This article was controversially published within the Hong Kong Blockchain Society (香港區塊鏈學會) almost exactly a month ago. Now that the Ethereum rally has stopped, we believe that this is a great moment to involve the public and think deeply into the underlying crisis.

Public market exposure challenges trust in the truth machine

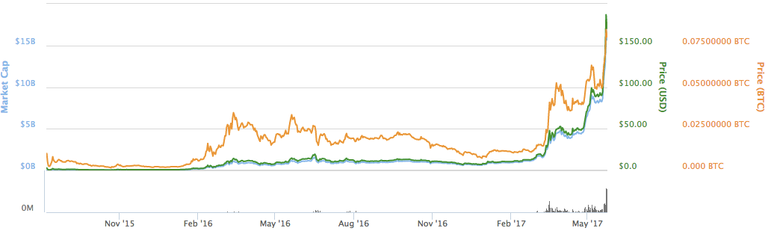

Ether has grow over 10 times its value in the last three months, joining the ranks of other amazing market opportunities such as the South Sea Company, the Tulip Mania, the dotcom party of 1999, and the Bitcoin bomb… just a few years ago. It looks like crypto-land may once again hit the headlines for all the wrong reasons soon. When Ether becomes too expensive, Ethereum will fail, and join the ranks of history’s bubble troubles.

First, let’s clarify what everything is:

- Ethereum is a general purpose blockchain platform that hosts distributed apps (dapps), which operate by executing conditional functions called smart contracts. As with any blockchain network, consensus deciding which blocks and chains are legit depends on contributors to the network. Originally, the consensus algorithm is based on proof-of-work (PoW), where network participants receive tokens for their contribution: “mining”. Sometime this year (2017), the consensus algorithm would be switched to proof-of-stake (PoS), where the tokens in the system no longer change over time, but are moved between network participants, and randomly-chosen participants with larger holdings decide which blocks and chains are legit: “minting”.

- Ether (ETH) is the aforementioned token that is required to operate Ethereum dapps, specifically to run smart contracts. However, although dapps require Ether to run, it isn’t actually element running the smart contracts.

- Gas actually executes the smart contracts. No gas means no dapp operations. How much gas does each smart contract need? That is correlated to the number of executable lines that a smart contract has. So, dapps must purchase gas with ETH, but who sets the price of gas/ETH? It’s an auction: the dapp or developer gives a price, and someone on Ethereum would “mine it” if the price is right.

Analogy: Ethereum is a magic machine that runs on Russian gas and ETH is the Russian Rouble. The rouble goes up in value with respect to every other currency in the world — USD, EUR, CNY, JPY, CAD — because everyone believes the magic machine will be amazing and world-changing, and everyone — individuals, businesses, companies — want to use the magic machine. However, there is a small point of detail: roubles do not make the magic machine work, but rather the Russian gas. And who controls the Russian gas? Unlucky, it’s Gazprom, but luckily, Ethereum isn’t owned by a Gazprom… or is it?

A flame that burns twice as bright burns half as long

Dapps burn money to buy Ether to burn gas to run smart contracts

As ETH becomes more expensive, Ethereum dapps have basically stopped operating. This might not seem like an issue now, because there aren’t a lot of major Ethereum dapps out there, but an expensive ETH or even a fluctuating ETH poises major issues to dapp operations, because the businesses behind the dapps crave stability, and ETH does not provide that stability.

But why does ETH price matter? Gas prices could also free float like ETH… well that would be wonderful but that just is not the case, sort of. There are a few issues:

- Gas prices are not set by the miners. Dapps bid for the gas. Therein lies the first major issue: gas prices are not standardized, and there is no ‘recommended price’ to even reference, much less a free market for gas.

- Even if there was a Ethereum Gas Index (EGI), the price would not be free floating either. There is a recommended range to bid for gas. And this is hardcoded into each Ethereum release. But that doesn’t really kill the EGI idea.

- Perhaps part of the reason for a lack of an EGI is dapps may be running different versions of Ethereum, and each would have different ranges of gas bids.

- Miners are aware that ETH is appreciating daily, and they are aware of the power they have in Ethereum: without them, the network does not function! So they are incentivized to keep the price stable… which means it actually gets more expensive to run dapps, since ETH is rising!

Ethereum miners form a de facto OPEC, or in our analogy, Gazprom. This is bad for a supposedly decentralized system on which trust in the machine depends. So, how do you get rid of Gazprom?

Breaking the power of the miners may be the reason for the upcoming hardfork that switches Ethereum from PoW to PoS, among other official reasons. But like the Soviet Union’s transition to democracy heaven, the power remains the same, but simply changes hands. And like the Soviet disunion, power is reorganized into an oligarchy.

Assuming this hardfork does not fork the community, holders or rather hoarders of ETH control the network. One may argue that their interests are aligned with the interests of the network, but that is not and cannot be guaranteed. Especially when these oligarchs are anonymous! There is no way to hold them accountable… and guess what, they also have incentive to keep ETH high, otherwise their investment portfolio evaporates. These oligarchs can also easily manipulate the market to increase their position by buying and selling large amounts of ETH.

All this is bad news for Ethereum itself: the global distributed decentralized supercomputer grinds to a halt, because not only has public market speculation made it too expensive or at least too unpredictable to operate for business cases, it's not actually decentralized!

Can our Lord save Ethereum?

As the inventor of Ethereum and technical genius behind its implementations and operations, you bet Vitalik Buterin has foreseen these issues, and then some. He is one of the most influential people at Ethereum Foundation (officially Stiftung Ethereum).

But he is not the most influential, and there are lots of influential people at there with interests divergent from the long-term vision of Ethereum that Vitalik envisioned. Can the movers and shakers at die Stiftung come to a consensus?

I think at some point within the next two years, Vitalik will be like, "enough is enough! I've had it with these motherf*cking fakes, ruining my motherf*cking name!" I believe in Vitalik and "Ethereum", just not the current Ethereum.

Something is rotten in the state of cryptocoins

The eventual collapse of Ethereum will set off a tsunami that will sink all other public cryptocoins and wash away the facade of the utopia of decentralization: the lack of governance to control rampant speculation and the de facto centralization of control by anonymous miners or stakeholders.

When these anonymous centralized powers say “to the moon”, the markets rally. Then they sell after they’ve had a good run. Then off it’s to the moon again. Without governance, everyone else gets burned, or drowned. And the biggest casualty is the dream of every cryptocoin itself: legitimacy. Cryptoanarchists are too young, too simple, sometimes naïve.

To be [currency] or not to be: that is the question

Ether traders are forgetting that ETH is fundamentally a token. This means that while ETH may have inherent value, its value is limited to its utility value. For ETH, that is constrained within the Ethereum system. If more dapps are created, ETH value increases. But if ETH grows uncontrollably, dapps have no incentive to operate. Everyone has incentive to hoard.

Hoarding also hurts other cryptocoins. Most if not all ICOs so far are treated like currency rather than tokens. Not only does this violate real-world regulations — the Howey Test — it encourages behaviours that run counter to the ICO project’s grand vision. In fact, ICOs should be renamed ITOs: initial token offerings, but I digress.

So how could crypto-tokens be protected from falling into the speculation trap? There are two ways which may even be combined:

- Peg to a fiat currency. For example, the Chuck E. Cheese token is pegged to the USD, and there is no incentive for kids to hoard Chuck E. Cheese tokens, because they won’t fluctuate in value. The downside is that you’d be at the mercy of that country’s economic policy. For Chuck E. Cheese, they might have a policy that does not accept Canadian Chuck E. Cheese tokens because each is actually worth less.

- Token Half-life. Instead of modelling crypto-tokens like gold (which is guaranteed to never change), why not model it after uranium? This disincentivizes hoarding. One model worth studying is the Tokugawa Shogunate that taxed citizens with rice and other crops. Because rice cannot be kept forever, the government was incentivized to redistribute or grow stronger its own army, like a forced investment.

While the world is bullish on the price of Ether, I am bearish on the future of Ethereum, unless some major revolution happens. Until these issues are solved, public blockchains cannot compete with permissioned blockchains like Hyperledger and R3 Corda.

Gabriel Chan, 22. May 2017