Whales are Accumulating Ethereum

Ethereum has been a major influencer in the blockchain sector. Popular for its innovative ability to run additional tokens and applications on its network, many label Ethereum as digital oil.

Peaking over $1,400, ETH’s price has pulled back by 90% in the last twelve months and currently trades at $108 at the time of writing. According to studies, this has prompted some of the largest holders of Ethereum to double down and accumulate while the market panic sells.

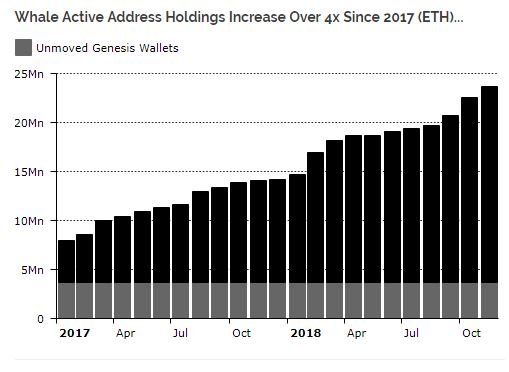

A recent analysis by Diar and TokenAnalyst revealed 5,200 active Ethereum “whale” balances are sitting on 80% more ETH tokens than at the beginning of 2018, taking the accumulation strategy to the next level!

(A “whale” is a term often used to describe a large holder of cryptocurrencies and/or one who has considerable influence over the price of a digital asset)

The report explains that the 5,200 active addresses “have held balances that propped them up within the Top 1000 since Ethereum’s Genesis,” amounting to just under 20% of the total circulating supply of Ethereum.

Source: https://diar.co/volume-2-issue-47/#1

Decreased Liquidity and Dumped ICO Tokens

One of the interesting points made in the report mentions the high chances of active traders and investors selling their positions in ERC-20 tokens. Many popular ICOs in 2017 developed their own digital tokens using Ethereum-based smart contracts, such as ERC-20.

These tokens were often purchased using ETH. In most cases, these tokens running on the Ethereum protocol lacked liquidity and only had trading pairs with ETH on much smaller exchanges.

FIND OUT HOW MUCH VOLUME HAS CRASHED AND WHO IS BUYING ALL THE ETHEREUM HERE >> https://www.crushthestreet.com/articles/digital-currencies/study-shows-record-levels-of-ethereum-are-being-purchased-buy-low-sell-high

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.crushthestreet.com/articles/digital-currencies/study-shows-record-levels-of-ethereum-are-being-purchased-buy-low-sell-high