VS.

VS.

Cryptocurrency lovers around the globe are busy trying to turn their fiat into crypto. In order to

do this, fiat dependents, must use what is called an exchange. There are many exchanges across

the world. Some exchange crypto for other crypto. Some exchange fiat for crypto (and back).

Others do both! Litecoin Pat decided to conduct an experiment with two popular

cryptocurrency exchanges to determine what has the better user experience.

The experiment is between Coinbase (a very popular exchange) and ABRA (an exchange growing in popularity).

There are many other exchanges that exist across the globe but these two are quite popular

(especially in America). Other cryptocurrency exchanges such as Robinhood, GoldMoney, &

Circle Invest were not considered for this experiment. Why? Because those exchanges do not

allow you to send your BTC, LTC, etc. off of the exchange. You are forced to convert back into

fiat to get off the exchange. Crypto lovers what to keep their crypto without converting back

into fiat. Coinbase and ABRA allow you to send your crypto to a private wallet, which is a must

for security.

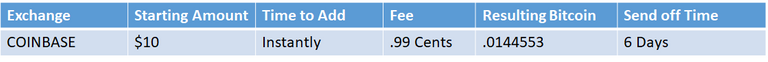

Below you will find the results of exchanging 10 dollars into Bitcoin. *Bitcoin was used instead

of any other altcoin (Litecoin is not an altcoin) for the simplicity of the experiment. Bitcoin was

purchased within a minute of each other. I do not think the spot price of Bitcoin changed within

that minute. The Spot price of BTC at the time was 6,233.01.

Coinbase – What’s nice about Coinbase is that I was able to buy BTC instantly. It appears to pull

from your linked ACH bank account. The purchase amount shows up instantly. You do not have

to transfer USD to your Coinbase USD wallet (although you can). What’s not so nice is that for

10 dollars it charged a .99 cent fee. The fee schedule changes with the amount of crypto you

buy and this experiment is using $10. Additionally, it takes 6 days (a long, long time) to be able

to get your crypto off of the exchange and send it to a personal wallet of your choosing.

That is a long time, and if your purchase is much more (let’s say $10,000) it might make you nervous to

hold your BTC on an exchange that may or may not use fractional reserves to “hold” your BTC.

The resulting Bitcoin from my $10-dollar purchase was .00144553 ($8.96). I should note that there will be a transaction fee when I do send it to my personal wallet. This applies to both Coinbase and ABRA and I am not sure if one will be more or not (my guess is it is the same).

ABRA – In order to purchase on ABRA you have to deposit USD (or other crypto including BTC

and LTC) from your linked ACH bank account. This process took me about 2 days. ABRA appears

to use an “Exchange Spread” in order to garner fees and profitability. The spot price for BTC

was 6,233.01 and the “Buy” price was 6,295.00. This is known as the exchange spread and

many exchanges use this practice. The fee seemed fair and was less than Coinbase. The

resulting BTC amount was .00158848 ($9.85). This amount was more than Coinbase. So ten

dollars turned into more BTC on ABRA than it did on Coinbase. Additionally, it only took the

ABRA exchange 5 hours in order for me to send my BTC off of the exchange. This is a huge

advantage, especially for larger purchases. The only downside was that it did take ABRA a

couple of days to deposit my initial 10 dollars.

There are other ways to purchase crypto on the ABRA exchange as well. For heavier fees they

do allow credit cards (MasterCard and Visa) and for a lesser fee (American Express). There are

limits to these amounts, but I thought I would mention it. As far as I know, Coinbase no longer

allows you to use credit cards to purchase crypto. Coinbase also appears to be more heavily

regulated, this may change in the future.

Conclusion

In my opinion the ABRA exchange was superior. Not only did my initial $10-dollar investment

result in more BTC, it allowed me to send the BTC off of the exchange faster. The buying and

moving experience was just better on the ABRA exchange. Both ABRA and Coinbase allow

purchases of other Cryptocurrency (this is a long list for ABRA and Coinbase), but both restrict

which coins can be sent off of the exchange. As far as I know, ABRA allows the following to be

withdrawn to a private wallet: BTC, LTC, BCH. Coinbase allows: BTC, BCH, ETH, ETC, LTC, ZRX

(not sure what this is), BAT (Basic Attention Token), and USDC (I think this is a stable coin).

It’s very important to send your crypto to a wallet where you hold the private keys. Without

being able to send the crypto off the exchange creates a certain amount of risk. The exchange

could collapse depending on what practices they use. ABRA allows you to send off quite quickly,

so I see that as an advantage. Things can change (for better or worse) but as of right now, I

believe that ABRA is the clear winner when buying crypto.

LITECOIN PAT

I'm sorry about the upload quality. It looks fine on my phone, but not on my desktop computer. It also looks better on Twitter.

Congratulations @mcdermpt! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board of Honor

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard: