Hey Steemians,

So the Securities & Exchange Commission in a report dated 25/07/2017 classified Ethereum tokens as securities. This follows after an ICO by Dao rose about $150million almost the same amounts usually raised by companies that are going public. It wasn't a surprise to us!

What's really behind this?

"...the Commission deems it appropriate and in the public interest to issue this Report in order to stress that the U.S. federal securities law may apply to various activities, including distributed ledger technology, depending on the particular facts and circumstances, without regard to the form of the organization or technology used to effectuate a particular offer or sale."

So basically, the SEC rules over the securities markets and as many of you might have noticed. US citizens have not been allowed to participate in most Ethereum fund driven ICOs. This has made it even more interesting for us to see the SEC come in and speak about the cryptocurrency space.

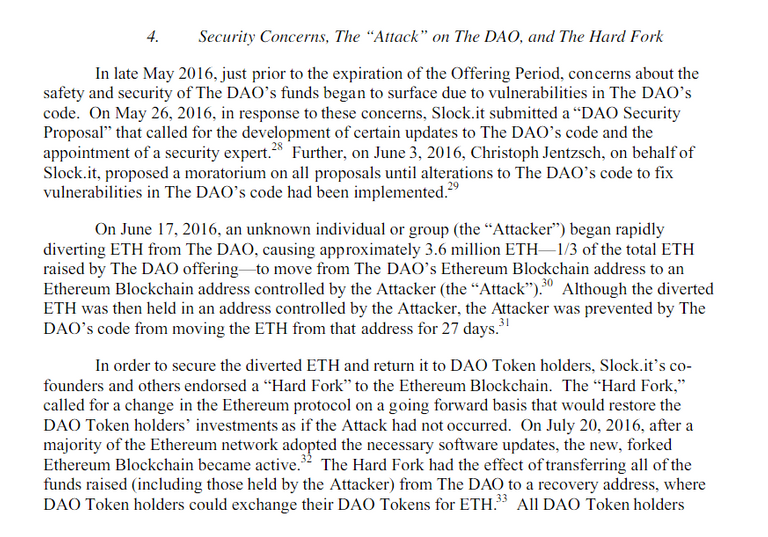

**Here is a screenshot of what was in the SEC report**

So bascially, we see here that the SEC was intrigued by the Dao token and this where its attention was gotten.

We wait to see how this story develops but one thing we know for sure is that there is lots of chances of scalability for the Ethereum space and also Initial Coin Offerings.

Those with views on this SEC saga and welcome to comment.

Cheers and Have a great day from @cryptoforgod