View Original Article On Our MEDIUM Platform:

As previously announced, 2gether has started the presale of the 2GT Coin in Spain, and access will be opened to the remaining Eurozone countries in the following weeks. (Follow us on social media and don’t miss anything! 😉).

Today we’ll briefly explain the supply and distribution of the 2GT Coins. For an in-depth explanation, download the Whitepaper and Tokenomics paper, available on our web.

Summary

- 2GT Coin total supply: 2,400,000,000 tokens

- 2GT Coins available in the 1st token sale: 400,000,000 tokens

- Hard Cap of the 1st token sale: €20,000,000

- Unitary price: €0.05

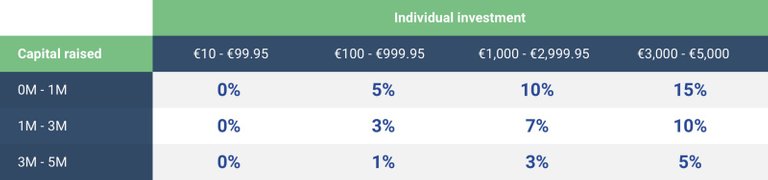

- Bonus structure:

Bonus structure for the first €5M or until the 2GT is VFA approved

- Accepted currencies: EUR, BTC, and ETH

- Token delivery: in the investor’s Ether wallet within the 2gether app

- Spain start date: January 14, 2019

- Eurozone start date: H1 2019

Token supply and distribution

As mentioned above, the total supply of 2GT Coins will be capped at 2,400,000,000, and no more 2GT Coins will ever be created. But, how are they going to be allocated?

2GT Coin distribution

1st and 2nd token sales. The funds raised will be used to reach our business goals through 2021 and fund the 2GT rewards during the same period. To learn more about how we plan to use the funds, check out our upcoming Intended Use of Funds article. The 2GT Coins issued in these sales won’t have a lock-up period.

Community. These 2GT Coins will be used to create and boost 2gether’s client base, and they won’t have a lock-up period.

Partners. A strong network of partners is important to create a platform like 2gether — that’s why we’ll use these 2GT Coins to foster partnerships. Some of our partners already include A.T. Kearney, KPMG, Uría Menéndez, and Swiss Crypto Advisors. These 2GT Coins won’t have a lock-up period.

Team. We have a really talented team that is working hard to make 2gether a reality and that plays a key role in the project’s success. The team members will have a four-year lock-up period with a 24-month cliff.

Early investors. Some of them are former J.P. Morgan bankers or McKinsey partners, and they have helped craft 2gether. They will have an 18-month lock-up period with a 12-month cliff.

Authorized Fund. A reserve to ensure that 2GT rewards are always distributed when accrued by a community member, and to raise further funds if needed, among other uses. The lock-up period will be managed by the smart contract following dynamic rules.

Token supply calendar

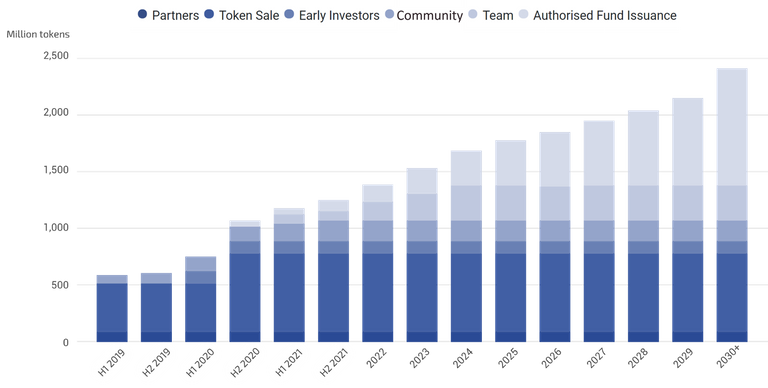

To limit potential volatility in the value of the 2GT Coin, we’ve implemented lock-up periods to ensure progressive token issuance following the 1st and 2nd token sales. The chart below highlights the predicted circulating supply year by year:

Predicted circulating supply

More info 👇

We’ve posted the Whitepaper and the Tokenomics documents on our web, where you can find more information about 2gether and the 2GT Coin.

We’ll also post more articles, such as the regulation around the regulations issued under Malta’s Virtual Financial Assets Act (VFAA) and the Intended Use of Funds, in the coming weeks.

In the meantime, follow us on Twitter and join our community! 🚀