Since the birth of the Digital Asset class, Bitcoin has been king and today, 8 years later, continues to act as the backbone of cryptocurrency exchange. In order to procure more obscure tokens, one must trade for them in exchange for BTC on a multitude of exchanges, further driving the demand of Bitcoin which some would argue is better though of as a store of value, not a means to purchase other goods. This however, is not a strong enough factor to propagate the continued dominance of Bitcoin in the Digital Asset space.

In July 2015, Ethereum, an open source, distributed, Blockchain based smart contract protocol, was introduced. This opened up a world of possibilities that Bitcoin which a purely transaction based protocol could not provide. Not only does Ethereum's ability to execute more complex transactions/contracts distinguish the protocol from Bitcoin and other altcoins, it allows for the use of Ethereum as a foundation upon which other currencies and assets can be created.

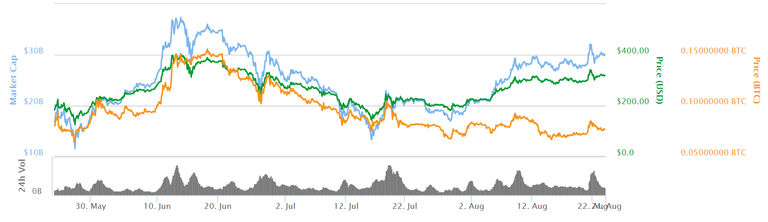

This hypothesis seems less outlandish when you analyse the new booming space in the cryptocurrency world: ICO's. Many people speculated as to which markets would be hit hardest by the emergence of cryptocurrencies and cyrptoassets but it is clear to see that venture capitalism is the first pillar of the traditional financial world to feel its effects. ICOs - Initial Coin Offering - are a play on IPOs, and have taken the cryptocurrency world by storm. Developers of these sophisticated networks and software protocols have all but abandoned the traditional route of acquiring angel investors. No longer do they need to report to a higher authority on their benchmark achievements to access more funds to fuel their business' development, these new ICO millionaires have chosen to pave their own way. Most notable of the bunch in recent memory is Filecoin, a data storage protocol and token. Filecoin blew competing ICO's out of the water and successfully raised $250MM in 20 minutes. By any standard these numbers are impressive and their brief but blistering coin offering propelled Filecoin to the status of ICO giant. ICO's like Gnosis and Tezos are other notable ICO giants that have generated incredible amounts of wealth in short periods of time, Gnosis being valued at 191MM as of August 15th, 2017. In the past, BTC and ETH have fluctuated nearly in parallel relative to the USD and to eachother, but since mid-July, Ethereum has broken away. Below, it is clear to see that Ethereum has gained enough momentum and utility to drive its valuation independent of Bitcoin.

It is clear to see that these new, more sophisticated protocols are having a big impact in the VC market but how exactly does this contribute to the valuation of ETH? Being that many of the new ICO's are powered by Ethereum. this hypothesis hinges on the assumption that if any of these ICO's take off. the value of Ethereum will rise alongside it. This is the main difference in the analysis of Ethereum relative to Bitcoin, Ethereum simply has much more potential. In the same way that binary computer language is built upon to create more sophisticated, human-level programming languages, Ethereum will serve as the cornerstone for the next generation of industry-specific tokens to come.

"In order to procure more obscure tokens, one must trade for them in exchange for BTC on a multitude of exchanges, further driving the demand of Bitcoin which some would argue is better though of as a store of value, not a means to purchase other goods. This however, is not a strong enough factor to propagate the continued dominance of Bitcoin in the Digital Asset space."

could you expand on this point? thank you :)