Buyer beware.

Full credit to hacked.com, but I wanted to add it here to spread the word:

https://hacked.com/ico-analysis-ethereum-link/

Ever wanted a currency “backed” by traditional wealth, such as gold and silver? Sure, haven’t we all? In this answer lies the motivation for any cryptocurrency that involves gold, silver, or other precious metals: people associate gold and silver with “real” wealth and this sort of frequency noise makes it easier to gloss over any other problems with the offering.

In Ethereum.LINK, we have a lot of off-the-top, too-obvious red flags, but before we run through them, let’s talk about what Ethereum.LINK is supposed to be.

From the whitepaper:

Ethereum.link is a growing platform connecting traditional markets and businesses with last technology and new generation crypto currency, smart contracts and the big spectrum of tools Ethereum platform has to offer, we aim to exponentially increase Ethereum integration into small and medium businesses.

This doesn’t tell us anything at all. The 9 page whitepaper spends most of its time explaining the on-boarding and trading of silver-based assets on the Ethereum blockchain thanks to the help of Ethereum.link. A few paragraphs later, the anonymous authors tell us:

Ethereum.link is the link between crypto-currency and international silver market, it is projected to grow into a large and decentralized platform for digital silver certificates trading.

Projected by whom, Anonymous Author?

The real purpose of Ethereum.LINK, to be damning in honesty, seems to be to attract traditional investors who have recently heard buzzwords like “Ethereum.” They almost say as much here:

[…] second is to be the first choice among traditional investors used to make a low risk investment while at the same they are trying the Ethereum protocol.

The Problem with “Proof of Ownership”

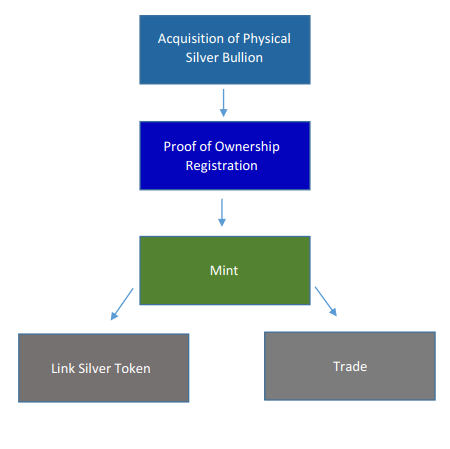

For its part, Ethereum.LINK provides the following diagram for how LNKS tokens will be traded:

But is “proof of ownership” even actually possible? This is something that’s been considered a long time in the cryptocurrency community, and was recently brought back to this author’s attention with the OneGram[] ordeal. To prove ownership, one needs to be holding/using the thing in question. Due to the pseudonymity of the blockchain, the only actual way to identify someone (private key) also gives you the opportunity to sweep all their funds. The ability to provide the matching private key is a way to prove that you own the contents of a given encrypted piece of data, sure, and there have been numerous methods employed over the years in an effort to achieve this. One method people have thought of is first spending the funds from an address to another, providing the private key for that one afterward, and claiming ownership of the new one.

But Ethereum.LINK does not illustrate Proof of Ownership as a technical problem to solve, nor does it do much to address it. Instead, it puts it up as something the platform is already technically capable of achieving and then adds it in as part of the process for trading silver on Ethereum.

How can you prove that you own any silver purchased by Ethereum.LINK? What evidence, really, do your blockchain receipts mean to the authorities? How can Ethereum.LINK prove that your silver is in safe keeping? No amount of cameras, documents, shipping receipts, weights and measures, and the like, can actually prove the existence or ownership of a given object – only within reason. The question with Ethereum.LINK then becomes, regardless of the unliklihood of their claims, will enough people see that the silver exists within reason, and not down-trade the token as a result?

Issuance Done Right

For all the negativity so far and still to come, it’s worth noting in bold letters that the way that Ethereum.LINK is issuing LNKS tokens, regardless of their actual value or the value of this project as a whole, is exactly the right approach to issuance. We saw Tezos do the same recently, where the actual issuance of coins is in relation to the demand of the market. According to Ethereum.LINK:

For every Card that is sent to the Minter Smart Contract, $LNKS Silver tokens will be issued in return. For instance, a 100g Silver Card sent to the Minter Smart Contract returns 100 $LNKS Silver tokens to the user.

The Minter Smart Contract is the one that will allow them to actually generate tokens. Without a full review, it itself is suspect, but assuming it operates as intended, then this is a clean and safe way to insure against undue inflation in the economy. None of these statements should be misconstrued as a belief that there will be any sort of Ethereum.LINK economy, because there will not be.

The Team

This information is not immediately evident anywhere on the website, although there are links that are supposed to make it plain. Completely anonymous teams in this stage of cryptocurrency require real, lasting, and network-effect-inducing novelty and innovation in order to be taken seriously anymore – and we’re not seeing any of that here. Instead what we have here is an at-best half-baked notion of moving silver over Ether with few if any actual, concrete details on how that will be achieved.

This lack of public face to blame mistakes on when they inevitably occur amounts to a dock of a full 5 points from their potential 10 point score. Some hasty fix of this issue would only get it back a maximum of two points, due to all the other problems.

The Verdict

If Ethereum.LINK is not an obvious scam, it’s a less-obvious one. If it’s not a scam at all, Ethereum.LINK is a project which has not found its team yet – supposing its intended purpose is even truly possible.

There are a lot – an awful lot – of security measures that go into place when transacting in precious metals. In fact, one of the reasons we use paper money and digital currencies is to avoid these problems. To make it truly profitable to steward silver on a large scale, and allow for silver assets to be traded, is a mammoth task.

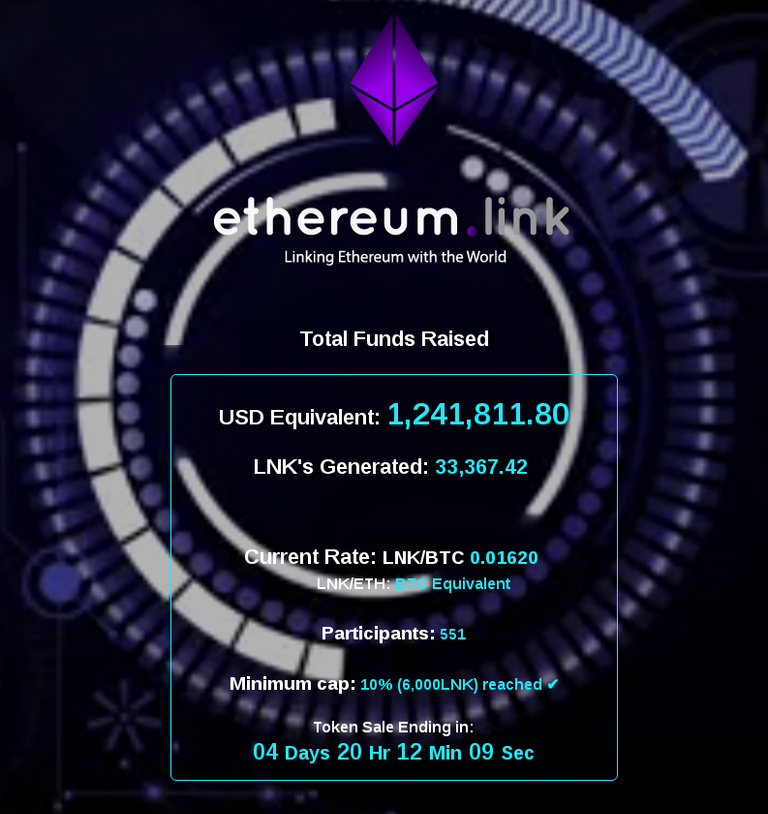

The author notes that over $1,000,000 has been raised by Ethereum.LINK thus far, and he would like to wish his sincerest condolences to their owners, as they will probably never make it home.

Here in Ethereum.LINK we find our lowest rating since beginning the ICO Analysis series here at Hacked: a 0.5. We give them half a point for being able to build a website and author a smart contract. Their potential victim pool, by and large, cannot say as much for themselves, which is part of the critique of smart contract platforms overall (too complex).

Hey dude... I kind of don't appreciate you doing this.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://hacked.com/ico-analysis-ethereum-link/