When the upsurge became a habit, the rich became a belief.

In 2017, the digital encryption money was very hot, which created a lot of "one night rich" legend.

Many people in the circle of money are impetuous. After seeing too many 95, I earn one hundred million in just one year. I feel like a God. When I was young, I earn a lot of money. I will destroy myself and make quick money, so I can't do general work.

A post - 80s saute said to the media.

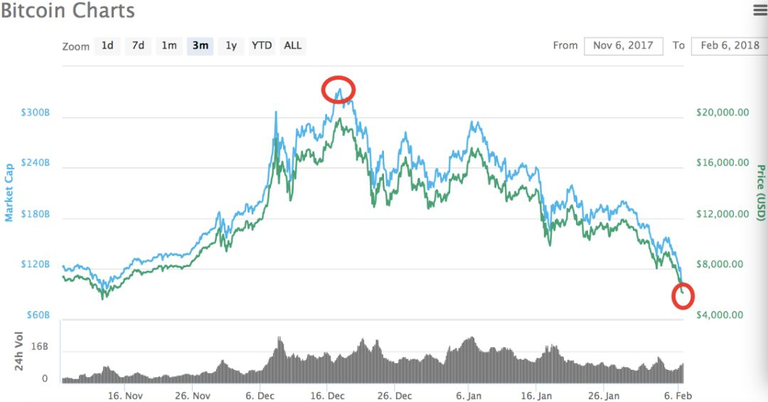

But now, with only 51 days, bitcoin has fallen from $20000 to $6000, or about $230 billion (about 14 thousand and 400 yuan).

The biggest bubble in human history is broken.

In recent times, the price of the bitcoin has flashed out, and the price has been wrestling from $20000 in December 17, 2017. In the afternoon of February 6th, the GDAX platform showed that the price of bitcoin fell below $6000 and fell more than 25% in 24 hours. In only 51 days, it fell 70%.

Nouriel Robini (Nouriel Roubini), a professor of economics at Stern college, New York University, who has accurately predicted the subprime mortgage crisis, says:

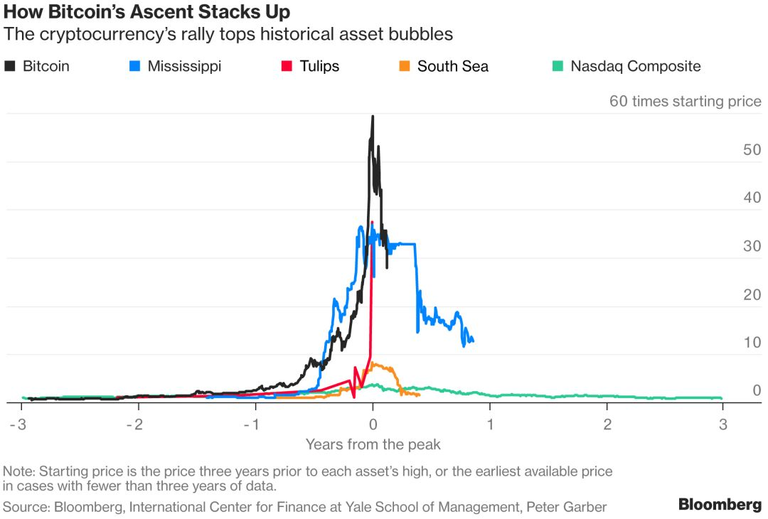

Bitcoin is the biggest bubble in human history, and it is disillusioned..

Several big asset bubbles in the history of human history: Black: bitcoin; blue: Mississippi bubble; red: Tulip bubble

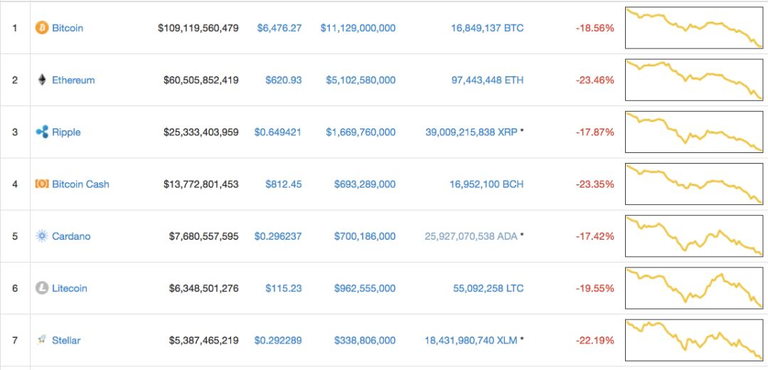

As the global stock market in February 6th, digital virtual currency market, but also Starving people fill the land.

A lot of currency speculation in enjoy a soaring sweetness, taste of this obsession, and fought, they think this is faith, but is in fact infatuation.

At one o'clock in the morning, Jiang Shan suddenly sent a message, saying that bitcoin was still falling. During this time, he almost went to the toilet with his cell phone and stared at the disc. I asked it useful? He said it was no use, but he looked at his heart, but he felt his anxiety. He recently asked me from time to time, when it was the end of the fall. (Securities Times Network reported in February 5th)

Unexpectedly, in the social media abroad, the voice of "perseverance is victory" is rising.

Today is to buy some! Full storehouse!

Bitcoins are experiencing difficult times, but only those who hold firmly can live to the end.

Don't sell it in a hurry! Learn the trading skills and start at a low price.

If I have any money, I'll start with the digital money. I don't care about the performance of the market.

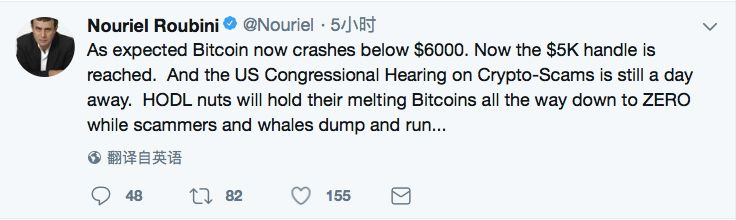

But Ruri El rurien retaliate on personal social media:

Bitcoin fell 6000 dollars. The next goal is $5000. Tomorrow, the US Congress will hold a digital encrypted monetary hearing. The big crocodile is running, and the obstinate fools will see their bitcoin worthless...

Encrypted currency will face global supervision

How big is the bubble of the virtual digital encrypted currency, and look at the increase in them. For the risk that regulators Chinese is foresight.

As early as last September 4th, the people's Bank of China, such as the seven ministries and committees issued a bulletin, emergency call to stop ICO (first currency issue) activities. At the same time take measures to require virtual currency exchange in September 30, 2017 before completely shutting down all trading activities in the Chinese.

After clearing and renovating, the amount of virtual currency trading in renminbi has decreased from less than 90% of the total volume of global transactions to less than 1%, and the risk level has been greatly reduced.

However, the transaction of ICO and virtual currency has not been completely evacuated from China. Many people turn to offshore platform websites to continue to participate in virtual currency transactions.

In this case, the central bank's Financial Times reported in February 4th that, for domestic and foreign ICO and virtual currency transactions, relevant departments will take a series of regulatory measures, including banning related business presence, banning and dispose of virtual currency trading platform websites.

For the money saute, the bigger news is from South Korea and the United States.

Last December, the Korean government finally decided to take a number of measures to curb speculative and criminal activities in the virtual currency market.

Recently, JP Morgan chase, Bank of America, Citibank, Lloyd and other American bank banks announced, will prohibit its customers to use credit card borrowing to buy bitcoin encryption currency, for fear of customers or because of falling prices and suffered huge losses, banks could not recover the money.

More importantly, the US Congress will hold an encrypted monetary hearing. The chairman of the U.S. Commodity Futures Commission and the vice president of the US Securities Regulatory Commission will attend the Senate hearing to discuss issues related to encrypted currency.

On the 6 th of the United States, Christopher Giancarlo, chairman of the SEC Jayson Clayton and the Commodity Futures Trading Commission (CFTC), testified at the Senate hearing. They released the signal of strengthening the legislation and promising the block chain technology.

In the pre issued testimony, Giancarlo said that in view of market fraud and manipulation, digital money may need to be supervised more carefully, but he favors block chain technology. "No harm does happen" is the right way to develop distributed account technology.

Giancarlo's conclusion is that SEC and CFTC should make every effort to leave space for digital money. Digital currency marks the paradigm shift of payment, traditional financing process and economic activity. If regulation disregards these developments, it is irresponsible.

Clayton said that investors in digital currencies need comprehensive protection, and SEC may support the US Treasury and the Federal Reserve to require additional legislation on digital currency. He does not deny the role of digital money in the modern financial ecosystem.

It is foreseeable that the encrypt currency will usher in a wave of global regulation. In the face of danger, banking regulators, experts remind earnestly unilateral rise behind, those who survived the crash after several waves of bitcoin "believers", but held in contempt.

Latest news:

Bitcoin prices rebounded overnight rose $2000

According to trading platform Bitstamp data, the 7 day up to the update, bitcoin prices have returned to over $8000, more than 13% in the last 24 hours.

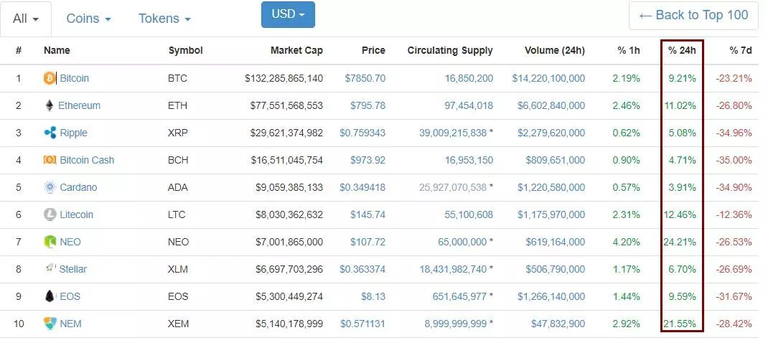

As a recent update, digital currency market and the price tracking website Coinmarketcap data also show that the digital currency market top ten in the past 24 hours of collective rise, the largest increase over 24%, 6 were below the $580 Ethernet currency rose about 11%, approaching $800. The 6 day was below $0.6 reboxetine currency back above $0.7.

However, while bitcoin has gone out of the valley for three months, it still faces a situation of tighter regulation.