Sometimes it can be difficult to decide where to go with your crypto portfolio. There are many ways to analyze assets and make investment decisions. While some investors try to weigh different investment opportunities based on the value of the underlying technology, others base their decisions on technical analysis (TA). Some investors discard their belief in TA all together, but others like myself trade almost entirely based on TA.

Whether or not you belong to the first or latter sort of people, it can be helpful to have some basic understanding of TA if you're trading on a regular basis.

Charts containing technical indicators may appear overwhelming at first, but once you get a feeling of the different types of indicators technical charts can bring you a lot better insight then just the candle bars that many exchanges provide. The basic goal of TA is to investigate different aspects of supply and demand for an asset, and to help estimate where the general trend is going.

Today we will have a look at some indicators for GNT (Golem) based on data from Poloniex.

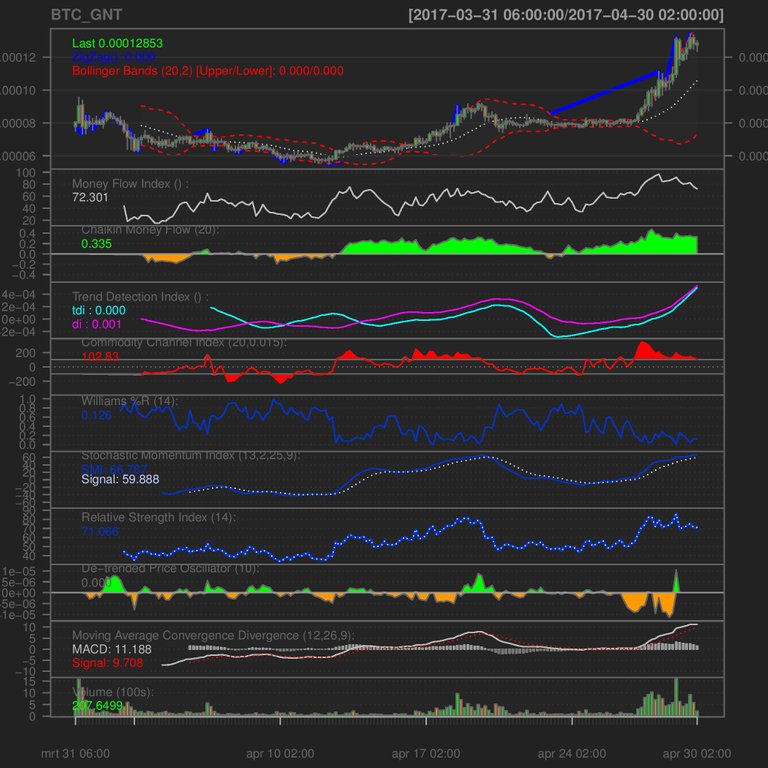

Here is an overview I made using 4-hour data for the past 30 days.

Go where the money goes

One way to look at the market is to analyze a combination of prices and trading volumes. There are several indicators that help you understand buy and sell pressure. Money flow indicators are used to determine the rate at which money goes in or out of an asset.

Money Flow Index (MFI)

Money Flow (MF) is the product of price and volume. Positive MF occurs when the current price is higher than the previous price while negative MF occurs when the current price is below the last price. The MFI is calculated by dividing positive MF by negative MF for the past N periods and scaling between 0 and 100. Divergence between MFI and price is an indication that the market is headed toward reversal. That can both be positive or a negative change. In addition, MFI values above 80 provide an indication that the market is at a top, while values below 20 are indicative of a bottom. As you can see the MFI was 72.301 when I printed the graph, currently the GNT market is near a top. Also, the indicator is slightly going down while prices aren't, hence we may expect increasing selling pressure.

Read more about MFI

Chaikin Money Flow (CMF)

CMF compares total volume over the last N periods to total volume times the Close Location Value (CLV) over the last N periods. CLV is a measure for how the price of the asset has closed relative to the high and low of the trading block. When the CMF is above 0.25 it is indicative of a a bullish market, when it is below -.25 it signals a bearish market. If the CMF remains below zero while the price is rising, it indicates increasing likelihood of reversal. The last CMF value was .335, hence it indicate a bullish trend.

Go with the trend

Another method is to focus on identifying trends. The trend has three faces, we all know up and down trends, but markets can also move sideways when investors are generally indecisive. Knowing what markets did in retrospect is often easy. The hard part is determining what is currently happening when markets moving in real time and the space on the right in your graph is empty. There are some indicators that may help you.

Trend Detection Index

The Trend Detection Index (TDI) attempts to identify starting and ending trends. The TDI exists out of two parts, the Trend Index (usually abbreviated TDI) and the Direction Index (DI). The TDI signals a trend if it is positive and is indicative of a period of consolidation when negative. The DI indicates whether the trend is positive or negative.

The basic TDI strategy is to take a long position if both the TDI and DI are positive or go short if the TDI is positive and the DI is negative. Currently, the TDI is does not signal a strong trend. The GNT market has largely moved sideways in the past 30 days. In these situations it can be helpful to look at the TDI of currencies linked to GNT (like ETH). The TDI for ETH now is .165/.179, and signals a stronger positive trend.

Commodity Channel Index (CDI)

The CDI is another indicator that can be used to identify emerging trends or warn of extreme market conditions. CCI compares current prices to the average price level over a longer period of time. CCI is high when prices are far above their previous period average. CCI is low when prices are below average. The CCI is a flexible indicator that can signal emerging trends, but also be used to identify overbought and oversold markets.

The CCI usually moves between -100 to 100. A basic CCI trading strategy is to buy if CCI rises above 100 and sell if it falls

below -100, and also sell when it falls below 100 and rises above -100. Currently the CCI is at 102.83 and moving down. We may expect the CCI to signal a sell soon.

Identify what's Overbought or Oversold

Closely related to trend identification strategies are strategies that aim to signal whether a market is overbought or oversold. Overbought markets have enjoyed a period of time where there has been a significant and consistent upward move in price over without much pullback. Oversold describes the opposite situation when there has been a significant and consistent downward trend without much pullback. Generally, market hover around an equilibrium, and the equilibrium follows a trend. Overbought/oversold indicators aim to provide signals on when to enter or exit a market by comparing current prices to a trend.

William's %R

Williams %R, or William's Percent Range (%R), is a momentum indicator that signals overbought and oversold points. The Williams %R compares closing prices to the highs and the lows over a specified period and can be used to determine when to enter or exit a market.

The %R and many other oscillators are interpreted in a similar way. When the indicator is below 20, a market may likely be overbought while values above 80 are indicative of an oversold market. Values below 20 or above 80 are not necessarily signals of bull/bear trends. A general strategy is to use trend indicators to determine whether or not to invest in (or leave) a market and buy when the indicator moves from oversold back below 80 and sell when the indicator goes from below to above 20. Currently, the %R of .291 does not indicate either an overbought or oversold situation. It is close to a sell signal however, and it generated buy signals early in April.

Stochastic Momentum Index (SMI)

The SMI is closely related and moves between -100 and 100. A market may be overbought when the momentum oscillator is above +50 and oversold when it is below -50. The current 62.210 is indicative of GNT being overbought. Many people use a moving average around the SMI, the 9 period simple moving average of the SMI is at 61.920. We may expect short-term sell pressure in the coming days especially when the moving average of the SMI drops below 50.

Relative Strength Index (RSI)

The RSI is another oscillator used to identify overbought/oversold markets.RSI values range from 0 to 100. Values of 70 and up are indicative of a market becoming overbought or overvalued, and may head toward reversal or a correction. An RSI of 30 or below is commonly interpreted as an oversold signal. Some traders use 80/20 marks. Currently the RSI reads 67.311, which agrees with the R% that the market is not overbought. If a sharp increase happens at this point, we may expect a correction as it drives the RSI above 70/80.

De-trended Price Oscillator (DPO)

The DPO removes the trend from the closing prices by subtracting a moving average. The DPO does not extend to the price point because it uses a lagged moving average. This distinguishes the DPO from momentum-type oscillators. The DPO is not used to generate buy/sell signals but to identify cycles in a market and estimate typical cycle length. As you can see, the DPO goes above and below zero on a high frequency. You may count approximately 20 cycles, which indicates that GNT moves very fast between short-termed up and downward trends that typically last between 1-2 days.

Moving average convergence/divergence (MACD)

The MACD is arguably the most common oscillator, Poloniex provides it as a standard indicator in their tradeview. The MACD is closely related to the DPO and is roughly a momentum-type version of it that shows the relationship between two moving averages of prices. The MACD I plotted is calculated by subtracting the 26-period exponential moving average (EMA) from the 12-period EMA. A nine-period EMA of the MACD itself, called the "signal line", is plotted on top of the MACD, and it often used to generate buy and sell signals. The histogram shows the difference between the difference between the MACD and its moving average. Reading the MACD is an art itself, and it can be used very flexibly. The MACD is often used in four different ways.

When the MACD drops below the signal line and the histogram turns negative, it is an indication that the market turns bearish, and you can expect people to star selling. When the MACD rises above the signal line and the histogram turns positive, the indicator gives a bull signal, and it is often seen as the time to buy. Many traders that use the MACD wait for a confirmed cross-over before entering to avoid taking a position too early. However, if you have strong believes that the market may go up or down, you may want to enter a position before the cross-over is confirmed to avoid entering a position while the market is already pumping or dropping.

When the price diverges from the MACD it signals that the current trend has come to end.

When the MACD rises sharply and the short moving average pulls away from the long moving average the MACD signals that the market is overbought and will soon head for a correction.

A cross-over with the zero line signals reversals. When the MACD is positive, the short moving average is above the long moving average, which indicates upward momentum. The opposite holds for negative MACD values. The zero line acts as an area of support and resistance for the indicator.

In the recent days the MACD has risen sharply, indicating that the market is in danger of getting overbought. Currently the MACD is positive and the fast moving average is about to drop below the signal line. We may expect traders that follow the MACD to start selling.

Miscellaneous tools

Bollinger Bands

In the upper price graph you see two red dashed lines, these are called the Bollinger Bands. Bollinger Bands are used to compare volatility and price levels. The Bollinger Bands consist of two lines, sometimes accompanied by a third (in my plot the white dashed line). The upper and lower bands are two standard deviations above and below the Moving Average (20 period in this case). The middle band is generally a 20-period SMA of the typical price, which is calculated by taking the average of the high, low and closing price. Wide bands indicate uncertainty, and small bands are indicative of a stable period. When the price goes outside the bands, you may expect a correction that pushes the price back to the range between the Bollinger Bands.

Zig-Zag

Zig-Zag is a trend-highlighting tool that draws lines by removing price changes smaller than a certain threshold and linearly interpolating lines between the extremes. The Zig-Zag is a non-predictive tool and its purpose is to filter noise and make chart patterns clearer. However, some traders use it to spot trend-breaks and predict reversals. In that fashion, the last Zig-Zag line has ended, indicating that the last pump has come to an end.

Keep an eye on the volumes

Finally, while a lot of traders keep their eyes fixed on price movements, a lot of information is contained in the trading volumes. My personal favorite trading algorithms are heavily based on volumes. It is often difficult to make statements about an asset solely by looking at its volumes, but is indicative of the market's interest. Comparing trading volumes to the volumes of comparable assets can be indicative of the general preference of one asset over another by the wider trading community. Also, low trading volumes are bad for market efficiency. Often it is easier to predict movements during low volumes, but it is harder to find a taker for your orders. In general I try to avoid low volumes because it can be difficult to get out fast whenever you may wish to leave the market.

This article deserves more credit, I wish I could resteem it, but it's too late 🤔

RSI, MACD and Bollinger are my friends.

oh well don't worry about it, I don't write for steem credits, I write for people that like to read something new! One of my favorites is a stochastic momentum index around the RSI. Made some good trades with that! And agree bollinger is a must-watch!

Is the Stochastic RSI (on tradingview) the same thing as what you're describing?

Seems I wrote the %R, RSI and Zig-Zag using graphs for Ethereum's price data, but I think the examples are clear enough to understand how the indicators work. Either way, GNT and ETH are heavily linked, so I would recommend analysis of both assets to guide your decisions, good luck!