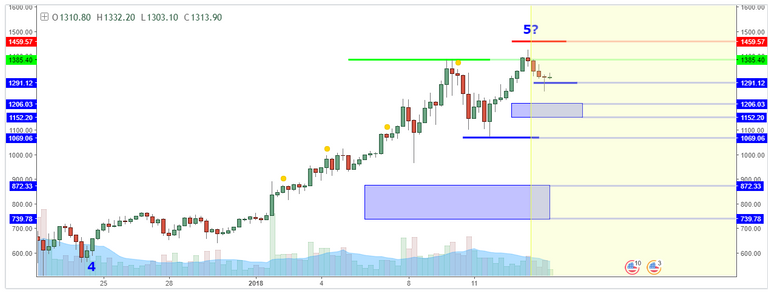

ETHUSD -4.32% update: 1424 all time high made as this market pushes its way into a potential reversal zone. In this report I am going to talk about the next potential supports and what to make of the current wave count.

First, let's talk best practices. On a new high, it is always a good idea to lock in some profit. This does not mean sell your entire position. It means to take some profit while you can and look to buy back in if there is a pull back. I keep reading over and over, "HOLD" but that is greed talking and these same people are going to be the ones to buy from when they are shaken out during a sharp retrace. Can this market go higher? Sure. No one can predict the top, but at least you have a chance to capitalize on the buyers while they are still buying enthusiastically.

As far as the reversal zone: this market is in a high risk area. This is defined by the 1459 upper boundary of the projection measured from the 1069 low. That does not guarantee that it will reverse, but it should be very clear that this level is NOT an attractive place to initiate a new long position. Why not short? Price may be in an attractive area to short, BUT there is no confirmation at all which makes the idea low probability at the moment.

What about the wave count? I always write about when 5 waves are in place, the chance of a broader retrace increases. As you can see there was a retrace attempt that took this market to the .382 of the recent bullish structure at the 1069 area, and the support held. Since 5 waves were in place, I was expecting that support to be compromised which would be more in line with the broader correction scenario. So what happened? The market negated the wave count. This happens, and is the reason why as short term traders we must always be flexible and open to anything. This is also why having the ability to interpret context comes into play significantly in situations like this.

In a more normal environment, I would be looking for the current leg to be the B Wave, which implies a much steeper pullback to come. Based on the context of this environment though, I am not labeling this as a B wave. This is the Wave 5 of 5 which still has some room to run before facing the increased possibility of the broader correction again. How much higher? 1540 is a reasonable area to anticipate as the next target IF price pushes through the 1459 boundary without any bearish reversal activity. Remember there is little precision in TA. It offers ways to arrive at estimates that are derived from the information available at the moment.

The retrace levels I am watching for in case of a shallow pullback are 1291 (.382 of recent bullish swing) and the 1206 to 1152 support zone (.618 of recent bullish swing). Based on the current structure, it is reasonable for this market to present a shallow retrace (subwave 4) and make one more attempt higher (subwave 5) before a broader correction is likely.

In summary, just because the market has potential to go higher does not mean it is safe to take on a new position. Current levels offer a chance to lock some portion of profit for those who took risk at lower prices. At the same time, shorting may offer more attractive reward/risk, but without confirmation, you are selling into a situation where momentum is working against you which does not justify taking a risk in terms of MY trading plan. For me, the best thing to do is wait to see IF the market chooses to revisit a projected support level , wait for some form of reversal, and quantify risk from there for a swing trade long. There is no need to chase, because the market will eventually line up factors that make the most sense when it comes to reward/risk AND supportive momentum. Patience pays.

Questions and comments welcome.

@nazmul i just start following you.... good luck.

nice writer