ETHUSD

As Bitcoin heads into the fork, it has reached all time highs, breaking above $6000 yesterday. Unsurprisingly alt coins are taking a bit of a beating and likely in part because individuals are selling off to acquire BTC for the hard fork.

This is what is known as a lemmings trade. We saw the same thing going into the August 1 fork where bitcoin cash was created. We should be looking for similar setups as post fork the major Alt coins all got a price bump in both USD and BTC pairings.

We are stalking Ethereum for an entry. The fork is estimated to occur on October 25th, some exchanges are suggesting sooner, October 23 - traders and investors need to be on their toes.

Daily

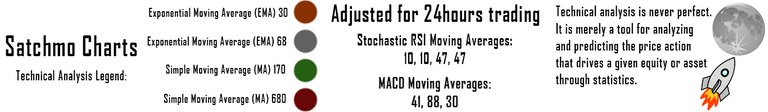

On the daily time frame we have been tracking this pennant formation and while there are a few ways to draw it especially on the different exchanges, It looks like we are going to hit the lower trendline. Currently, the price has found support at the 68ema and this needs to hold.

If thee 68ema fails to hold (grey line) we would be looking for a test of the lower trendline, which if it breaks, we find support at the 170dma (green line) just below.

The Stochastic RSI has been maintaining its slight uptrend as the price continues to consolidate. A bearish MACD cross occurred and the RSI has been trending down. Bullish momentum is waning as ETHUSD plays out the chart formation.

4 hour

The 4 hour time frame is a lot more concerning for bulls as the moving averages have continued their convergence in a bearish manner and the price has fallen below them, failing to negate the double top formation we pointed out in our last analysis of ETHUSD.

The Stochastic RSI is in a downtrend and the RSI continues to slide lower. Looking at the MACD it is hanging around deviation zero and with any signs of life we will look for bulls to come in and by this dip over the next few days, specifically post fork.

Just above trendline support, we are observing a trendless 680dma which will act as support though it is going to converge at the TL.

1 hour

Th 1 hour time frame is showing us a similar story to the 4 hour with a series of bearish moving average crosses. I would note the price range for fluctuations in ETHUSD have tightened over the last few hours though it is still in a downtrend.

The 30 ema has crossed below the 680dma and the 68ema is not far behind. ETHUSD also lost pivot support on this time frame and will have to work hard to reclaim it.

The Stochastic RSI has reached downtrend on this time frame with the MACD showing a bearish cross and sitting well below deviation zero. The RSI is hugging oversold ranges and while more downside action should be expected, it will become increasingly difficult for bears and short sellers will need to take profits ahead of the fork - to get their bitcoin gold.

Long term holders should be looking for an opportunity to add if price support holds at the trendline as well as traders should be looking to position for a scalping opportunity after the fork if/when individuals sell off their bitcoin.

Bullish Above: $314

Bearish Below: $287, very bearish if trendline and 170dma fail to hold - approximately $276

RISK TRADE: R/R is not here yet to take a position given the event we know is incoming. Once could begin scaling into a long position, but the prudent should wait for either a test and bounce of trendline or a break back above the $300s which would drive the moving averages back into a bullish setup.

Don't forget to use stop losses!!!

Previous Articles:

BTCUSD

LTCUSD

XMRUSD

ETHUSD

BTCUSD

DASHUSD

ZECUSD

Follow at your own risk, Not a financial adviser, understand the risks associated with trading and investing. Manage your own Risk - in other words you could lose it all and it's your own fault.

It's days like this I wish I had everything in Bitcoin rather than 1/3 Bitcoin 1/3 Ethereum and 1/3 Litecoin. .... and my $800 in Steem is down to 91 pennies.

I know that feeling!

I will have to adjust my ratio if Bitcoin ever dips again .... I don't want to chase it here.

Smart, I am not 1 for chasing either, missed opportunity is just that, there will always be more.

This is a good time to invest altcoins. If you agree, what coin do you think will be most profitable after the hard fork?

That is a tough call and I personally like to play in the major alt coins, rather than penny stock equivalents. I would look for diversity among major coins rather than an eggs in one basket approach.

Thanks a lot, sounds like a good approach! I think I will try to do the same when I'll have enough money to invest :)

Very nice post, priority now for sure is for Bitcoin, thus other events will not have any effect, up to the end of BTC hard fork.

Every one is baying BTC and selling their coins.

Upvoted

I would be happy if you visit my last post about steem price and add a comment.

My thinking exactly which means there are trade opportunities being set up across the space right now.

That's true.

Good Analysis there, most people should have known this was the way things would go in October, it has been covered by lots of people.

It will be quite interesting in November once the forks are out of the way. I suspect a fall in bitcoin and the alts shooting up.

Hold tight for the rollercoaster ride.

Love me a roller coaster ride! Im looking forward to the action across the market post fork. After Aug fork BTCUSD had a consolidation period before pushing higher again, and during that we saw a rise in most alt:btc pairings. I am expecting similar. "Cash" ready!

Looking forward to the fork and rollercoaster that it brings. I have my hands up and I'm enjoying the ride.

Fantastic analysis, as always!

Thanks!

ETHUSD keeps falling even after the successful hard fork Byzantium. I am wondering if there is any fundamental reason why? I know everyone is piling into BTC but ETH should be doing better IMO. Right now ETH = $294.

Thanks for all of your hard work. This is good info.

Will I sell the gold in my wedding and buy ETH? say what?

:)))

you have some good posts, you know what your talking about.

new follower.

I've just started to get into some of the altcoins. There is money to be made somewhere, but it is hard to pick a certain place. My thinking is to have a handful, maybe 5 or 6, and focus on trading between them when the ratio looks right.

This is a better strategy than most, my recommendation is to focus on market cap, play the top tickers, trying to call bottoms and tops can be hard enough and often people get trapped in loser coins due to emotions and poor decision making.

Use stop losses and a balanced approach, 5% a day is better than 100% once in a blue moon if at all. You should do well ;-)