After falling below $ 1200 an ounce in 2018, gold rebounded sharply over the next 12 months. Its yield increased by almost 20%, and quotations - up to $ 1,519 per ounce. The rally continued in 2020. The COVID-19 coronavirus pandemic has increased the popularity of the precious metal as a hedging instrument, which has led to an increase in its price.

The yellow metal rose 17% in the first half of 2020, and another 10% in July, reaching a record high of $ 2067 an ounce on August 6. Since then, an ounce of gold has dropped to $ 1,844 (December 14) amid news of a coronavirus vaccine. However, the euphoria about the vaccine is premature. The pandemic is not leaving the agenda. Nevertheless, the yield on the yellow precious metal this year was in the range of 16-30%. Note that our forecast for 2020 assumed the growth of precious metal quotations to $ 1600-1700 per ounce in the event of increased geopolitical and economic instability. We can say that our forecast was fully justified.

The interest of Western investors in the precious metal led to an increase in its rate from a minimum of $ 1160 in the summer of 2018 to a record high of $ 2073 in August of this year. During this time, the precious metal has become one of the most profitable financial assets on the planet. This year, the economic fallout from the pandemic and negative bond yields have driven a record $ 60 billion in gold ETF capital growth. This is twice as much as in 2009, at the height of the financial crisis.

The pandemic has convinced investors that gold should be part of their portfolios. The yellow precious metal has become a leading hedge against volatility in equity markets, negative interest rates and falling production volumes. Gold turned out to be one of the most profitable assets in 2020.

Large investors bought gold to protect against deflation, which could result from slowing economic growth and higher inflation as the authorities continue to pump liquidity into the economy. Thus, the American bank JPMorgan earned about 1 billion dollars this year from trading in precious metals (mainly gold). According to the consulting company Coalition, this year revenues from trading in precious metals from the 50 largest investment banks will double and will reach a nine-year high of $ 2.5 billion. Private banks of Russia also did not stay away from this trend. In August, they increased the total volume of reserves of the yellow metal to a record figure of 121 tons.

Even Warren Buffett changed his mind about gold. Previously, he considered precious metals a useless asset. This year, his Berkshire Hathaway Inc. acquired 20.9 million shares of one of the largest gold mining companies in the world - Barrick Gold Corp. (Canada).

However, demand in the main gold consuming countries, India and China, has not been up to par this year. People sold their savings in gold or pledged them when the precious metal rose to a record high in local currencies. The high cost of the yellow precious metal and the economic turmoil caused by the pandemic have crippled consumer demand. Therefore, jewellery purchases in the first half of the year decreased in volume by 46% compared to the same period last year. The reason is quarantine and a decrease in the income of the population. According to our forecast, this year the demand for jewellery will fall by 31%, to 1,327 tons, and in 2021 it will grow by 9%, to 1,447 tons.

Investors will continue to fill the gap in demand. This year, exchange-traded funds will accumulate 1205 tons of precious metal in their reserves, which is three times more than in 2019. The figure may reach 1,362 tons next year.

Central banks have been buying precious metals on a quarterly basis since early 2011. In the third quarter of this year, they became net sellers, reducing reserves by 12.1 tons. Nonetheless, CBRs remain net buyers on an annualized basis as demand for the first three quarters was 220.6 tonnes. In all likelihood, they will maintain this status in 2020, although the volume of purchases will be less than in the previous two years. Russia has suspended purchases, and China has not reported an increase in reserves since September 2019.

Central banks of many countries of the world spend their gold reserves to save the economy and national currencies from the consequences of the pandemic (for example, the Central Bank of Turkey). At the same time, in the third quarter of this year, a record volume of investment coins was sold all over the world - 86.8 tons. Demand volume for all of 2020 could well bypass the 2013 record of 271.1 tonnes, as 220.5 tonnes of gold bullion coins were sold during the first three quarters.

It is noteworthy that demand increased against the backdrop of a record rally in the precious metal. The US Mint sold 346% more gold American Eagles (678,000 ounces) in the first 10 months than in the same period last year. At the same time, the Perth Mint (Australia) sold 617.8 thousand ounces in coins and bullion, which is 141.1% higher on an annualized basis.

In Russia, compared to last year, the demand for coins and bars as a whole increased by 25%, to 5 tons (160.7 thousand ounces). The economic conditions in 2020 mimic the 2008 global financial crisis in significant ways. The pandemic exacerbated the recession due to quarantine restrictions, suspending activity in entire sectors of the economy, increasing volatility in financial markets. This led to a stock market crash in March. Gold failed to stand aside as traders traded it for the dollar to cover losses in other positions. A similar situation occurred during the global financial crisis of 2008-2009 when the VIX volatility index reached record highs and the yellow metal suffered from selling pressure. However, in November 2009 the rate jumped to a high of $ 1196 as the markets decided that the crisis was over. However, the rally in the precious metal continued in July 2010 after trading in a sideways trend for 8 months.

According to our forecast, in 2021 there should be an increase in the rate of gold to $ 2,000 per ounce. This will be facilitated by the following factors: first, the rise in inflationary expectations and the weakening of the US currency as a result of generous fiscal and monetary stimulus; second, an increase in investment demand and a gradual recovery in consumer demand in China and India will support the precious metal rate at a high level; third, government bonds (government debt) will not be able to play the role of defensive assets in the face of inflation and negative interest rates, since they will cease to generate income. At the same time, the opportunity cost of owning gold decreases. This will increase the popularity of the precious metal in the eyes of investors in 2021.

All Western countries are experiencing unprecedented growth in the money supply. From the beginning of February to the end of October, the aggregate volume of money supply in the United States increased from $ 15.4 billion to $ 18.8 billion, an increase of 22%. In the United States, the Eurozone, the United Kingdom and Japan, the figure as a whole rose by 15.7% from February to September 2020. Consequently, the risk of higher inflation in 2021 is very high.

As the purchasing power of the leading currencies decreases, gold tends to rise. The yellow precious metal is an inflation hedging instrument.

According to the IMF forecast, real GDP growth will stabilize in 2021, which means that the purchasing power of the population in the main countries that consume precious metals - China and India - will increase. Signs of a recovery in consumer demand in these countries emerge at the end of 2020. Thus, in October, jewellery sales in China grew by 17% year on year. All these circumstances justify our forecast of the gold rate for 2021 - $ 2000-2100 per ounce.

How to quickly buy gold at the best prices!

Nowadays, due to the high demand for gold, it is not always easy to acquire this precious metal. Its acquisition from banks requires significant procedures. And also in them, a pair does not have the quantity we need. Moreover, we may have significant problems with the storage of such an amount of gold. Do not forget that it is not safe to store it either!

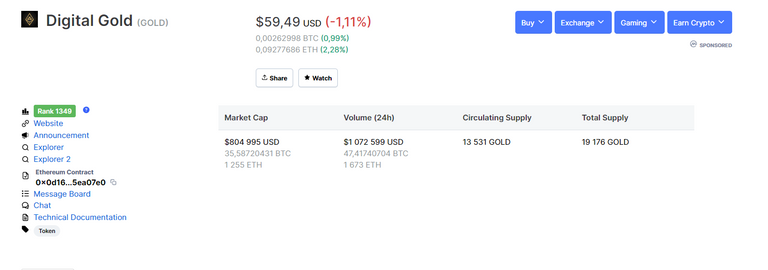

Digital Gold could be the solution to invest in this precious metal. There is nothing new in investing with cryptocurrency in this metal! Imagine buying gold futures! Digital Gold is a project that issues gold crypto coins! 1 such coin is equal to 1 gram of 999 gold!

Where to find Digital Gold

The easiest way to find a given project is on Coinmarketcap.com. There you can get acquainted with the market situation and the price of cryptocurrency gold today. Quickly go to the developer's website or go to the exchange where you can easily buy gold documents and documents!

An innovative method

Digital Gold is a tool that works not only for the cryptocurrency market. Preserving your savings during this difficult time is difficult enough. Moreover, the project has significant advantages! You don't need storage space! You do not need to pay extra taxes and fees! You can sell this gold and invest somewhere else in the cryptocurrency community!

Website: https://gold.storage/ru/home

Telegram: https://t.me/digitalgoldcoin

Steemit: https://steemit.com/@digitalgoldcoin

Youtube: https://www.youtube.com/channel/UCUo-D88vDTvntg2QhxDqBGQ

Reddit: https://www.reddit.com/r/golderc20/

ANN: https://bitcointalk.org/index.php?topic=5161544.0

Coinmarketcap: https://coinmarketcap.com/currencies/digital-gold/

Bitcointalk Galantin

Bitcointalk links https://bitcointalk.org/index.php?action=profile;u=2299006

Wallet 0x61F7C0C58CE5b94c416F2dBE98396553d07346F1