Week 51 - Dec 18 Investment Moves

- Current US markets @ 11:25 am (EST)

- Dec 18 Investment moves

- BITCOIN to 107K

- 1% in BITCOIN rule of thumb?

- Fed will Cut the Rate again.

Current US markets @ 11:25 am (EST)

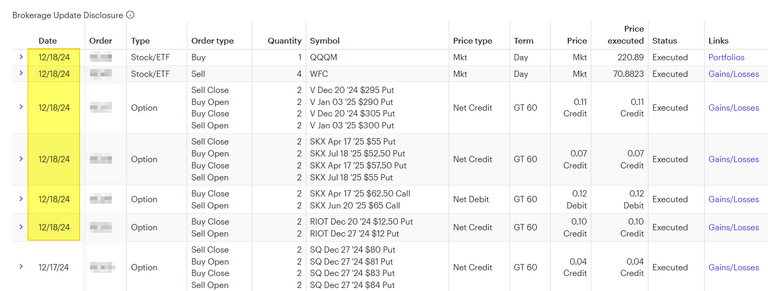

Dec 18 Investment moves

Think of each trade as a baby step toward a goal. Regarding investment moves, each adjustment I make should either reduce risk (to prevent losing money) or add risk back into the trade (to make more money). This is true with options trades as the option moves toward WORTHLESS contracts or moves to have more value. Then is just a matter of which side of the trade I was on (Buyer or Seller of the option).

Summary:

- Sold off WFC (from dividend payout) to reduce position size.

- Buy 1 share of QQQM, adding more Tech ETF to my portfolio. This is part of my long-term portfolio, which is rebalancing away from DIVIDEND stocks.

- Rolled Visa Put credit spread out TWO weeks and down in STRIKE PRICE for $11 each.

- Rolled SKX put credit spread out several months and down in STRIKE price for $7 each.

- Rolled SKX-covered call-up and out for $12 debit (cash out of pocket).

- Rolled Riot cash secured put down and out for $10 credit.

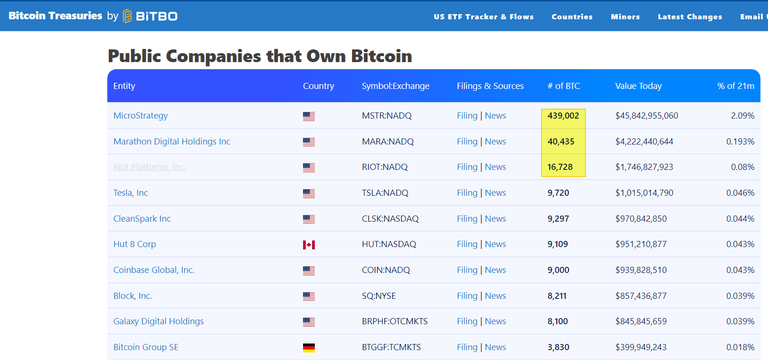

BITCOIN to 107K

Bitcoin is in the news daily now. I think we are seeing some FOMO and YOLO happening here. Spot ETF is buying Bitcoin. Companies are buying Bitcoin. Countries and Sovereign wealth funds are looking at it.

RIOT Platform announced on X (Twitter) that they hold over 17K Bitcoin now, which is higher than the # shown on the Treasuries Website. This was a DEC 16 post (2 days old) and that data has not FLOWED into the website tracking all the holdings of various entities.

1% in BITCOIN rule of thumb?

Rules of thumb are often just suggestions and guidelines. Years ago that was the 1% of total assets in Bitcoin. Not enough to hurt you if it drops to ZERO, but enough to enjoy the GAINS if it holds value.

I had a similar view but I think that is so 2019. Since 2020, that rule of thumb has been updated. Since the introduction of SPOT ETF and public companies holding Bitcoin, I think it is time to say if BIG businesses are holding BITCOIN, you should also.

If you are an unbeliever: 1%-2%

If you are starting, 5% of your networth should be in Bitcoin.

If you are Orange Pill, dislike Debasement of FIAT, and believe printing money is bad for ALL people --> then 10% is a good place to be.

I don't recommend going all-in, but you can still own REAL ESTATE and STOCKS but know that everything else is SECOND to Bitcoin.

Fed will Cut the Rate again.

This move has been priced in already. Let's look at the next 4 weeks or so to see what happens.

Posted Using InLeo Alpha