillion and includes spending on federal programs through the end of the fiscal year in October 2021. The plan provides for direct payments of $ 600 for most Americans and increases in unemployment benefits. It also includes an extension of an estimated $ 284 billion small business lending program and funds for schools, airlines and the distribution of coronavirus vaccines. US President Trump signed the above bill.

The UK and the EU reached an agreement on the terms of trade relations after Brexit, avoiding a no-trade exit. The Brexit deal will keep Britain's access to a single block market with zero tariffs and quotas, but will not extend to the country's financial sector. Brussels has not yet decided on granting Britain access to the block's financial market. Many other aspects of the future relationship between the two sides also remain uncertain.

The demand for gold in Asian hubs increased slightly last week as buyers rushed to take advantage of the slight price drop and made purchases. In China, discounts on the purchase of gold narrowed to $ 15-20 / oz, demand revived ahead of the holidays.

Gold prices last week again tried to overcome the strong local resistance level of $ 1900 / oz, but so far unsuccessfully. It was not possible to take the level, and prices returned to the level of $ 1883 / oz.

Silver prices in Chicago rose to $ 26.88 / oz last week in correlation with the gold market, but the market is currently correcting down to $ 26.69 / oz. The ratio of prices for gold and silver fell to 70.99 (average value over 5 years - 79.5). The platinum/silver ratio was 39.05 (5-year average - 57).

Investments in the largest ETFs investing in gold and silver fell 0.1% and 0.3%, respectively, last week, according to Reuters. The platinum market last week confirmed the movement in the upward trend. Platinum prices have tested the $ 1,050 / oz level and are currently trying to gain a foothold slightly higher. The spread between gold and platinum widened to $ 852 / oz, between palladium and platinum - to $ 1326 / oz.

The palladium market remains highly volatile, with prices surging to $ 2,414 / oz after staying in the $ 2020-2050 / oz range for a week. Investments in the largest ETFs investing in platinum and palladium have remained unchanged over the past week, according to Reuters.

A new way to invest in Gold !

The market situation for precious metals is shaping up very well today. However, it should not be denied that today there are more interesting investment instruments, and even more so for investing in gold. By purchasing gold as a physical asset, you lose the opportunity to quickly and efficiently manage it. This means you lose the opportunity to receive additional income from such investments.

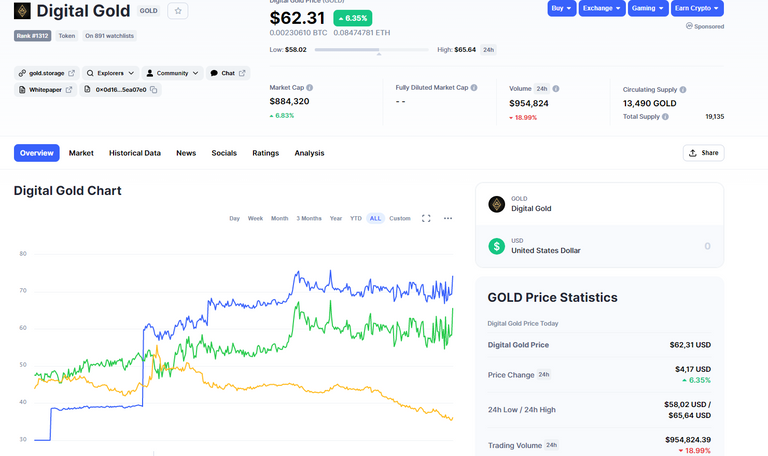

The fact is that a project has been working on the cryptocurrency market for several years, which offers its clients a unique opportunity. Investing in gold using cryptocurrencies. Digital Gold has become a worthy tool in the cryptocurrency market. They allow us not only to invest. But also to trade an asset 24/7. Digital Gold is presented as a stable coin in the cryptocurrency market. Which does not depend on the price of cryptocurrencies but depends on the price of Gold.

Using the investment advantages of Digital Gold, you can make short-term profits even in the long term. Following the rise and fall of gold, you can play this asset for additional profit.

Of course, this method is not for everyone. But the development of digital currency cannot be denied. Since in the last article we have already discussed this issue. The largest central banks in the world are thinking to release their digital asset. After that, the digital currency will be recognized around the world.

Website: https://gold.storage/ru/home

Telegram: https://t.me/digitalgoldcoin

Steemit: https://steemit.com/@digitalgoldcoin

Youtube: https://www.youtube.com/channel/UCUo-D88vDTvntg2QhxDqBGQ

Reddit: https://www.reddit.com/r/golderc20/

ANN: https://bitcointalk.org/index.php?topic=5161544.0

Coinmarketcap: https://coinmarketcap.com/currencies/digital-gold/

Bitcointalk Galantin

Bitcointalk links https://bitcointalk.org/index.php?action=profile;u=2299006

Wallet 0x61F7C0C58CE5b94c416F2dBE98396553d07346F1

Thanks for the informational report, @cjapan. I'll be watching and listening.

Yes! Thanks a lot. But this is the last report this year (

Congratulations @cjapan! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @hivebuzz: