Everyone wants to get rich, but not everyone is willing to pay the price

It's funny how I start this article, because I've always heard that everything has a price, saying this I don't want to scare or demotivate you, but to show you what is the price to pay to be able to build wealth and a good portfolio to achieve financial freedom, and in the end we will come to the conclusion that this price is worth paying.

When I talk about "price" I refer to decisions/actions that we have to take to achieve a certain goal, and these decisions/actions can be difficult, because sometimes we have to give up certain things that we like at the moment to be able to enjoy them in the future and this stirs our emotions.

When we talk about creating wealth, we can't just talk about money, there are other important factors that lead us to a path of prosperity to achieve the success we want so much. Our beliefs and behaviors will define whether we will be able to achieve what we want or not, so more than making money, we have to know how to maintain it, what we can create with it and what we can be with it.

So lets start by talking about goals and purpose.

Goals and Purpose

I want to start by talking about my personal experience as an investor, and I want to mention a priori that I paid a very high price, but I call it the price of learning.

My experience as an investor started with me making money and making high profits and getting the investments I made right, but it didn't start well at all. And now you ask, what do you mean you made money and it didn't start well? Are you stupid? Well.. The right word may not be stupid, but I would say that lack of mindset and greed are the most correct words.

The mistakes I made were the mistakes that most investors make, such as:

- Withdrawing money as soon as you see profits and spending it all instead of reinvesting

- Only looking for opportunities to make a lot of money in a short period of time and believing everything you are told without doing your own analysis.

- Not having a strategy and not being patient.

There are more common mistakes that I'll talk about later and give "solutions" to them, but now that I've given some examples of what my experience has been, I'll talk about the beliefs that led me not to fall into the same mistakes:

- Create a purpose in everything you do: When we create a purpose ( a reason why ) to carry out a certain action, it becomes easier to have the necessary motivation to accomplish the tasks and not to fail with what we have committed to, for example instead of telling ourselves that we want to start investing and build a good portfolio to be rich, we can think about the WHY'S we want to be rich, if we provide the reasons why we want to achieve something, it becomes more easy to do and we don't make the mistake of following others and taking speculation for granted, because we know the reason why we're taking X action, and our purpose is different from other people's.

Create a purpose in everything you do in life, not only in investments, but in general goals you have, such as exercising every day, and you will notice a big difference in your motivation, discipline and happiness.

- Create clear and realistic goals: A goal is what you specifically want to achieve in the end result, and purpose helps you stay motivated to achieve those goals.

There's nothing wrong with being ambitious, ambition is healthy but we have to stay realistic and know where we are so that we can come up with a viable strategy with the tools we currently have, and as we achieve our goals we create new goals because we already have more knowledge and more tools.

In the case of creating an investment portfolio, if we have the goal of reaching a certain number and if we are really focused on that goal, we will not let external things harm that same goal, but it is advisable to always leave a room for error, because things do not always go as expected and we have to know how to recognize that things will not be in our favor 100% of the time, we must take mistakes as lessons and look for solutions.

Study the field

I really like a quote that was mentioned by the famous investor Warren Buffet "Risk comes from not knowing what you're doing"

Many new investors enter the markets and choose investments that they have no knowledge of, they just choose them because they heard about it, by this I don't mean that they are not lucky enough to make money because we live in the information age and we just need to find the right one and be lucky, but luck will not always be in our favor. That's why I recommend that before entering any type of market and before building a Portfolio that you inform yourself of the basic things to know and that you seek to know what is behind the investments you want to make.

Here are some rules to choose the investments you make:

Study the basic concepts of the area where you want to invest.

Understand what is behind the projects/companies/currencies, understand what value they are creating, if they are sustainable and if you believe in their vision.

Look for as much information about them as possible, see the news that may have an impact, look for discussions on the topics and draw your own conclusion.

The power of your habits

In the cases of building wealth and a good Portfolio, your habits will have a great impact on their success, so I'm going to talk about some habits that can make all the difference.

- Pay yourself first: When I mean paying yourself first, I mean that every month you should put aside some money for yourself, not only to invest, but also to save or to buy something you aspire to. I know that every month is different and I know that expenses vary from month to month, but I always try to take 30% to 40% of what I earn and divide it into 3: investment savings, purchase savings and emergency fund.

- Spending less than you can afford: This has always been one of my problems, a salesman doesn't need to try too hard to convince me to buy something or spend money, but it's important to know where we spend the money and try to allocate the money to better things, of course we should enjoy the fruits of what we produce, but we shouldn't spend more than what we have, remember that we don't need a specific reason to save and we have to know how to say NO.

- Create good eating and sports habits: Now you ask me, but what does eating well and doing sports have to do with creating Wealth and a Portfolio? Well usually when we create good habits in certain areas of our life, we end up getting into a certain rhythm and having good habits in almost everything we do, and being very honest it is important to point out that with a healthy mind and body we feel good about ourselves and that can be fundamental for us to make conscious decisions and be disciplined, there are more important things than money.

- Read: Reading is perhaps one of the best habits we can have on a daily basis, when I refer to reading I am not only talking about books, but content in general, if we are informed and aware of what we should buy, where we should invest, how we should invest and what risks we should take into account, we greatly minimize the probability of failure.

There are a lot of articles and books that talk about common mistakes to avoid, what we should take into account when investing and what strategies we should adopt.

Here are some book recommendations:

- Psychology of money

- Rich dad poor dad

- 7 secrets for invest like Warren Buffet

- My personal MBA

Expand your circle of influence: My parents always told me: join the good ones and you will be like them, join the bad ones and you will be worse than them, and, show me your friends and I will show you your future.

The people we surround ourselves with have a great impact on our lives and can influence our decisions and way of thinking, so we should look for people who can help us achieve what we want, when I say this I don't mean using people out of interest, but being interested in people and the content they can share with us.

Following a figure that we idealize can be great for us if that person has gotten to where we want to go and guides us to the right path.

The people we surround ourselves with have a great impact on our lives and can influence our decisions and way of thinking, so we should look for people who can help us achieve what we want, when I say this I don't mean using people out of interest, but being interested in people and the content they can share with us.

Remember, the more people we know, the more information we have, the more trust in those people we generate the more influence we have, so always work your circle of influence.

The power of compounding

Good investing isn't necessarly about earning the highest returns, because the highest returns tend to be one-off hits that can't be repeated. It's about earning pretty good returns that you can stick with and which can be repeated for the longest period of time. That's when compounding runs wild.

Of course, for this you need to be patient and persistent, and we are emotional beings and it is not always easy to see our portfolio negative, but do not forget that sometimes the fall is just a push for a significantly large rise.

Using dollar-cost averaging is the best strategy for those looking to invest for the long term, as it involves investing the same amount of money in a target security at regular intervals over a certain period of time, regardless of the price. By averaging the dollar cost, investors can reduce their average cost per share and reduce the impact of volatility on their portfolios.

Here are some examples of the power of coumpounding:

STOCKS:

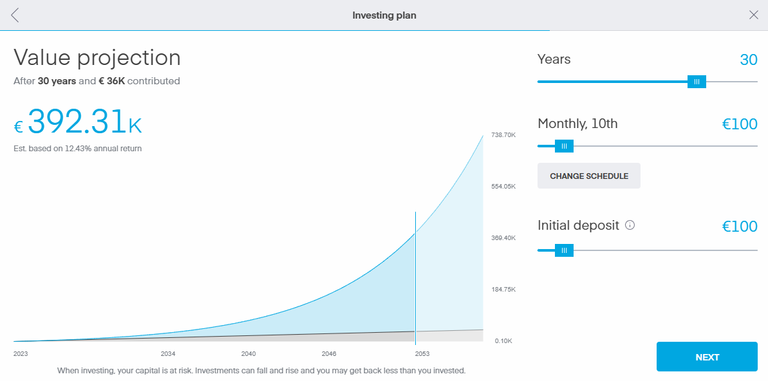

Using the Trading212 simulator we observe that with an investment of €100 per month we achieve an annual investment return of 12.43% (which to be honest is quite good) which in 30 years is converted into almost 400 thousand euros, of course this is just a simulator and the returns will not always be positive and great, but if we are patient and if we use the power of compounding in the long run, we won't regret it. ( Vanguard S&P 500 ETF )

CRYPTO:

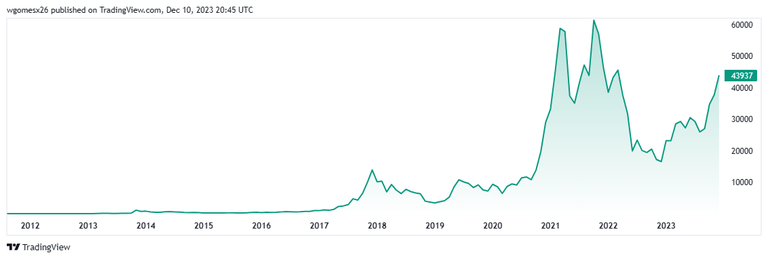

Although those who invested between 2021 and 2022 have not yet recovered from the giant crash, Bitcoin has proven to be quite resilient and it is predicted that it can exceed the value of 100 thousand euros per BTC in 2024, as many indicators point to it. There are many other cryptocurrencies that more than currencies have become good investments with good projects behind them, so if you are new to this world of crypto, look to know more about other cryptocurrencies, other than the traditional ones: BTC and ETH.

There are many other ways to invest and where to allocate your money, such as buying gold, being a shareholder in a company, buying real estate, creating a business.... Opportunities are everywhere, we just need to know how to recognize and take advantage of them.

Risk management

Generally speaking, people who try to get rich and fail fall into one of two categories:

- First, there are those who take a great risk in the hope of getting rich quickly. They jump without looking and end up crashing to the bottom of the cliff.

- On the other hand, there are people who are paralyzed by the fear of not daring to take any risk, which is the greatest risk of all, keep money in the bank, under the mattress and let inflation slowly destroy your wealth.

People who create wealth are open to new investments that can help them grow their money, identify risks and reduce them to the smallest possible degree.

The best way to manage our risks is to have the right information and have a strategy, of course things don't always go as we expected, risks exist everywhere, but if we minimize them the probability of being successful is greater. Having an emergency fund is also a great way to manage risks, because with a good emergency fund we are ready for any adversity that comes our way.

The numbers don't lie

To conclude this article, I want to talk about the importance of accounting and being aware of the performance of our results.

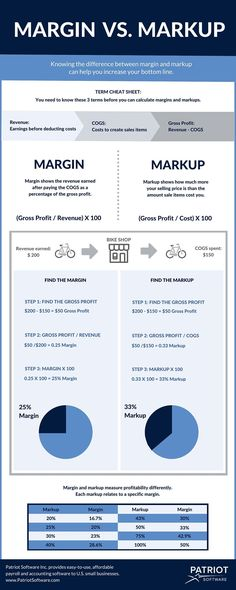

There are several ways to evaluate our results, most companies evaluate the Cash flow statement, Income Statment, Balance Sheet and Financial Ratios, but to be simpler for you I will only talk about Profit Margin and Markup.

Profit Margin: Is the difference between how much revenue you capture and how much you spend to capture it, expressed in percentage terms.

((Revenue-cost)/revenue)x100= % profit margin

For example: You spend 1€ to get 2€=50% margin

Spend 100€ and sell it for 150€= 50€ profit= profit margin of 33%.

Profit Margin can never exceed 100% ( only happens if you sell something that cost you nothing )

Markup: Margins can never be more than 100% BUT markups can be 200%, 500% and 1000%. ( Higher price + Lower cost= Higher markup )

((Price-cost)/cost)x100= % markup

For example: Cost 1€ and you sell it for 2€= 100% Markup.

When you are analyzing your performance you should pay attention to the profit margin and the markup, because the higher they are in better situation you are, and the positive thing about all this is that many brokers already show our results in profit margin or markup, which gives us a better idea of how our portfolio is doing and makes it easier for us to do the math.

Doing these calculations is also important to understand what risk management we should take into consideration, where we can allocate our money and what strategies we should take.

Congratulations if you read this article till the end!

This topic is very complex and depends from person to person, in the future I can write another article talking about the same topic in more detail, but these, I would say, are the most important steps to take to build wealth and a good Portfolio, but do your study because there are many more steps to take to be successful.

I wish you a great week and don't forget that opportunities are everywhere.

Purpose - one thing I want to add when defining a purpose, when answering the question "why am taking that action" is to also slow down a second and think of another action that you might (in theory) be taking but that you deliberately won't. An action that might help you get rich, yet would not be aligned with your higher purpose. I'll caricature for illustration: you want to be rich but are you ready to rob a bank or mug someone and steal his possessions to become rich? No, because these actions (hopefully) do not fit into your bigger narrative.

Risk: alongside W. Buffets quote I'd like to complement with a quote from the "Big Short" movie: "It's not what you don't know that kills you. It's what you think you know, but it just ain't so."

Third, I want to stress again how much investment is an information game. The best investment lies therefore where you know more, are better positioned and have more information than others: I am talking about investing in yourself and in projects you can personally contribute to and get involved with.

Other than these small contributions, very good article. I for one still have to work on my "sporting habits" 😄

1- I completely agree with you, and here comes the part of our values, and I like to say that above any ideology or decision our values must be seen as a priority.

2- This phrase perhaps taught me one of the greatest lessons of my life, the thing that kills us is what we are sure is right, having a broader vision and giving space to listen to others is always beneficial.

3- One more time I agree with you, nothing better than create value that benefits our life’s and people’s life’s.

4- Maybe you can create an “sports goal” for 2024 😂, “new year, new life” they say.

Thank you for you feedback Sorin, is always insightful and inspiring!

Congratulations @wgomes26! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next payout target is 50 HP.

The unit is Hive Power equivalent because post and comment rewards can be split into HP and HBD

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!