Hello traders, today I am going to show you how you can use multiple time frame analysis to increase you profits in the forex markets. I just joined Steemit please kindly up vote and follow @taylortee

What is is multiple timeframe trading technique (MTFT)?

Its a trading technique that uses more than one trading timeframe to analyse a trading setup and then take a trade based on that. Multi Timeframe traders do not use one single timeframe to trade, they use a handful of them to do their technical analysis and then eventually will settle on one trading timeframe to execute an order. In most cases, the trading timeframe that they settle in to enter a buy or sell order is the timeframe where the buy or sell signal is found from analyzing the different timeframes.

What Is The Purpose Of Multi Timeframe Trading?

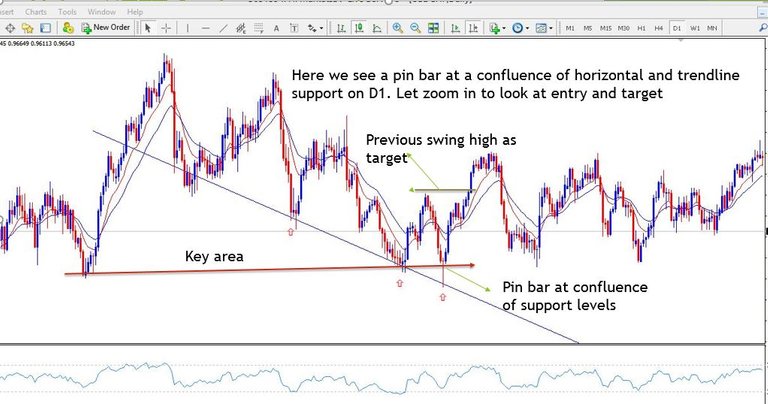

MTFT is used for two purposes 1. to get better trade entries and exits and 2. to manage trades. To illustrate the first use, lets look at one trade, firstly taken trading exclusivley off the day chart and secondly taken using MTFT.

Lets zoom in to see the setup closely. You will see that this was a 2R trade and target was hit after 10 days. The daily bullish pin bar is the buy signal and the stop would go below the tail of the pin bar 120 pips away.

Now lets look at this trade from a MTFT perspective. After seeing price approaching the trendline support we can go to the hourly chart and look for an entry there as shown below. You can see that we also had a pin bar on the hourly chart and it is the buy signal. The stop would go belo the pin bar tail 25 pips below. The target would be the same like the one on the daily chart.

This shows how using MTFT can give excellent entries and massively change the ris:reward ratio from 1:2 to 1:13!

Now lets look at how you can use MTFT for trade management in the same trade above.

Remember, even after entering on the hourly, the chart, the trade was based on the daily chart the zoning down was done to catch the move early. The trade can be managed using the daily timeframe and not the 1 hour timeframe. A good plan of action was to use the watch the daily timeframe lows and whichever candlestick made a lower low, and move the stop loss and place a trailing stop 2 pips below the low of that daily candlestick. If price moved 2 pips past the low of that candlestick, the trade would be stopped out hopefully with some hundreds of pips in profit. Based on this trailing stop strategy, we only had to move our stop loss only once before price hit profit target:

How to do MTTF

The secret to multi timeframe trading is to think outside the box a little bit.

- Start Checking The Larger Timeframes

-Use the top down approach and start with the larger time frames first and checking them to see if there’s any potential trading setups forming.

-Start from the Monthly timeframe and work my way down to the daily timeframe because the monthly timeframe gives a better and bigger picture of what is happening in terms of trend

-The monthly timeframe can hide trading setups that form in the weekly, daily, and anything below the daily timeframe.

-Similarly, the weekly timeframe can hide good trading setups that are forming in the daily, 4 hr and the 1 hour timeframes.

That’s why when you do a top down technical analysis, you don’t miss a thing!

What to keep an eye out for on Higher time frame

-is price near a major support or resistance or fibonnacci retracement level?

-is price near a major support turned resistance or resistance turned support level?

-is price near a confluence level i.e does it coincide with other support or resistance levels, trend lines, channels?

-is price forming a channel and where is the price now in relation to the channel trendlines, is it close or not?

-is price heading towards a major trendline?

-are there any chart patterns forming in the larger timeframes, for example, the head and shoulder pattern?

2.After higher time frames, zone down a bit

-Note The possible Trading Setups That Will Happen During The Week

-only focus on trading setups that will have the potential to form during the week.

-draw your lines, trendlines, channels, etc and wait to see if price will reach them. You can set price alerts on your MT4 to get a sound when price gets to the level if you use the platform

-any other trading setups that is way off, don’t bother for now. Only focus on trading setups that will most likely happen within the trading week or trading setups that can happen in 1 to 2 days.

-you need to make a note of them and constantly monitor them because sometimes, price can travel fast and reach them and you can miss those amazing trading setups is you are not watching and monitoring them.

- Now to the smaller time frame

-Watch price as it reaches that trendline (or support level etc) that you’ve drawn on the higher timeframe.

-You can switch to the 4 hour charts to check out the price action in there and also switch to the 1 hour timeframe.

-If it is a sell trade setup, look for bearish candlesticks as sell trade entry confirmation.

-If it is a bullish trade setup, look for bullish reversal candlesticks for buy trade entry confirmation.

Here are important tips:

Sometimes, the 1 hour will not give you reliable reversal candlestick patterns to give you the confidence to make a trade.

when such situations happens, do not trade in the 1 hour but switch to the 4 hour timeframe and wait there to see if you can  get a reliable reversal candlestick pattern in that timeframe to buy or sell.

get a reliable reversal candlestick pattern in that timeframe to buy or sell.

Advantages Of Multi Time Frame Trading

- gives you better trade entries

- better trade entries also gives you better or excellent risk:reward ratio which in simple terms means you risk less for the potential to earn more, even 13 times what you risked.

- gives you a better perspective of what can happen, where prices are most likely to reverse etc because of the top down technical analysis approach used and this gets you out of trouble because you know that you should not be looking to sell if price is now near a very major support level or you should not think about buying when price is now near a major resistance level in the monthly timeframe.

- allows you to take trades that have potential to move hundreds to thousands of pips in profits

suitable for trend and swing traders

Disadvantages of Multi Time Frame Trading

- many new traders may find it difficult initially.

- Can be difficult to choose what smaller timeframe you should stick to for your trade entries

- forget multi timeframe trading is you are a forex scalper at heart! This is not good for you.

- There's a risk of getting too caught up in the smaller time frame and over trade

Thanks for reading to this point. Share your thoughts, are you already using MTFT? If not would you like to try it after reading this post? Please do not forget to upvote and follow @taylortee.

Alll the best in your trading!!

great post.

thanks a lot, please do not forget to follow. Im new here and just founding my feet.

I am still learning the bitcoin trading techniques. I have saved for further research and reading. I shall try to follow your articles as much as I can.

thanks for that, this is not for bitcoin trading though. have you seen my free introduction to forex ebook?