How to mine “ether” and what is the profit margin as a miner?

You can refer to this profit calculator. One important thing to keep in mind is that after Casper upgrade, the “mining” mechanism will be completely different and you will likely need to have a large amount of “ether” to be eligible for producing the block1.Primary market: can you still buy from the developer (if ICO is still ongoing)?

No.

(Fun fact: during ICO, 1 BTC = 1000~2000 ETH, 1 BTC is now worth about 10 ETH)Secondary market: which exchange to buy and sell it?

Plenty of places, you can refer to this list.Valuation: how much do you value this coin?

Ultimately I think it depends on the collective value of the decentralized applications built on Ethereum blockchain2, but it is still too early to tell. Please comment below with your thoughts and opinions!Storage: which wallet to use?

Many people use MyEtherWallet, there is also this guide if you want more information.

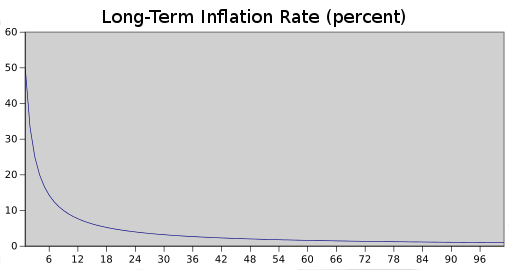

[1] The whitepaper mentioned a very interesting point - every year, there will be a constant amount of ether to be issued, so that people in this era and in the future will both have chances of obtaining ether. This is to avoid the wealth concentration in Bitcoin. Although there will be constant amount of ether to be issued every year, the inflation rate will gradually drop towards 0%. Also, people tend to lose cryptocurrency for many different reasons, so eventually, the total number of ether will tend to converge to a constant number.

[2] Although it is often perceived that Ethereum in theory can support all types of decentralization applications with its Smart Contract support, many of the applications mentioned in the whitepaper are finance related, such as financial derivatives, insurance contracts or prediction market. The two particularly interesting applications I found in the whitepaper are Namecoin and SchellingCoin. They are both worth reading.

(Image Source: the official Ethereum whitepaper)

Ethereum has been conservative in this dip moment. I own ETH and I believe that it can overcome Bitcoin in volume...

I also think that ETH will be the one to stay in the long run and empower the dApps ecosystem.

I agree. Besides, we have many tokens been built on Ethereum platform...

Great post. Thanks.

Sincerely, Ether miner

Followed

Awesome, glad that you like it. How is your mining experience so far?

Great! The past week and a half has seen my profitability drop drastically with the bearish market, but it will turn around! I switch between mining coins directly and using nicehash.

I cant wait for ethereum to actually build a GUI based windows wallet. My ether wallet is such a pain.

What is your biggest complaint about MEW btw?

That all of my other tokens have to be individually refreshed to show their balance. Man is that annoying

Congratulations @cryptostories! You received a personal award!

Click here to view your Board

Do not miss the last post from @steemitboard:

Congratulations @cryptostories! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!