——Previous review——

What are the conditions for starting an investment activity?

"When I have money, I will start investing right away!" The loophole in this sentence is not just:

When can you have money? In case there is always no money at all?

Unfortunately, we look at the world and, in the end, the “coincidence” thing really happens to most people. Therefore, many people have never invested in their lives. Even more people have not even started - they must know, the vast majority of those who "start" investing have ended in failure.

In fact, we have mentioned before:

Just money (funds) itself is not worthy of being called "capital", because people who "hold money" may not have enough wisdom to turn their "funds" into "capital", not "money" mismatch, was the "people" who are holding money are not worthy of standing behind the capital.

(Please read the sixth week of the article, "Do you have any capital?")

So, another loophole in the above sentence is:

Investment does not have to wait until there is a lot of money to do.

After mentioning GAFATA in last week's article, many people leave a message that are similar to "I don't have much money right now, so...". In fact, these people have either never read the article in the sixth week, or, even more frighteningly, although the article in the sixth week has been read, but now it has not been a few months, and there is no impression in the mind...

Do you remember what you did after reading the sixth week of the article?

Many people look back and they will all feel the same emotion.:

Why didn't we start acting at the time?

In fact, the initial difference between each person is not so great. What ultimately changes people is the starting point of his practice and the subsequent actions.

Those who have changed overnight will have little chance of appearing, and even if they do, we can basically ignore them.

I guess six months later, when I mentioned this article again, there will be many readers also who regret it.

So if you haven't started yet and you see the supplements in this section, then go ahead and act.

However, the biggest loophole in the above sentence is this place:

Investment does not have to wait until there is money to do it.

Investing in this matter, it is really not necessary to wait until there is money to do it. You can make an investment without money. This is a fact that many people have never thought of and have never been shocked.

Let's take a look at the idea:

What is the most important element in investing in this activity?

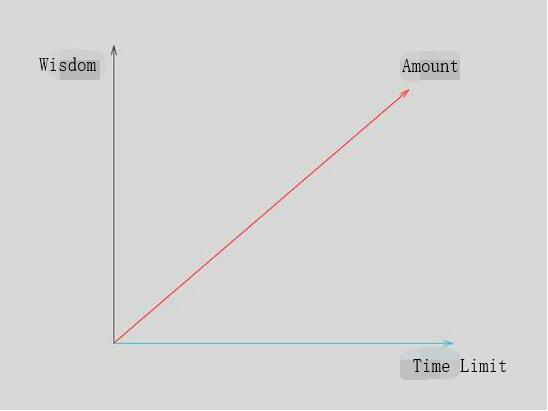

In fact, we have long given the answer, which is the investor's "thinking ability" (or "wisdom") - if the funds wants to become capital, then it needs three elements: "amount", "time limit", "wisdom". Order of importance between them, most likely this is the most reasonable:

Wisdom > Time Limit > Amount

Why is the amount actually a relatively low factor in investment activity? In fact, the sixth week of the article also mentioned, because the core indicators to measure the success of the investment is not the amount of "money" (this is the absolute value), but the final proportion of the money. How much (relative value) has been increased - the growth ratio is a more essential measure.

Some readers saw there and thought of an idea: conduct an investment game with me.

Unfortunately, I will not participate, and I also recommend that you do not compare too much with others.

the reason is simple:

Investment is always your own business.

Each of us has a different starting point, and the accumulated wisdom and corresponding time concept are different. Excessive comparisons only cause unnecessary mood swings.

In fact, in investing in this matter, the only opponent you need to defeat is yesterday's yourself.

We are not perfect, but we can make ourselves better every day. This thing can still be done. So don't put your precious attention on the outside, just concentrate them and use them in the most useful places.

Another reason is that at the starting point, the "amount" thing is almost "a factor that cannot be controlled by oneself" for everyone. You are rich second generation, you "directly" have more money, you aren't, even "a certain amount" is not necessarily.

However, the term “time limit” is fair to everyone and has nothing to do with the difference in starting point. I am not rich second generation, I am not very rich, but I think that any normal person, as long as "subjectively a little firmer", can take out thousands of dollars, or tens of thousands of dollars, "judgment it is a life imprisonment" - as long as this is done, one person is investment areas, in this dimension of "time limit", they has already stood at the highest dimension with all "qualified investors" and all "excellent investors" - Can't be higher anymore.

To be able to understand this truth, what is needed is wisdom - something more subjective than the amount and time limit. It can be done by anyone. This is really a counterintuitive thing:

The hardest thing is the easiest, the most difficult, because it is too simple, and even many people simply did not expect it...

Going a little deeper, "investment wisdom" is unlikely to be obtained through "geneticity" - we have explained this in the twenty-first week article "The rigid demand for investment is to hedge".

So, in the end, our conclusions are combined and retelled, namely:

The most important factor in investment activities is wisdom. At this point, no one has an "innate advantage."

Many years ago, on that sunny afternoon, I suddenly understood the moment of this, sweating, but my mind was exceptionally clear, looking up and seeing the future.

Everyone has a moment of awakening, and you are no exception.

I don't know how many times you got this pleasure when you looked at this column. Even if you haven't, don't be discouraged because you are not alone.

China's education has given us a lot of professional knowledge, but the understanding of time and the polishing of the mind have never been taught to everyone.

So watching so many readers can't take the first step, I think I have to do something.

We said a few weeks ago that for some people, "finding an excuse" is them rigid demand. In the investment field, the biggest excuse is:

I don't have enough money yet.

Now I have told you that what is really important is not money, but time and wisdom. And no one has an innate advantage, and everyone has so much time, so don't hesitate any more.

This is a resumption of the thinking process. I have been a teacher for many years, and I know that thinking about this thing will be "unnatural, how hard" when I first started. The above ideas are obviously "old-fashioned" for the readers of this column. But we all have a certain "meta-cognitive ability", we can use our metacognitive ability to examine our own thinking, and further "advanced use method" is to use metacognitive ability to try to figure out other people's thinking (results and The process) - all the good teachers are masters in this area (the reason why most teachers are not qualified is also here).

Therefore, even if it is "a reader who has already realized that he has read another statement of this content", many people will be surprised to find that although they have read it before, they are not understanding enough.

In the eighth week of the article, we mentioned "Multi-dimensionality to build competitiveness", I guess you (or a large percentage of readers) just did not think of the relationship between today's article and the eighth week of the article.

Since we conclude that there are three dimensions in defining “capital”, then “further” in any dimension is the basic means of building multi-dimensional competitiveness. Since the "amount" is subject to congenital restrictions, since "the time limit is easy to achieve the highest point", since "wisdom" everyone has no innate advantage; and since "wisdom" is the most important factor, then:

Why not start exercising your wisdom right away?

Even you should ask yourself seriously: “Why didn’t you start from the sixth week?” or “Why didn’t you start from the eighth week?”

Then thinking. There is only one methodology behind the whole process of thinking:

Constantly ask yourself "What is the most important thing?" Active thinking, initiative correction; Once you find the "most important thing", you will start to ponder it... In the process, the process is still repeated, perhaps "the most important thing is What's the answer will change...

This is actually the “values” mentioned in the 18th week of the article “What determines your destiny” and the steps that must be taken when refining values.

I hope that through this example, you can understand:

At any time, you need to ask yourself "What is more important?", "What is the most important?"

If you don't have the answer to this question, you are a "headless fly"; if you have asked, but haven't found the answer yet, you still also "headless fly"; if you haven't even asked this question, then you are not as good as "headless fly".

Many people regard the freedom of wealth as the most important thing, so they are doomed can't achieve this wish.

Because that's just a milestone, not the ultimate goal. If you look at those who truly achieve this achievement, very few people are ultimately aiming at the freedom of wealth.

They either want to create more contributions to society, and they want to make their value even better.

So in their view, obviously there are more important things than making money.

In my opinion, at least one thing is more important:

Polishing the concepts and values in your mind.

Many people make the wrong choices at the end, in the final analysis, because the concepts in their minds are unclear and their values are vague.

For example, the concept of "having money", in fact, many people did not think clearly. Then how can you know when you are "rich", how can you wait for that node and then invest?

Give the readers of this column the most "close" example. Before I start this column, I also ask myself:

What are the factors that define the value of this column?

What is the more important factor?

Which factor is the most important?

The final conclusion is:

I must do it to make a larger percentage of readers earn a larger percentage of money in the future.

Very naked.

Of course, because I have been a teacher for a long time, I know that it is very important to let the “students” (or “listeners” and “readers”) temporarily “do not think another things” at certain stages. “It’s also very important for specific pursue at a specific stage. Therefore, I did not "talk about money naked when I came up start", and even "not talking about money for a long time..."

However, if you look closely, my definition is very clear and accurate: the definition of "a larger proportion" appears twice.

The first "greater proportion" stems from my determination of knowledge and education. I believe that everything can be learned, and everything can be doing better and better through practice. Even, I have mentioned a phenomenon on many occasions: "Don't say smart, even 'stupid' is not born! Most of the 'stupid' is actually learned from the day after tomorrow, and is affected by the environment..." To mention the other, "meta-cognitive ability" alone, I know how many people it will affect, and it will bring about tremendous changes in all aspects of a person's life.

The second "larger proportion" stems from my simple perception of reality. The "starting conditions" of the readers of this column (that is, how much "capital" you already have when you subscribe to this column) is not something I can control - in fact, no one can control it, isn't it? Fortunately, this "uncontrollable factor" also happens to be a factor that is actually not so important, because... just mentioned:

The growth ratio (in investment activities) is a more essential measure.

So, I finally made sure that this column, I can do it - I know what I should do, I know how I can do that... and because I have the ability to think "what is the most important thing" So, in fact, I am sure that I can do quite well, so I can start doing it. And, not only do you have to start, but you can also set the goal to "do better, even best" from the beginning.

Even if you think "I have no money", how do you start investing?

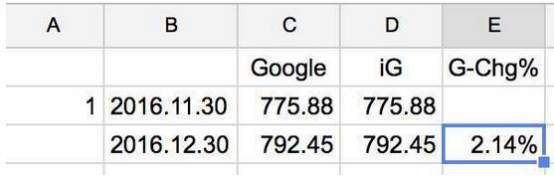

Create an Excel spreadsheet (or use a Number on your Mac, or use Google Spreadsheet on the line)... Then, imagine you buy Google stock for $1, then update the stock price at the end of each month to calculate Compared to the initial investment of 1 dollar, the rise and fall - Done.

Of course, you can also track several companies at the same time. However, it is recommended that you don't pay too much attention. Three or five are enough, otherwise your energy will not be taken care of - even if it is a "virtual investment." Because it didn't take long for you to know that the "tempering the brain" is very real and not "virtual" at all.

The reason why it is "not false" is because it can really cultivate your abilities.

For example, patience.

Recording once a month, it seems that it is not difficult, but in fact, for beginners, it is don't simple.

Because most people measure their time by day or hour, few people plan for weeks, months, or even years. So this is equivalent to improving your perception of time and your patience.

At the same time, you are also very likely to improve your English skills.

I said it very early:

If you can't learn English well, don't learn it. Use it directly.

Although it is a mock investment, you will also pay attention to the movements of overseas companies. Because it involves money, you will be mentally motivated, naturally will find out the meaning of each word, and find out the meaning of each sentence.

Use it repeatedly, you will find that English is not your obstacle.

Have you reacted? What are the conditions for starting an investment activity? It turned out to be nothing more than:

As long as you are willing to……

Here are a few key points:

1 In fact, the stocks you start tracking are not really GAFATA both all right. If your English is not good, then you can choose a company in the domestic stock market that you believe will continue to grow in the future. Because in the next few days, if you are idle, you will pay attention to the company’s financial report and other News.

2 The amount must be set to 1 yuan - the most convenient and smallest unit. 1 yuan, 1,000 yuan, 10 million yuan, or the dollar or the yuan, in fact, it does not matter. Not because "anyway, virtual investment", but because you have to develop a habit from the beginning: focus on relative value rather than absolute value - the growth ratio is really important.

3 Update data only once a month. Never look at this data at other times of the month. It is not only meaningless, but more terrible is to develop bad habits - as for how terrible the bad habit is, you will understand more and more in the future. (Further self-training is: If there is even an exception, you can't help but look at the data until the end of the month, then you must find a way to punish yourself properly...)

Many people will involuntarily think: "What is the point of doing this?" If you can think out, you have already done it - You have never done it. In other words, in your current situation, you can't think of anything.

Let you do it, then you do it, less nonsense.

Because the premise is clear:

1 You want to learn;

2 I have experience;

3 Although I know that you can't think clear "what is the point of doing this," I guess you can at least understand that "do it without loss"...

Keep doing it for at least 12 months, then you are qualified - and this is already very, very fast, and you will become more aware of this in the future.

In the future, you will see countless people, rushing into the "investment field", even if there is no basic training beforehand, even they think they have rushed into the market. In fact, after opening the door, they actually entered the casino.

I think, I have tried to establish a certain degree of trust with the readers in a certain range - patiently waiting for updates every week, read each word patiently every week, persist in more than 20 weeks, you must have already realized the metacognition importance and power of cognitive ability must have already realized the great differences between the stages of “knowing”, “meeting”, “understanding” and “deep understanding”.

Over the years, I have had in-depth contact with many recognized investment field experts. In the end, if you have such an opportunity as me, you will also find out. In fact, at all levels, the biggest problem that everyone faces is exactly the same:

How can I make myself worthy of that opportunity?

If you are not an "entry-level investor", then I would like to remind you here:

Every thought loophole will eventually lead to the break. The more capital you have, the more amazing the effect of lead to the break...

I have experienced many times and have suffered a lot of losses. It is a bloody lesson that is hard to tell and preach. Because that lesson is of no use to others, because the lesson is only from a "specific thinking loophole that belongs to you"...

The whole road to the road to wealth and freedom, the things to do are very simple, trying to block one after another the most common, most ordinary, and most terrible thinking loopholes - even from the time when you have no money to invest. I have already started this work. When you finally have the money to invest, one day, you may have a year, two years, or even a "lifetime" experience, and then"the opportunity is really coming" When you are worthy - even, you are more worthy of the opportunity than others.

It's that simple.

【You don't want to miss them】

——What are the conditions for starting an investment activity?——

——Do you really have no chance?——

——Respect the difference in the magnitude of capital.——