Fantasy Football - Investing or Gambling?

In February of 2014, I was getting off of a plane on a trip to visit my friend Rob in San Diego. I powered up my phone and could barely keep up with the notifications downloading to my text inbox, Facebook messenger, and Facebook notifications. One of the stocks that I had told many friends about had exploded that day. It was a very risky stock that was only $0.003 (yes, a fraction of a penny) when my original investment of $1,300 was made - that should highlight my confidence at the time. Two years of waiting, and it finally would pay off. That day I sold, albeit not all of my shares, but enough to pay off my student loans that had been hanging over my head for 6+ years. What I did wasn't traditional, nor typical. I believed that regardless of the size of the company, you can always minimize your risk by finding out as much as you possibly could about the company or subject. I wanted to do that again but military assignments and deployments cut down on time allotted for the amount of research I liked to do. Couple that with being an analyst by trait, and it was difficult to do analysis all day long then come home and voluntarily do the same. That was until I realized the analytics and potential of fantasy sports; fantasy football in particular.

This is not a pitch to suggest anyone invest the money I did into such a risky penny stock, but to illustrate rather that there’s room for risk in a well-balanced portfolio and therefore room for fantasy football in general. The analogy that I often use is selecting a player in fantasy football. It could be the player everyone picks or that nobody is considering, but that you’ve got knowledge of an increased workload AKA opportunity. Everyone uses the first several rounds of a fantasy football draft to get about as sure-fire players as they can get – these are your safer stocks like Apple, Microsoft, and Amazon. But by the time you get to the last round you’ve selected a few players that you aren’t too confident about but that you hope will pay dividends – these are your pharma, marijuana stocks that maintain varying amounts of speculation.

Every August millions of people prepare to draft a fantasy football team. It’s quite noticeably taken over a large portion of football fans discussion – casual or advanced. These people sign up for an account on one or more sites where they create groups that are typically limited to their friends, family and coworker circles. Once signed up, if they haven’t begun already, the research ensues in hopes of learning more critical information than the others. As a desired result of the research and learning, each individual hopes to draft the best team before the season starts. Barring the legalities of it for the sake of brevity and varying state laws, money is usually put into a pool where the best team at the end of the season wins a majority, if not all, of the pot.

The draft, or initial selection of players, is arguably the most important part of a successful fantasy football season, but it is not the only important part. Throughout the season the research and analysis continues to increase your chances of winning. To believe a player will continue to do well the entire season is common and we will consider that “long”. You can be “long” on a player and therefore unlikely to trade him due to consistent returns on your investment. To believe a player will only do well because of the matchup that week or an injury to another player, we will consider that “short”. You can be short on a player by only playing him one or two weeks and then dropping or trading that player after in hopes of getting a better return on your investment elsewhere. This can usually be accomplished by trading with someone who may not understand that the next few games will be really tough for that player given the matchups. The only reason you know those matchups will be tough is through your in depth research and analysis.

The key to winning in seasonal fantasy football is through knowing when to buy and when to sell a player. Many players go undrafted at the beginning of the season yet end up as significant contributors to a team by the end of the season. Knowing how to identify who those players will be, takes knowledge. Conducting trend analysis on all players can help you spot when a player has been seeing an increased workload, or increased snaps which translate to opportunity. In the 2016 season, Kansas City Chief’s WR Tyreek Hill went undrafted in almost all fantasy football drafts. Around week 5, those who were monitoring the amount of snaps he was participating in, followed by the amount of touches he was getting per snap noticed that both had been increasing. This kind of data, at the very least, would have put Tyreek Hill on your team’s bench (a limited reserve spot that’s weekly performance doesn’t count toward your score). In standard scoring leagues, Hill went on to finish in the top 20 at his position and made those who invested in him very happy.

It’s 2017 and investing in fantasy football is a thing. Wait, investing? That can’t be right. Putting money on a player is like putting money on a horse in a race, and that’s considered gambling, right? Investopedia defines investing as “the act of committing money or capital to an endeavor with the expectation of obtaining an additional income or profit.” (investopedia.com, 2017) Albeit still broad, Investopedia’s definition is still more focused than Merriam-Webster’s that defines the word invest as “to commit (money) in order to earn a financial return”. (Merriam-webster.com, 2017) Both definitions are important because both can be applied to a multitude of things, including fantasy football.

Stocks are an interesting concept. You technically become a part owner of the company you buy stock in. As someone who really enjoys investing (and the analysis that goes with it), I enjoy the idea of owning a part of the company but that never factors into my decision. The end goal for most is appreciation or supplemental income from dividends. That's why it is important, in my opinion, to take emotion out of all investing. Of course, it's important to understand and like the company you're investing in, but that doesn't guarantee that the financials are indicative of future growth. That is why I also believe that buying a stock without understanding the company and their financials should be considered gambling.

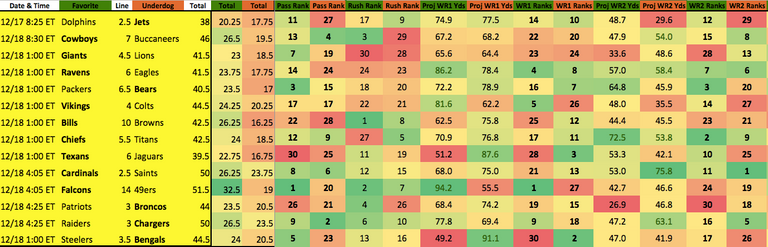

I maintain that doing your own research is the best way to minimize your risk. You can minimize risk with knowledge and that holds true for stocks, fantasy football, and poker. When you play a game where the "house" or nobody can win, than that is gambling in my opinion. This includes things like lottery tickets, vegas over/unders, prop bets, scratch off tickets, etc. In my opinion, anytime someone can consistently win more often than not (>50%) based on their knowledge or skills then it makes sense as to why someone would continue to do that for money. The parallel's between research for stocks and fantasy football are surprisingly evident. There are patterns, trends, projections, value and a degree of randomness in both. I'm not afraid to admit that I've used exponential smoothing in both. I'll finish with a screen capture of just one part of the excel spreadsheet I create and prepare every week when deciding on what players to target and use for daily fantasy football. Of note, green column headers relates to the vegas implied favorite team while orange is the underdog. I post my pics and analysis on Instagram @fanvatic

Sources:

http://www.investopedia.com/terms/i/investing.asp

https://www.merriam-webster.com/dictionary/invest