Assuming creditors and other nations accept the currency of a debtor nation which is experiencing an exponential debt explosion, is there a hard limit on how much debt an economy can bear?

Bring together a couple of other ideas to explore this question:

- All debt is serviced by labour, energy and land.

- Wages reflect interest rates.

Consider a few simplification assumptions: all labour is in the one economy and energy and land are not considered and effectively zero cost so we can focus on labour.

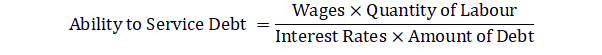

Then the ability to service debt could be described with this equation:

Zero interest rates imply no value to money - a conceptual issue to avoid for now.

Making interest rates and wages static and fixed means that as debt increases then the amount of labour required to service the debt needs to increase. A consequence of this is that there is a maximum amount of labour available so there is a maximum amount of debt that can be serviced.

If we reduce interest rates, in the long term we would expect debt to increase as money becomes cheaper and we would also expect wages to reduce to ‘compete’ with cheap financing. This means that as interest rates reduce making it apparently easier to service debt, the long term effect on wages make the servicing harder as more labour is required. Correspondingly, as wages reduce, the pool of available labour becomes smaller (confirmed by reducing participation rates) further lowering the limit on debt before it becomes unserviceable.

In essence, the debt limit is fixed by the value of the workforce required to service that debt.

Taking some recent US figures, the debt in 2013 was approx. $146T or $970k per worker. With interest approx. 2.7%, this means that $400B or $26k of each worker’s labour services the debt. A median per worker income of $31k enables the total sustainable debt to still grow by 20% or another 30T; or continuing borrowing for 8-15 years if workers did not need food. Of course for the US example, annual trade deficit of $500B means that a considerable amount of overseas labour is supporting the servicing of the US debt. The support provided by the imports confirms that the US servicing debt with more debt.

Of course workers need their income to fulfil needs (food, shelter, etc), which at poverty levels would be approx. $15k leaving $16k per median worker to support debt. Current rate of imports can support 25% increase in debt (another $36.5T) and internal labour a further $9T for a total debt capacity of $191T. In 2016, debt was $163T, increasing by over $6T per annum so the approach to debt capacity would look to follow this trajectory:

2017 -> $170T

2018 -> $177T

2019 -> $185T

2020 -> $193T

This implies the crisis can be delayed till 2020 however as internal labour is used more for debt servicing, that will detract from consumption and reduce overall economic activity and consequently employment. This may potentially bring the crisis forward as will the planned interest rate increases, 1% over 2018. This implies the crisis would land late 2018 or 2019.

Of course these projections assumed that debt is homogeneous, efficiently administered and the US cannot simply print more money and distribute to the population directly, devalue the USD or increase imports (which increases both the debt and debt servicing capacity). As the economy and debt is not homogeneous, then, especially with increasing interest rates, the weakest firms, individuals and governments will commence defaulting thereby reducing the debt.

Some state governments are already defaulting or nearing default. Student and credit card debt defaults are increasing as are car loans. Home loans defaults and bankruptcies are yet to increase, perhaps as other liabilities would be sacrificed before home loan defaults and bankruptcies.

The debt has a limit that the US is rapidly approaching however there are several actions that can delay that debt crisis assuming that creditor nations will continue to support US debts – which they are obliged to do while the US is the major economic and military power and the USD is the global reserve currency. Actions to delay crisis and the increase of debt will in themselves result in economic challenges before the crisis hits.

Congratulations @robsverdict! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP