What is an Exchange of Cryptocurrencies?

A cryptocurrency exchange platform is a website where you can buy, sell or exchange cryptocurrencies for another digital currency or fiduciary money (USD, EUR, etc.). Depending on the exchange, they can operate as a stock exchange or as a currency exchange house.

In general, there are the following types of exchanges:

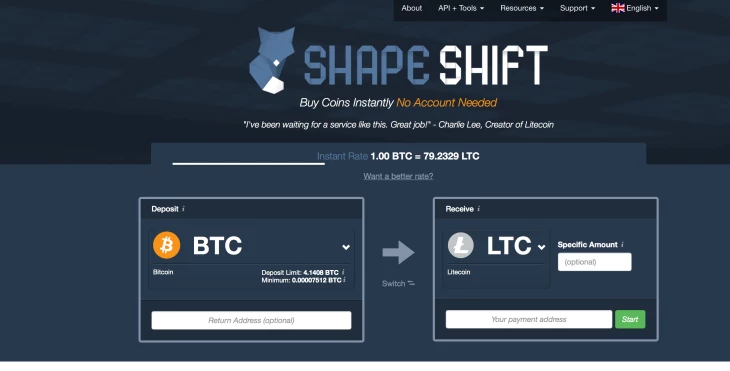

"Traditional" cryptocurrency exchanges:

these are exchanges that are like traditional stock exchanges where buyers and sellers trade based on the current market price of cryptocurrencies (with the exchange playing the role of intermediary). This type of trading platform usually takes a fee from each transaction. Some of these exchange types also allow users to convert fiduciary currency (such as the dollar) into cryptocurrencies such as Bitcoin at the market price. GDAX (subsidiary of Coinbase) is an example of this type of exchange, like Kraken. Shapeshift provides a similar service at no cost.

Direct trading exchanges:

these platforms offer direct trade between buyers and sellers. Direct trading exchanges do not use a fixed market price. The sellers establish their own exchange rate.

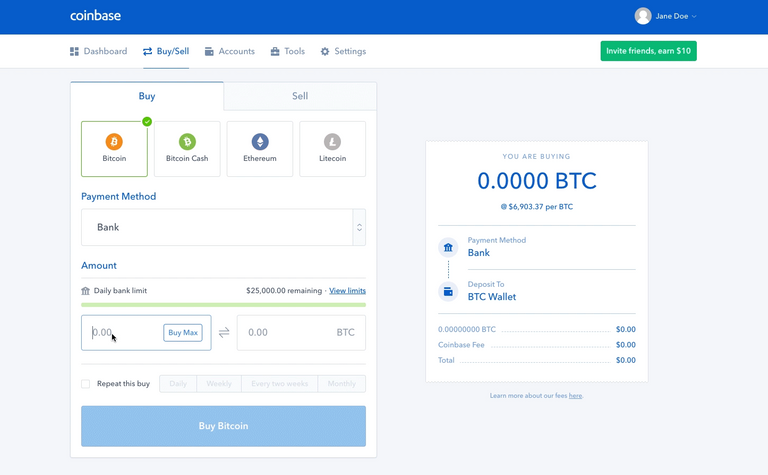

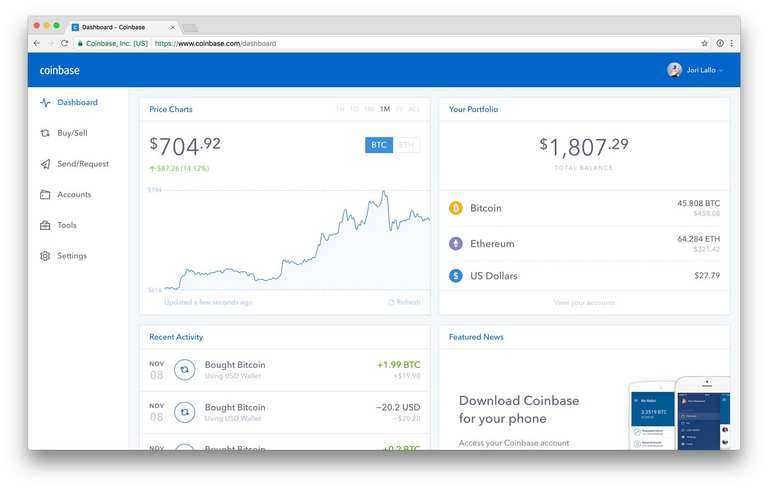

Cryptocurrency brokers (Brokers):

these are exchanges based on websites that operate like currency exchange bureaus. They allow customers to buy and sell cryptocurrencies at a price set by the intermediary (usually at the market price plus a small premium). Coinbase is an example of this type of exchange.

It is also advisable to opt for a secure trading platform that has robust security measures. Desirable security features include two-factor authentication, alerts by SMS or email, encrypted emails and wallet monitoring. A smartphone application can also be very useful in terms of access and monitoring of funds.

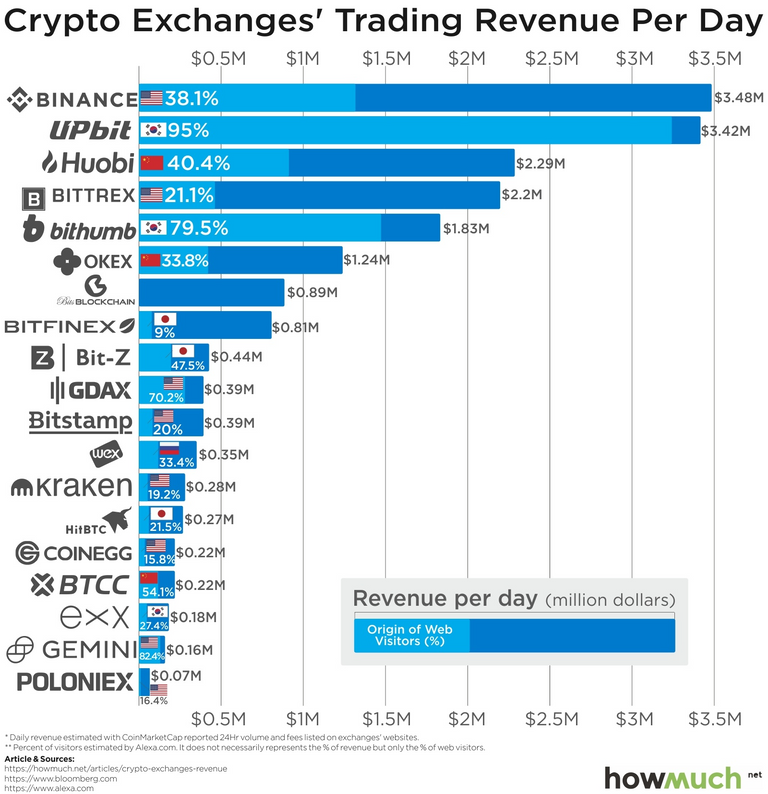

Finally, look for an exchange site that is making a good trading volume, in other words, one with a high number of trading pairs and high liquidity.

Now that we know the characteristics that we should look for in the best exchanges for cryptocurrency trading, let's continue to choose our favorites in particular.

- Binance

Binance is one of the newest exchanges in the industry. The Hong Kong-based company raised about $ 15 million in an ICO in July (2017) and immediately acquired 20,000 registered users as part of the collection. Changpeng Zhao, CEO of Binance, has an impressive resume with years of experience in cryptocurrencies. He was Director of Development at Blockchain, Cofounder and Director of Technology at OKCoin, and Founder and CEO of BijieTech before working at Binance. From its ICO to date, Binance has grown enormously and is now in the top 10 cryptocurrency exchanges in the world. Currently it has more than 140 altcoins listed on it, and the number increases as the days go by.

Binance's tariff structure is unique. For starters, they have a 0.1% standard trading rate, which is already quite lower than other pairs. If you pay using your own token (BNB), you currently receive a 50% discount on the negotiation rate, which drops to 0.05%. With this discount, Binance easily has the lowest rates in the industry.

Official site: https://www.binance.com/

Active markets: https://coinmarketcap.com/en/exchanges/binance/

- Bibox

Created in 2017 and based in Hong Kong, the Bibox stock exchange is one of the most advanced trading platforms in cryptocurrencies. It has a team with extensive experience from the exchanges of OKCoin and Huobi. The platform uses artificial intelligence (AI) technology to optimize transactions. The website has a basic mode and a full screen mode suitable for experienced and advanced operators.

Bibox Exchange lists several (more than 200) pairs of operations in cryptocurrencies but no pair of transactions with fiat money. The currencies include Bitcoin (BTC), Ethereum (ETH), Neo (NEO), EOS (EOS), Tether (USDT), and Dai (DAI), a stable currency with the value of one US dollar as Tether, but decentralized and in the chain of blocks of ethereum.

Deposits on the Bibox platform are free, while the withdrawal fee is 1 percent per transaction. Trading fees are set at 0.1 percent, while operators get discounts when they use the native Bibox token (BIX token holders receive 20% of the profits from the stock exchange, and also receive discounts on the trading commissions, similar to those of Binance). Its 24-hour trading volume is currently 170 million dollars, according to CoinMarketCap.

Bibox uses a ticket system by email that, according to users, is fast and efficient. The website is quite sophisticated and uses standard security features, including SSL encryption and 2-factor authentication. The exchange uses a cold wallet off line to store most of its funds.

Official site: https://www.bibox.com/

Active markets: https://coinmarketcap.com/en/exchanges/bibox/

- OKEx

OKEX is an exchange of digital assets, owned by OKCoin. The situation with the two is similar to the way in which GDAX is owned by Coinbase: one brand is aimed at retail consumers, while the other is dedicated to professional operators. The company behind both projects is based in China.

The most interesting aspect of OKEX is the independent desktop platform it offers, and the availability of Bitcoin and Litecoin futures contracts.

Rates at OKEX are probably the lowest in the industry at the time of writing this revision. There is a 0.03% charge for opening a new position and nothing is charged for the closing transaction. This is much better than the average of around 0.20-0.25%, offered by most other exchanges.

OKEX is one of the few exchanges that offers a separate desktop platform. While you may be used to browser-based negotiation, there are several advantages to using the software separately, such as multiple monitor support, visualization improvements, and better overall performance.

OKEX is directly related to OKCoin, so you can make a Yuan transfer to the latter and operate in a more sophisticated exchange. In addition, digital currency transfers are accepted, such as BTC, ETH and LTC.

Official site: https://www.okex.com/

Active markets: https://coinmarketcap.com/en/exchanges/okex/

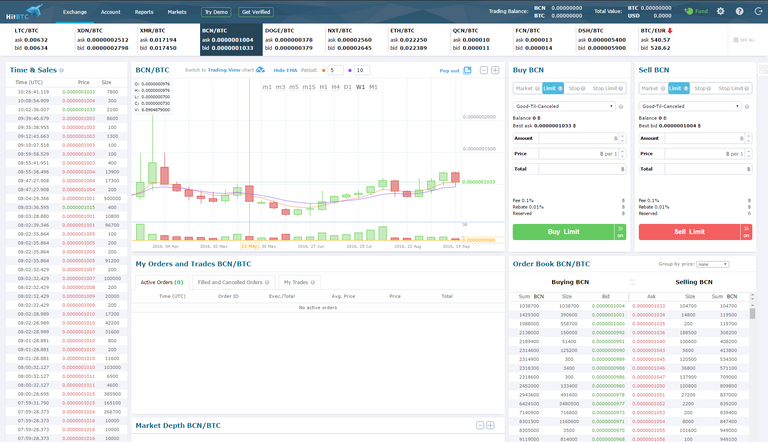

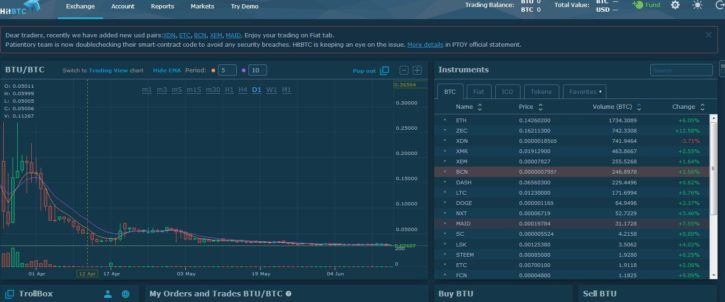

- HitBTC

HitBTC is a European-based cryptocurrency exchange launched in 2013. It is operated by Hit Techs Limited, based in London. HitBTC offers more than 150 trading pairs, including many recently added tokens and ICOs. It considers itself to be the "most advanced cryptocurrency exchange", and offers features such as a reimbursement system for market makers and an advanced match algorithm.

Users can not trade in fiat currency or connect a bank account, but can buy bitcoin on the platform using a credit card.

The platform has low rates and does not require a verified account to perform basic transactions. HitBTC is one of the largest Exchanges by volume of trade, with a daily volume of more than 700 million USD.

In early 2015, HitBTC was pirated almost at the same time as BTER and Excoin. HitBTC did not disclose how many coins were stolen and commented that user funds were not affected. While users have not complained about that particular event, there are some negative comments available on the forums. The problems reported range from a slow verification procedure, to "lost" coins, and the impossibility of withdrawing funds. In addition to that, there are claims that the Bitcoin volume in this exchange is artificially increased.

There are more than 150 digital assets available in HitBTC. Most of them are traded in exchange for Bitcoin and Ethereum.

Official site: https://hitbtc.com/

Active markets: https://coinmarketcap.com/en/exchanges/hitbtc/

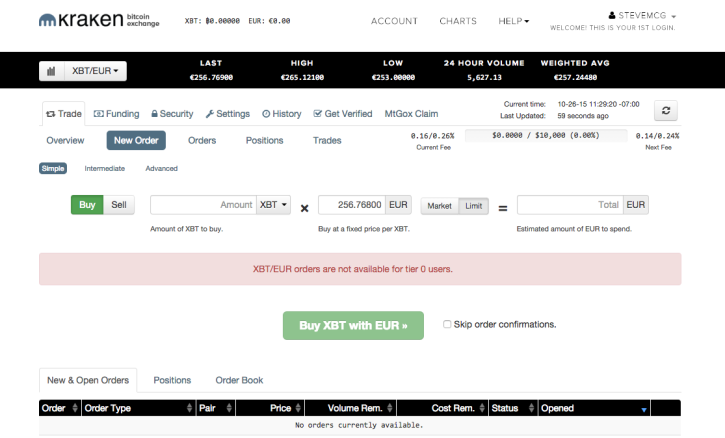

- Kraken

Founded in 2011, Kraken is the largest Bitcoin exchange in volume and liquidity in euros and is a partner in the first cryptocurrency bank. Kraken allows you to buy and sell bitcoins and trade between bitcoins and euros, US dollars, Canadian dollars, pounds sterling and Japanese yen. It is also possible to exchange digital currencies other than Bitcoin such as Ethereum, Monero, Ethereum Classic, Augur REP tokens, ICONOMI, Zcash, Litecoin, Dogecoin, Ripple and Stellar / Lumens.

Kraken is the favorite Bitcoin Exchange for many professional operators. They provide all the tools and reliability necessary to make expert decisions about the cryptocurrency exchange. They offer a high security environment with reliable cold storage, legal compliance and advanced types of orders, such as stop-loss orders.

Official site: https://www.kraken.com/

Active markets: https://coinmarketcap.com/en/exchanges/kraken/

- Huobi

Huobi is one of the largest Chinese exchange platforms. It is based in Beijing, China. The trading platform was founded by Leon Li in September 2013, and the company focuses on the Chinese market.

Huobi is an exchange of cryptocurrencies with a great focus on Southeast Asian markets. The company used to be even more specific, aimed mainly at Chinese customers, but since the ban on exchanges in the country, they have re-registered in the Seychelles. Although the company has reduced much of its functionality, due to regulatory pressure, they still have a solid volume of operations.

The new platform, Huobi Pro, is an exchange of cryptocurrencies with service centers in Beijing, Chengdu, Hong Kong, Seoul, Shenzhen, Singapore and Tokyo. It allows users to exchange different cryptocurrencies in exchange for Bitcoin, Ethereum, and the USDT token. Huobi Pro introduces an advanced distributed system architecture built to protect against DDoS attacks and other potential threats. Huobi is available for iOS and Android.

Huobi's trading platform seems to be one of the best in the cryptocurrency space, from the perspective of an operator. The graphics are provided by TradingView, which is always a solid option. The rest of the platform is also aligned in an intuitive way.

The marketing costs in Huobi are currently at 0.20% of the total value of the transaction, a flat and relatively fair rate.

Official site: https://www.hbg.com/

Active markets: https://coinmarketcap.com/en/exchanges/huobi/

- Bittrex

Bittrex is a regulated stock exchange based in the USA. UU which offers the trading of many established cryptocurrencies and tokens, as well as emerging currencies. In fact, they admit more than 190 cryptocurrencies to date. They also perform compliance audits on new cryptocurrencies, so that operators can be sure they are operating safely and legally.

The exchange was launched at the beginning of 2014. As a company based in the USA. UU., Bittrex has declared its commitment to follow all laws and regulations required by US government agencies. Poloniex is Bittrex's biggest rival. Both exchanges currently offer a wide variety of BTC, ETH and USDT trading pairs.

They offer quick transactions and great stability, so many experienced investors frequent this exchange.

Official site: https://bittrex.com/´

Active markets: https://coinmarketcap.com/en/exchanges/bittrex/

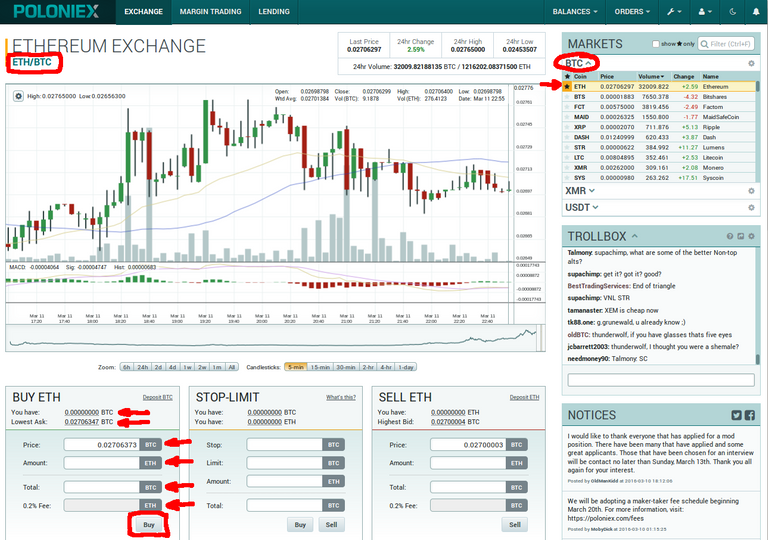

- Poloniex

It is impossible to analyze the commercial altcoins and not use the Poloniex exchange these days. Although Poloniex does not list all the existing altcoins, it does include the ones with the highest circulation and therefore they are the main exchange when it comes to trading with alternative cryptocurrencies. Poloniex was also one of the first platforms to support the Ethereum Classic after the Ethereum fork.

Among the main currencies listed in Poloniex are Monero, Ethereum Classic, Ripple, Litecoin, Factom and Maidsafe, to name a few. The platform generates a large amount of Bitcoin trading volume every day. In addition, some of the "main altcoins" even reach Poloniex's loan and trading margin markets, allowing them to gain even more exposure over time.

Official site: https://poloniex.com/

Active markets: https://coinmarketcap.com/en/exchanges/poloniex/

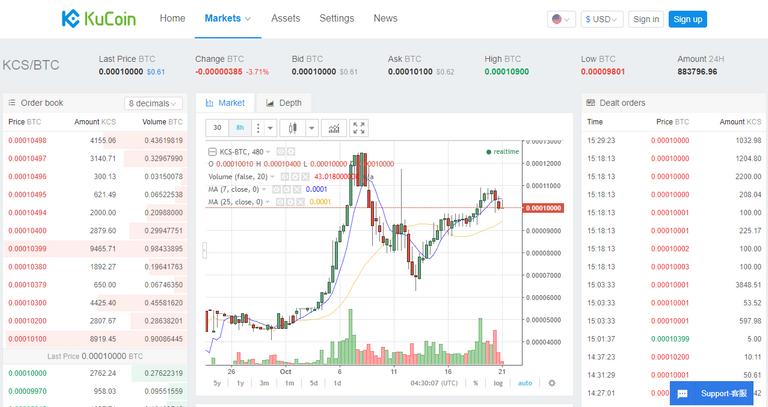

- Kucoin

Kucoin is one of the many cryptocurrency exchanges available to those in search of a modern and secure platform to trade between cryptocurrencies. It was founded by a team of experts who had already earned a reputation in giants of the industry, such as GF Securities, Ant Financial, Youling, Jianbang Communication and iBOX PAY. Kucoin aims to provide users with a secure and direct method to trade their currencies within a cutting-edge platform. The platform has its own tokens, called KuCoin Shares (KCS), similar to Binance. It was officially launched on September 15, 2017.

In general, KuCoin aims to be a more user-friendly exchange than the traditional exchanges available today. The platform shares 90% of the negotiation fees with users. They also offer painstaking customer service and generous referral rewards. Kucoin aims to always offer very low rates, both for trade and withdrawals, which makes it affordable to use this exchange. You do not have to pay to make a deposit, and marketing fees are only 0.1 percent, depending on the asset you buy.

With the competitive rates of negotiation and withdrawal, and the lack of fees for a deposit, Kucoin seems ready to leave its mark as a leader in the exchange of cryptocurrencies. Incentives, like the invitation bonus, should only help expand the platform.

Official site: https://www.kucoin.com/

Active markets: https://coinmarketcap.com/exchanges/kucoin/

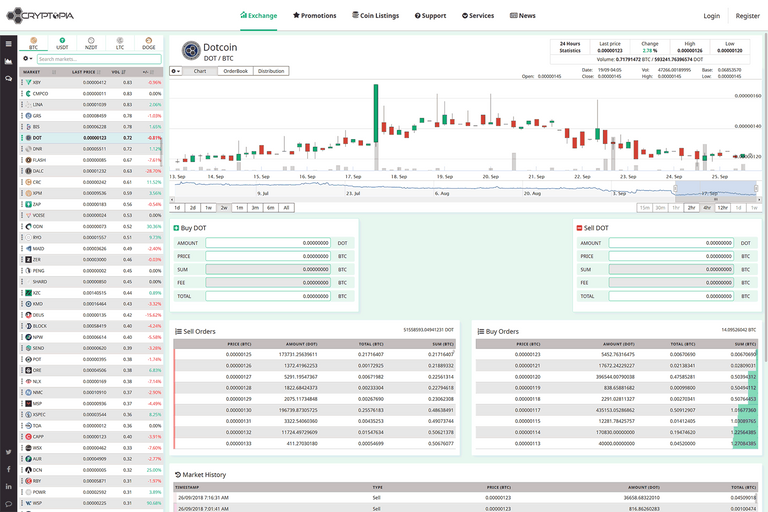

- Cryptopia

Cryptopia was founded in 2014, with the aim of being a comprehensive exchange that focuses on the user experience, with the integration of additional services, including a market and a wallet. It is headquartered in Christchurch, New Zealand. Cryptopia is remarkable because the first level of verification happens very fast and only requires an email address for initial verification.

While Cryptopia is not compatible with fiduciary money trading, it does admit a ridiculously large number of cryptocurrencies: more than 400 to date, with more being added all the time. The trading rate is also a low 0.20% per transaction, which compares favorably with many competitors. The website is quite extensive and extensive, which means that new users may find themselves a bit disoriented with their first experience operating through this site.

Official site: https://www.cryptopia.co.nz/

Active markets: https://coinmarketcap.com/exchanges/cryptopia/