Overview

In this post, I outline a 2018 price target of $1,375 for Ether (ETH), which represents 82% upside from the current price of $755 (data from www.coinmarketcap.com as of time of this writing on 12/31/17).

As background, Ethereum is a platform for developers to build decentralized applications (Dapps), with Ether (ETH) used as the currency paid by the developers to build Dapps on Ethereum. Therefore, the key driver of the valuation of ETH is the underlying demand from prospective developers on the Ethereum platform.

Through smart contracts, Ethereum holds significant long-term potential as a way to displace essentially any business that relies on a third party intermediary to disburse funds under a contract. Some applications of Ethereum, as outlined in the white paper on this platform, include financial contracts, hedging contracts, savings wallets, wills, employment contracts, multi-signature escrow, peer-to-peer gambling, and on-chain decentralized marketplaces (1).

Analysis

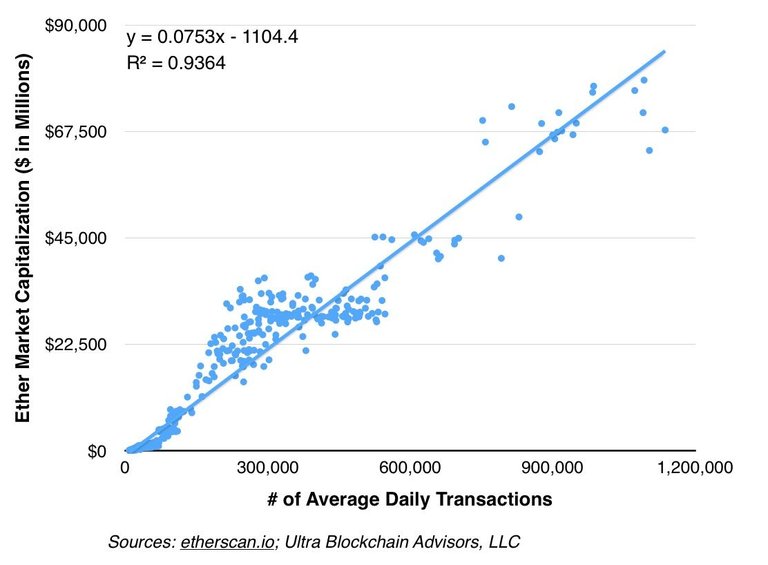

The market capitalization for ETH demonstrates a strong correlation (R2 > 93.6%) to the average number of daily transactions on Ethereum.

Based on this regression analysis of the market cap for ETH vs. the average number of daily transactions on Ethereum, the trendline for this relationship is as follows:

y = 0.0753(x) - 1,104.4

where:

y = market cap of ETH in millions of US dollars and

x = number of average daily transactions on Ethereum platform

The number of transactions on Ethereum has grown from 41,220 at year-end 2016 to 1,136,659 at year-end 2017 (2). I believe there is enough momentum for transactions to hit 2,000,000 by year-end 2018. This increase is transaction volume will be driven by a number of factors, including additional development projects from financial institutions in the Enterprise Ethereum Alliance, additional progress on scaling the platform, and overall higher level of adoption among developers.

Using the relationship established in the regression analysis above, the market cap forecast for ETH is $149.5 billion at an average daily transaction volume of 2,000,000. My estimate for the supply of ETH outstanding by year-end 2018 is 108.7 million ETH, up 12 million from the current supply of 96.7 million ETH as of 12/31/17 (3). Therefore, my price target for ETH at year-end 2018 is $1,375 ($149.5 billion market cap / 96.7 million ETH supply).

My 2018 price target of $1,375 for ETH represents 82% upside from the current price of $755 per www.coinmarketcap.com as of the time of this writing on 12/31/17.

Given the strong momentum of development on the Ethereum platform, the average number of daily transactions could easily exceed 2,000,000 by year end 2018. If transactions hit 3,000,000, then the market cap of ETH could trade around $224.7 billion (or $2,068 per ETH); and if transactions hit 4,000,000, then the market cap of ETH could trade around $300.1 billion (or $2,761 per ETH).

Therefore, ETH continues to represent an attractive cyrptocurrency investment opportunity at this point in time for investors with a 1+ year investment horizon.

Footnotes:

(1) http://www.the-blockchain.com/docs/Ethereum_white_paper-a_next_generation_smart_contract_and_decentralized_application_platform-vitalik-buterin.pdf

(2) https://etherscan.io/chart/tx

(3) https://etherscan.io/chart/ethersupplygrowth

Etherium target to get the more bigger.and this target is allrrady started.