Summary of this weeks price action:

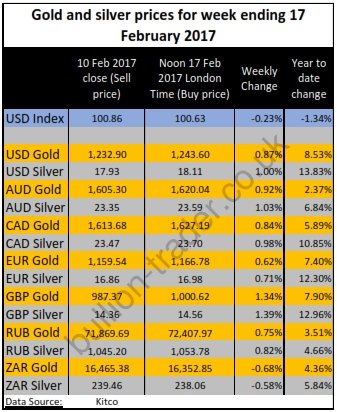

The USD index is down so the gold and silver price will automatically rise. The other currencies will also have fallen against the USD so the gold and silver prices have increased.

The exception is the South African Rand which rose against the USD this week which is why the gold and silver price has decreased.

Gold and silver strength will be evident if the USD index rises and the precious metals prices’ increase as well.

Here are a few news items you might be interested in.

- Reuters reported that the FTSE 100 (the top 100 companies on the London Stock Exchange) had extended it’s winning run as stronger metals had boosted the mining stocks. Let’s not forget that a weaker GBP vs USD would make metals prices higher in GBP terms and give the illusion that the metals are strong. While the metals have achieved higher prices throughout 2016 and this has continued into 2017, we do not believe they have displayed their true strength as when this happens prices will rise irrespective of what the currencies do.

- Marketwatch published an opinion that 200 of the world’s most powerful money managers no longer hate gold and say that it is undervalued (for only the third time in a decade). They cite the reasons are worries about inflation, stagflation and global protectionism. Perhaps the unintended consequences of quantitative easing can no longer be suppressed although they have always been lurking in the background. It will be interesting to see what happens if they try and park a portion of their half a trillion dollars under management into the shiny yellow metal.

- Sky News via MSN reported that British holiday maker have been forced to change their holiday plans due to the weak Pound. Brexit is getting the blame, of course, but few seem to realise that all currencies have been falling against each other since at least 2009. Even fewer realise that the insurance policy against these falls is Gold and Silver. It is the only way to protect your wealth, since their value increases as the currency in our pockets and bank accounts, devalues. At the moment, these two assets in particular are readily available and affordable for most. You won’t even need a loan to pay for them.

How to buy Gold and Silver – Part 1

With many different gold or silver ownership options available today, purchasing it online and paying the same company to store it for you, is very popular. It’s quick, it’s easy and can be carried out anywhere with an internet connection.

Unfortunately, these accounts aren’t all created equal.

This option is usually offered in the form of an allocated account or an un-allocated account (also called a pooled account).

This week we’ll delve into the allocated account option.

In an allocated gold or silver storage account, the storage company holds physically segregated gold on your behalf, acting in the role of custodian. That gold is said to be “ear-marked” or “set aside”, and you have full legal title to the specified gold, which is documented by a weight list or inventory list. In a bankruptcy scenario, the storage companies creditors cannot access this gold since it does not belong to them, it belongs to you.

You would be charged a storage fee, which would include an insurance fee, since they are storing your gold for you.

To summarise:

Allocated gold or silver account = you own the physical gold or silver in the account.

Interested in owning or selling physical gold and silver? Bullion Trader's exclusive, low fee, gold and silver market place, allows users to buy and sell Gold and Silver at their own price.

Have a good weekend everyone.