Who wants to work for the rest of their lives? I bet no one would raise their hands to say: 'Me'. Everyone wants to retire early but not everyone has the capacity to do so because of their living expenses.

The usual retirement age is 65 years old for most countries in the world. During this time, most won't have regular income anymore from their jobs but the living expenses won't stop. In fact, it maybe even higher because of medicine one needs to maintain because old age usually comes with health problems.

In my previous article, I discussed about the Power of Compounding, and how it can multiply your savings over a period of time. Time is your friend when it comes to investing and the longer period you save and invest, the higher it will be over the long term.

Do you want to become a millionaire? The power of compounding works to your advantage. The earlier you started investing, the earlier you will achieve your millionaire status.

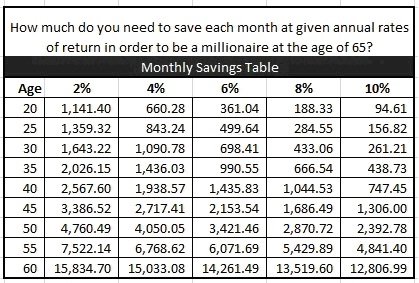

The table below shows the amount you need to save monthly at a given age and a fixed interest rate in order to become a millionaire at the retirement age of 65. Notice that the younger you are, the lower the amount you need to invest monthly. Conversely, the older you are, the higher the amount you need to invest monthly.

Of course, some investments may yield higher return than 10% but this is just only an illustration that you need to save and invest earlier in order to reap the great rewards in the future.

Don't be the 'I HAVE NO TIME'

When you’re 20, you had your first job and lived the life you want. Gimmicks and everything…. Someone approached you and convinced you to start your savings and investments for yourself and start educating yourself financially. You said: “Maybe Next Time, I want to enjoy life!”

When you’re 30, you had your family, your wife and two kids. Someone approached you and convinced you to start your savings and investments for yourself and start educating yourself financially. You said: “Maybe Next Time, my budget is not enough for my family and myself.”

When you’re 40, someone approached you and convinced you to start your savings and investments for yourself and start educating yourself financially. You said: “Maybe Next Time, my children are going to college.”

When you’re 50, you are retired. Someone approached you and convinced you to start your savings and investments for yourself and start educating yourself financially. Again, you said: “Maybe Next Time, my retirement fund is enough for me.”

True enough, the 'early bird catches the worm'. It’s not how much you earn but how much you save and invest. If you are the ‘early bird’ in investing, then you would catch the ‘worm’ sooner than the rest of your peers.