Index-fund pioneer to move investments to target-date funds

Bloomberg

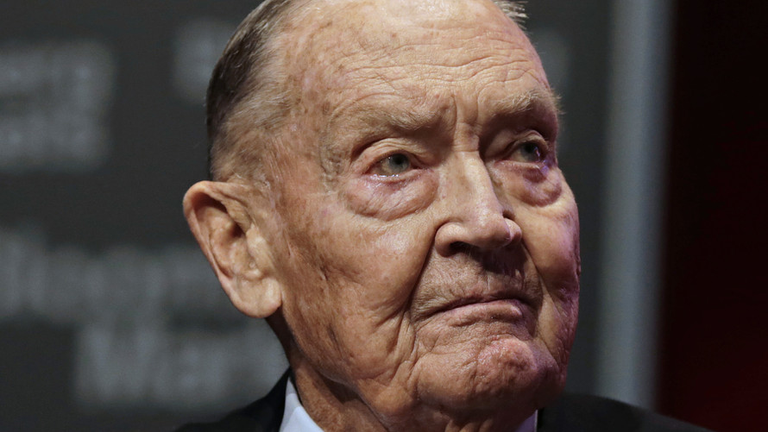

Vanguard’s founder, John Bogle.

By

Angela

Moore

Senior editor

Employees at investment giant Vanguard Group will no longer have access to an S&P 500 index fund SPX, +0.86% as a choice in its 401(k) retirement plan, according to a report in the Philadelphia Inquirer.

Vanguard confirmed the change.

“We believe the Total Stock Market Index Fund VTSMX, +0.85% VTI, +0.89% VTSAX, +0.85% is the best proxy for the U.S. market, offering exposure to large-, mid-, and small-cap stocks, whereas Vanguard Institutional Index Fund concentrates on large-cap stocks,” a spokeswoman told MarketWatch in an email.

The company, which popularized low-cost index investing, will remove the option to invest in the Vanguard Institutional Index Fund VINIX, +0.86% for employees this month and workers can reinvest their assets into any other available option. If the employee doesn’t take action, the company said it will move the assets to an age-appropriate target-date retirement fund based on the worker’s age.

The move is part of a larger strategy to streamline fund options for employees, the report said, citing the company. Vanguard eliminated 12 funds from its retirement-plan menu. The list of the dozen funds published by the Inquirer comprises a mix of actively managed and passive index funds.

A Vanguard spokeswoman pointed out that the company still offers 27 funds for its “crew members,” which is what the company calls its employees. The options available still allow the crew members to build personalized portfolios with different levels of risk, the company said.