During Ethereum’s big rally last month, when the price of a single coin went from $220 to just shy of $400 in the span of two weeks, one trader turned $55 million of paper wealth into more than $398 million. And nobody knows who they are, or – more importantly – who to tax.

As Bloomberg so astutely observes, the growing number of wealthy crypto investors is starting to infuriate regulators, who are now calling for more transparency in the cryptocurrency market. Specifically, they’re arguing that it’s time for cryptocurrency wallets to include information that might help identify users. Otherwise - they say - the continued association with criminality – cemented by the Dread Pirate Roberts’s life sentence – could start to impact the crypto-asset market which now has an aggregate valuation approaching McDonald’s Corp.

Others, like the purported owner of Ethereum wallet 0x00A651D43B6e209F5Ada45A35F92EFC0De3A5184, which holds 680,000 ether tokens, worth about $150 million at present prices but nearly twice that when ether was trading at its mid-June highs, have a different definition of transparency. Some one alleging to be the accounts owner penned an instagram post bragging about their gains in the middle of ether's June rally.

“I get many private messages asking how much ether I have,” the post read, alongside photos that purported to be the hardware powering a mining operation but looked lifted from another website.

“One of the cool things about Ethereum is that all wallets around the world are transparent and open for everyone to see. And this is my wallet’s savings.”

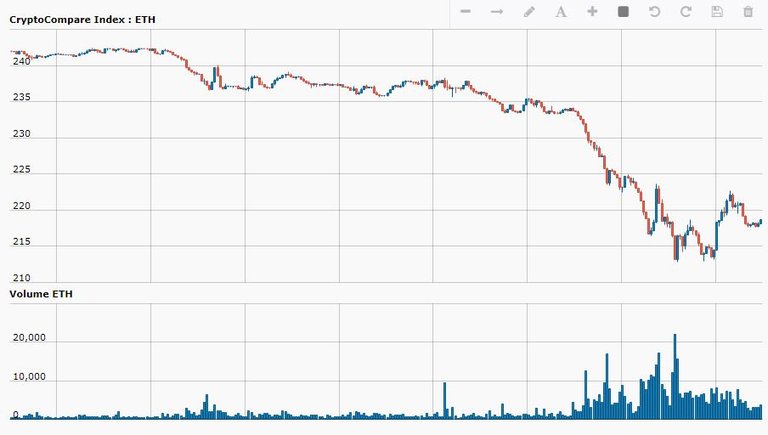

That trader is probably not in such high spirits today, with ethereum down 8% in recent trade:

While bitcoin’s popularity has been, in part, contingent on these privacy features, regulators see them as a threat that can aid tax cheats and criminals. Here’s Bloomberg, making the regulators’ case for them:

“That’s not to say that 0x00A651D43B6e209F5Ada45A35F92EFC0De3A5184 or any other entities are doing anything illegal. But opacity may be worsening jagged price movements. The value of ether, for example, rose from about $8 a unit at the start of the year to crest at $400 in June before settling around $250 today. A lack of transparency could also be stifling the mainstreaming of online money, according to draft legislation issued by the European Parliament in March.

“The credibility of virtual currencies will not rise if they are used for criminal purposes,” the draft said. “In this context, anonymity will become more a hindrance than an asset for virtual currencies” and their potential future popularity.”

It's no wonder reguators are becoming more interested in identifying owners of crypto assets: Thanks to the explosive rallies in cryptocurrencies this year, the ranks of the crypto millionaires are growing.

“The current value of all the ether held, $23 billion, means dozens of electronic wallets have accrued nine-figure positions. Many of them could be held by individuals, according to a Bloomberg analysis. Individuals can hold multiple wallets.”

Furthermore, it’s likely that the first crypto billionaires have been minted by now: Candidates include hedge fund manager Michael Novogratz, Joseph Lubin, founder of ConsenSys, a blockchain production studio that works on Ethereum, and Ethereum creator [Vitalik] Buterin.

“Novogratz, a former executive at Fortress Investment Group and Goldman Sachs Group Inc., has a long way to go, but he’s been a consistent booster. He said last month that he has 10 percent of his net worth invested in virtual money. That’s a stake worth at least $90 million, given a net worth calculated at $925 million, according to the Bloomberg Billionaires Index. Novogratz declined to comment.

Cryptocurrencies could become a $5 trillion industry, but they need to develop sound business principles to satisfy regulators and lend legitimacy, Novogratz said June 27 at a fintech conference in New York.Lubin, the former chief operating officer for Ethereum Switzerland GmbH, which developed the software, could hold hundreds of millions of dollars’ worth of ether, several investors said. The Canadian entrepreneur didn’t respond to requests for comment on his holdings.

‘The long-range vision is moving the fundamental transactional elements of our society from analog, friction-filled systems to natively digital frictionless systems,’ Lubin told Bloomberg Radio June 21. Buterin said in a Reddit post last month his ether holdings equal what would amount to about $117 million today, according to calculations by Bloomberg.”

Regulators’ push to unmask holders of bitcoin and Ethereum will likely succeed, but ironically, they could end up destroying – or at the very least damaging – the very assets they seek to tax: Outing users of one crypto asset will just boost demand for coins with enhanced privacy features like monero and zcash.

What then? I guess the authorities will just need to start over.

Source : ZeroHedge

For only the best of ZeroHedge and articles relating to Steem, Follow me @Zer0Hedge

People are so confused about how to tax/regulate cryptocurrencies and it's kind of hilarious. I'm just praying that the UK (my country) declares it as a currency soon and therefore won't tax it

Just to add, that account could belong to group of people and not just 1 person!

This is more than likely the case, but if it does only belong to one person....i would like to officially ask them publicly, if they would like to adopt me =)

And the tax offices will continue to push the "this is criminal" argument until they figure out a way to turn this into an advantage for them. Who will set the tone? As I think a lot will follow when a precedent is set somewhere in the world. Very interesting, I might do a blog post soon on my thoughts how this can be best done, even if it is just to structure my thoughts on it! (because they are not too structured yet haha)

awwww...too bad...so sad.

they can't steal from...

er.

I mean they can't tax him.

You speak the truth sir.

Buterin denies being a billionaire yet, for what it is worth.

This is a tricky subject. I completely understand why people would want to protect money from the government - especially the crypto community, with such strong ties to the anarchist and libertarian movements. Yet, the truth be told, cryptocurrency is not going to suddenly make tax evasion legal or easy. If anything, this is a terrible way to try and avoid taxes - as soon as the wallet can be connected to a person, they are in HUGE SHIT if they haven't been paying taxes.

I'm a fairly average dude, not really trying to overthrow the government, so I'll be paying all my taxes without any extra pestering from the gov. Just gonna pay it up front and sleep easier at night.

I'm sure you're right and it's just a matter of time before they do establish regulators for them.

Wonder if they may draw a line in the sand and then set new tax regulations?

It's really hard to understand the amount of money made from cryptocurrencies. Anyhow, I'm sure you're right and it's just a matter of time before they do establish regulators for them. And as you further say, probably destroy that coin(s). This may push new coins to the market or better privacy technologies. Who knows.

Shouldn't it only be taxed when the guy turns it into cash? I don't think the government would give him a refund next year if ETH drops to $2 and he's still holding.

If you sell after holding for a year or more it's taxed at captial gains rate up to 20% if you have losses in capital assets you subtract you losses from any gains as a deduction.

The IRS has already stated crypto is to be taxed with ca pital gains. I'm not for paying taxes, but anyone who thinks you can outright the gubmint is living a delusion, esp if you're posting on instagram. All that stuff is tracked. They don't call it the "world wide web" for no reason. Just pay the 30% and go on wiht your life.

https://steemit.com/mysterium/@biddle/mysterium-is-mysterious-and-potentially-extremely-lucrative

I saw this segment on Blumble-berg today too. I was laughing so hard because it's like they're just jealous. Their central banks are failing now, they know it's only a matter of time. Then they say "Waaaa! You guys doin bad stuff wit dat crypto!" As if only non-criminals use dollars.

Right, like when the US Govt flew a plane full of cash to IRAN ... I believe it was part of a $1.7 BILLION settlement!

I think the get rich off crypto phase might be quickly followed by money not needing to exist at all and everyone being wealthy!!!!!

Good post. Doesnt DASH have features as well?

I Strongly do not support Regulations for Crypto trading...we are all in this cos of the liberty of owning and enjoying your money without Regulations

Ohhh you have no idea what I will do with such money. I better start making plans now because I'm next in line.

Good Job !

Although the transaction was part of a blockchain, that does not make it illegal. Neither does it make any investment in crypto a way to finance illegal activities. What if you wanted to crowd fund a technology - isn't that what this is? It is not intended to fund Sheikh Yuk-a-Puk. As for the gain escaping taxation - isn't that yet to be seen? Good grief, who knows whether they made estimated tax payments or not? Finally, if there are tax consequences, the owner/s may decide that $400 million is enough to live comfortably in a tropical paradise with no extradition treaty... just saying... There are a lot of issues; no resolution will be easy. The SEC is trying desperately to stop ICOs and call them "securities", the IRS wants to tax people making gains and nobody can agree on how to handle this political football - even if they could find out who actually makes gains ... We live in interesting times.

This issue is so much more complex than most people give it credit for. The IRS worked forever to unlock the US owners of Swiss bank accounts and had to threaten to throw the Swiss out of the SWIFT system to even get that done. Yeah, and they're going to get a crypto exchange based in China to give up their data? I just have no idea how this is going to play out.

Bing a CPA myself, I'm just happy to not have any clients that are into cryptos - YET! Whatever advice I would give them would surely prove to be short sighted.

The world, it is a changin'

Lmfao this guy said the blackmarket will make the price go down ahahahah what a fool, ever heard of the deep web and the amount of people on it. Without considering the fact that, sadly, bitcoin offers a "legal" way out for fraudulent cash..

The regulators don't understand that regulating cryptos is a losing battle. The very creation of cryptos was to escape the banking system that is a cancer on this world. They just want their cut.

OH! If ONLY Andrew Jackson were here today to see this amazing coming destruction of the world banking system and its futile attempts at survival. He could only dream of a scenario where the banks could no longer control the wealth of families and regular people.

"I killed the bank"

-Andrew Jackson

Very well written article! Thanks for that zer0hedge.

One way or the other our goverments will have to interact with this new money, if they don't want be run over by the eastern hemisphere.

I hope they start sooner then later...

Who need Bloomberg's approval? lol

Legitimacy? Yeah Right!