![]()

I have been a small investor for a number of years and I was recently introduced to the new world of Crypto currency earlier this year. I was immediately excited about the potential this new form of currency offered and was hooked on the concept from the very start. I, like others looked at how I could invest by buying small holdings in Bitcoin, Ethereum and Litecoin.

I recently moved onto purchasing small holdings in Basic Attention Token, Ripple, ETC and Dash.

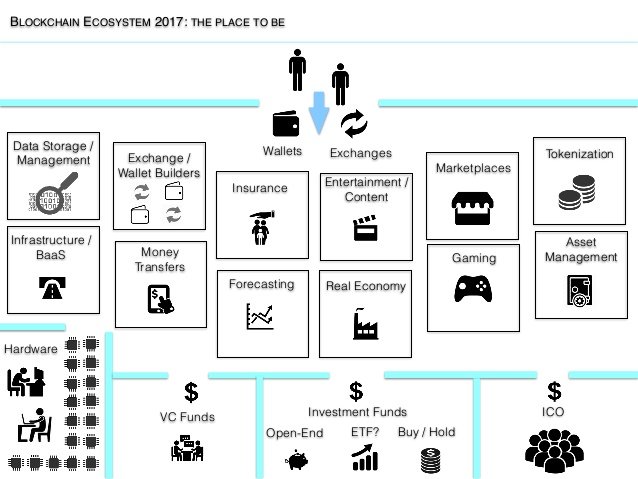

Initially these all proved fruitful with amazing increases and overall I have gained on my investments. I also moved into trading the currencies and made some early profits due to the rises and international interest in the currencies. I am still a newbie to trading and have been trying to hone my skills over the past few months by reading a lot of material about trading in general, not only in Crypto but CFD's, ETF's, Stocks and Forex.

There are several things that have amazed me over the past few months, one of which is the incredible rise of the market cap on these coins, the other is the amount of experts with various charts trying to predict this very unpredictable volatile crypto market. As I stated earlier, I am not an expert by any means but the crypto market just seems so new, so dynamic and so unpredictable at the moment that any sort of fundamental or technical analysis will not be entirely accurate or provide enough information to support genuine knowledge based investment or trading confidence due to the lack of history or trends available.

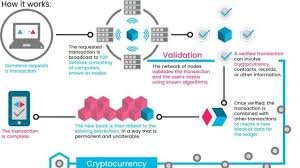

Don't get me wrong, I do believe there is a future for crypto currencies, especially with the potential of harnessing the millions of "unbanked" people around the world. I also believe there is an opportunity to offer people an alternative to the traditional currencies and banking systems which have taken advantage of normal people for many years. The concept of decentralisation and Smart Contracts is well constructed and is already proving to be beneficial in many areas. However, there are so many unknowns and so many uncertainties in the true value of crypto and what really drives the market.

The recent multitude of ICO's have proven to be a significant problem in providing confidence in the long term value as many of them have proven to be over valued and fundamentally flawed. Hence the news from China which has shook the market. Although many of the ICO's have received huge funding, a lot of this is due to people not wanting to miss out or FOMO(Fear of missing out) as it is known in the Crypto forums. I believe this FOMO is what has been driving the highs in this market for at least the past 8 months. Many people don't fully understand it but know someone that has told stories of making significant amounts of money and just jumped on board blindly. I now believe we are in somewhat a reverse of that position, whereby recent news from China about banning ICO's, Bitcoin (again) and applying regulation has caused massive fear and reduced confidence. In turn, I think we are finding the "band wagon" investors jumping ship and maybe selling at a loss to protect their money, whales potentially taking the opportunity to scare the market even further by selling large volumes in an attempt to bottom out the market and "shake the tree" even further in an attempt to get back in at a later date and snap up the fundamentally strong crypto's at a cheaper price.

All in all this is a very interesting time, we have seen similarities before with Bitcoin dipping after the Mt Gox and Silk Road issues, this is slightly different and although Bitcoin recovered remarkably from that position as people started to believe in it's value other than how it could be used on the Dark Web. I believe this is another watershed moment whereby regulation will be discussed and defined, ICO's will be tightened up and people will generally focus more on the fundamentals of a token, coin or platform before investing. This will be a good thing even though in the meantime, we will see significant drops in price as the currencies find their true value. This watershed could also secure the future use of the currencies especially if the regulations are designed properly and protect the ordinary people and not the big institutions.

Having said that does anyone think that the big institutions are currently involved in manipulating this current market and causing the reduced confidence and dip in value?

Possibly, history has shown us that big banks and institutions do not like to be sidelined with developments of this type.

I do not have a long term fear for this market due to the ground swell of interest it is generating, the fundamental strength and capabilities of the underpinning block chain, the way it is currently battling to find a settling point in the markets without actually crashing. You only have to look at the amount of exchanges that are now in operation, the amount of online material there is and the general excitement and development teams that are supporting it. We even have investment funds for Crypto, not to mention the entry into the mainstream Trading Platforms of some of the fundamentally stronger coins. However, I believe we are approaching a little fork in the road (pardon the pun), where the currency will take a step back before moving forward again and if we are keen for it to be a credible market then we have to accept the norms of traditional market conditions whereby bull trends are followed by bear trends and vice versa.

I'd like to hear what you think? What are your views? What are your experiences? Are you new to this market? What tips do you have?

Congratulations @contentcreator! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP