The first successful test of the Ethereum-based solution was implemented in January in the Sindh province of Pakistan. Nearly 100 people received around 3,000 rupees that were used for food via transaction authenticated on the Ethereum’s test net.

After successfully using the Ethereum blockchain to transfer Pakistani rupees to 100 people in 2017, the UN’s World Food Program is starting to arrange extra security to ensure it can safely execute the next stages of its work. A “test” is scheduled to begin in Jordan on May 1st, 2017, we will see the World Food Program sending a number of diners to more than 10,000 citizens in need of financial support and extra food. The goal for WFP is to expand the number of recipients to half a million citizens by 2018.

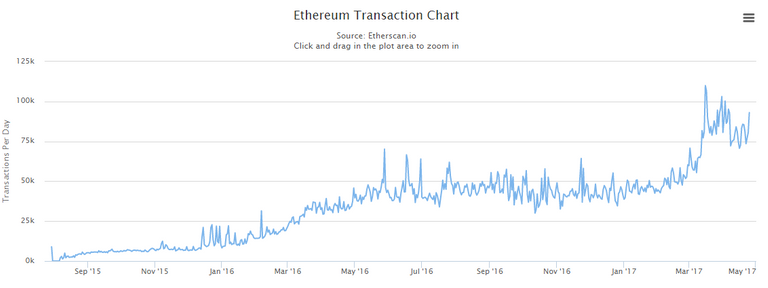

We are seeing about 100,000 transactions a day in the Ethereum network. With organisations like WFP starting to explore the potential use of the Ethereum network, we will start seeing this trend continue to increase exponentially. As the World’s Food Program is wanting to expand its yearly budget from $600m to $2bn a year. If the WFP tests work as expected, we could see a lot of transactions coming into the Ethereum from organisations like WFP and others that will follow its trend.

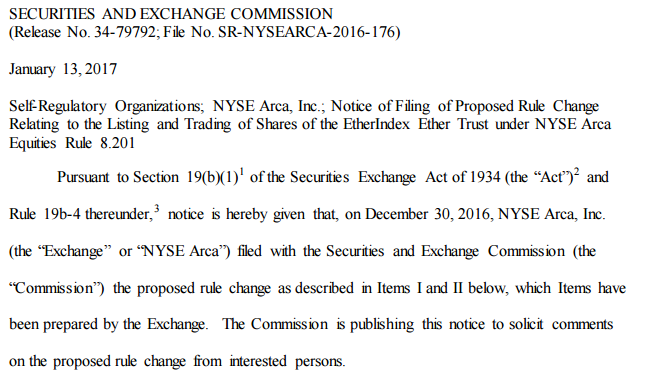

Ether ETF Proposal to SEC

In July 2016, the backers of the EtherIndex Ether Trust was filed, seeking to launch an ETF backed by a cache of ethers on the NYSE Arca exchange. The NYSE Arca then proposed a rule change clearing the way for the ETF listing in December, according to a notice published in January 2017.

Recently SEC posted a new notice which underlines that the agency has begun weighing whether it will approve or disprove the proposed ETF — which the agency remarked in the notice:

"The Commission is instituting proceedings pursuant to Section 19(b)(2)(B) of the Act11 to determine whether the proposed rule change should be approved or disapproved. Institution of such proceedings is appropriate at this time in view of the legal and policy issues raised by the proposed rule change. Institution of proceedings does not indicate that the Commission has reached any conclusions with respect to any of the issues involved. Rather, as described below, the Commission seeks and encourages interested persons to provide comments on the proposed rule change."

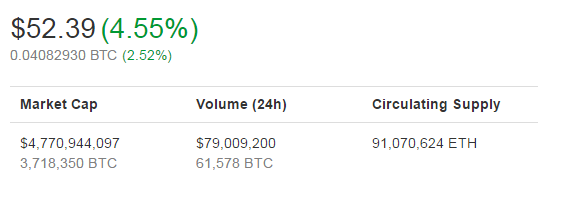

With the possibilities of a potential Ether ETF launch (subject not approved) would market the latest developments in the ether’s market, following the recent price increase that have seen the value of 1 ETH rise above $50, currently at $52.

Is Ethereum a Buy?

At the end of the day when we look at all of the variables of risk and rewards of the Ethereum market. We can agree that the market is currently inflating in volume, value and total market capital as the rest of the world starts to accept Ethereum as a solution to famine and poverty in countries like Jordan & Pakistan as previously mentioned.

Ethereum’s success and growth will continue to increase throughout the year, it has already demonstrated the possible growth and sustainability in the blockchain ecosystem. While Bitcoin is sitting at $20.1bn market capital with a price of $1283 — Ethereum is sustaining a solid $4.7bn total market which comes to 23.38% of Bitcoins current market capital. I think Ethereum has a lot of potential to reach $100 for 1 ETH by the end of 2017.

@heiditravels thoughts? :)

You seem to know a lot about the ecosystem, would love some criticism. @crypt0