I have watched the slow train crash of the Federal Reserve's ongoing policies. They have no exit strategy for their so-called assets or as they should be called liabilities on their books.

The reason for this asset buying or Bail out as it should be called is that banks and the US government are insolvent. The FED is in panic mode as the system is crumbling under their centrally planned manipulated monetary system. The system is on the verge of collapse at any Fiat economic system is.

The reason for buying the Mortgage Backed Securities (MBS) is that people were too indebted and shouldn't have bought the houses in the first place. Debt always becomes a burden when it is over accumulated. It is like a pyramid scheme. You always need more debt to fuel the ever expanding tower debt. At one point the engineering of the ever-expanding tower will fail and the tower becomes like a deck of cards. You can borrow money with interest in smaller amounts, but when everyone starts doing it in a sector or now all sectors there will never be enough "money" in circulation to pay off the Principle and Interest.

When debt is created it comes with Principle the amount borrowed and the interest charged to borrow the currency. The problem is that the interest doesn't exist and when everyone owes interest on some form of principle loans there is not enough currency in circulation to pay that interest. When we see mass bankruptcies like in 1980's 90's 2000's or during the great depression the cause was over the expansion of debt and not enough people to borrow any more money.

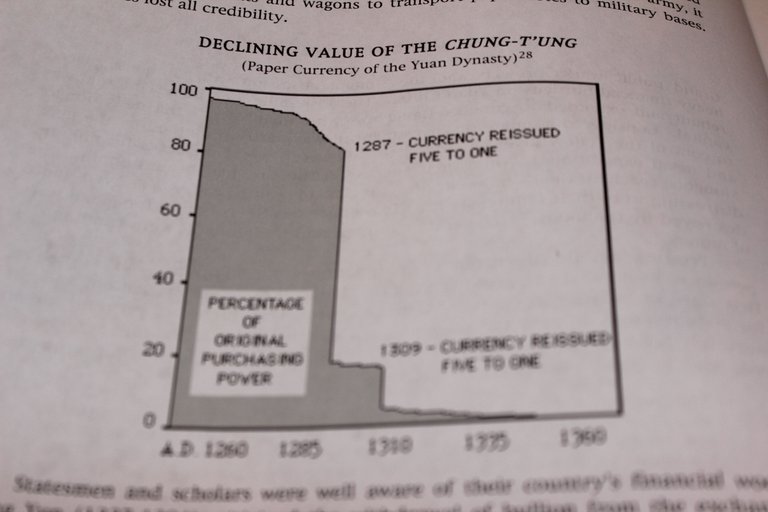

That is why you see the governments now worldwide are getting into deficit spending and an ever accumulating debt expansion. The US, Canada, Greece, Venezuela or anyone else will bankrupt themselves, but they use inflation, the printing of currency to make their debt cheaper. They think that this can be done until eternity and they are right. But history shows that the people that are forced to use the ever-depreciating currency at one point say I don't want your fake paper money anymore.

That is always the defining moment for any currencies existence. That is when the hyperinflation starts as no one will use the fake paper or electronic money anymore. I could list hundreds of failed currencies throughout history, but you only need to look up hyperinflation history to find 100's. I personally have bought many of these to use as educational tools for the population to understand what is coming down the line.

That said let's get back to what I was stating in the headline above. The FED will accumulate all assets.

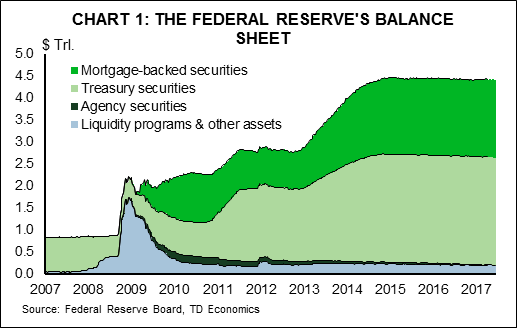

The reason why I am saying this is that the FED needs to constantly be in and manipulate the systems. The bubbles they have created through using debt purchases of US government debt through Quantitative Easing (QE), Operation Twist and other asset purchase systems they have put in place to prop up the system.

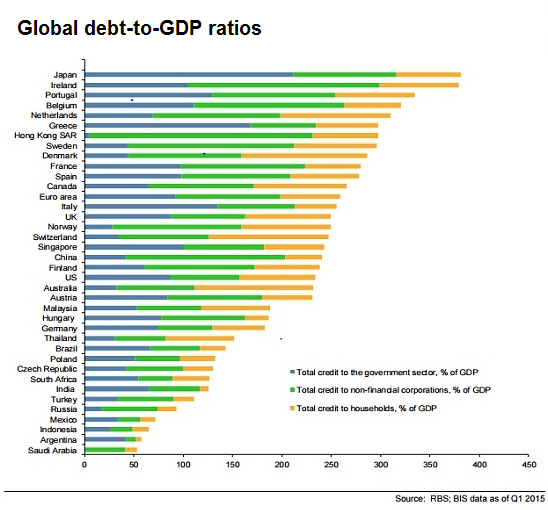

Kenneth Rogoff that I know I pushing a cashless society did some research of how government collapses under debt. Their historical figures came up with the number of 90% Debt to GDP for the collapse of governments. Many governments have above 90% Debt to GDP. The globe is overextended under a whopping debt of 327% to GDP as of June 29th, 2017.

At the point when overextended debt in stock margin debt, private household debt, student loans, government debt, business debt and all other types of debt will revert and start the greater depression one that world has never seen the FED and other central banks will start to buy up all assets they can stocks, bonds, consumer credit. Auto Backed Securities, Credit Default Swaps and all the other derivatives and any other asset that they feel they need to manipulate the value of.

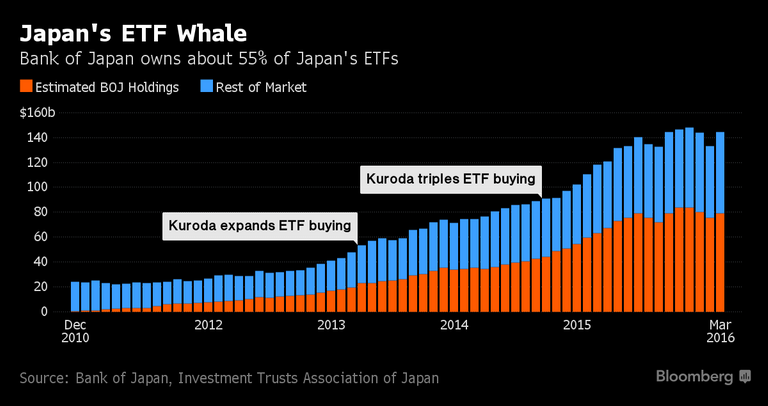

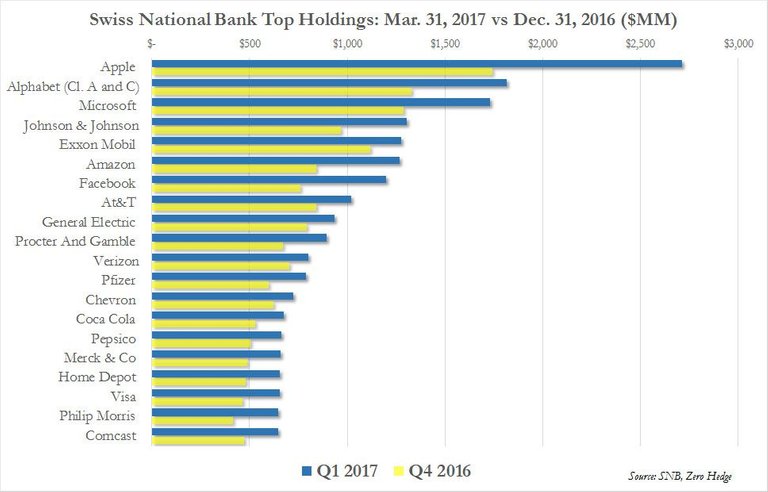

We have seen this already in Switzerland and Japan where the Central banks are buying stocks and ETF's.

You know a system is failing when a central bank that can print money out of thin air is used to buy shares from the stock exchanges. And the funniest is that the FED doesn't even need to buy US stocks as you can see the Swiss National Bank has accumulated mass amounts of the biggest US stocks to prop up the market for the FED without the FED needs to do anything.

Thats what the Central Planners do. They have stated that the system is flawed and needs to be manipulated. That is why not all Central Banks are doing asset purchases like QE all the time. They pass the buck over to the Bank of England, Bank of Japan, European Central Bank and many other major banks.

The Central banks are all currently planning their own demise as it will happen.

Back to their exit strategy that I said they didn't have. They do have one. It is a One world government, one world currency, one world taxation and a cashless society that will completely enslave you as your money that used to be your own property are now the state and the banks.

If you want to know more about the Central Bankers exit plan for the Greater Depression you should read my book the Canada, The Greatest Economy In The World? https://www.amazon.ca/Canada-Greatest-Economy-World-Yourself-ebook/dp/B073V5R72H/ref=zg_bs_5783492011_1?_encoding=UTF8&psc=1&refRID=5Z3Q4DF5E7R9BR1Z8KPN You can find it on Amazon which the Swiss Central Bank is holding in their assets.

It is time to expose the bankers and the globalists. #GIABO as @keiserreport would say.

The failure is near and if we can show the people the playbook they will fail to gain total control.

Shared on twitter. Stephen

Good post, and yes, this is nearly upon us, likely months rather than years. I think the key is this: I have no doubt whatsoever that these criminals have their exit strategies, collectively, and individually. First they want to survive the initial wipeout relatively intact - alive at least, and as rich as possible. Second, they then want to control whatever comes out of this, and keep ruling the roost. We need to think and talk, now, about how to prevent this. Their loot must be removed from them, their actions exposed, and if they are lucky (living in the right place, and not over their heads in paedophilia) they may just get away with spending the rest of their days in our prisons. How we make this happen is our challenge now, for ourselves, and our children. Db